McDonald’s Corp., Elliott Wave Technical Analysis

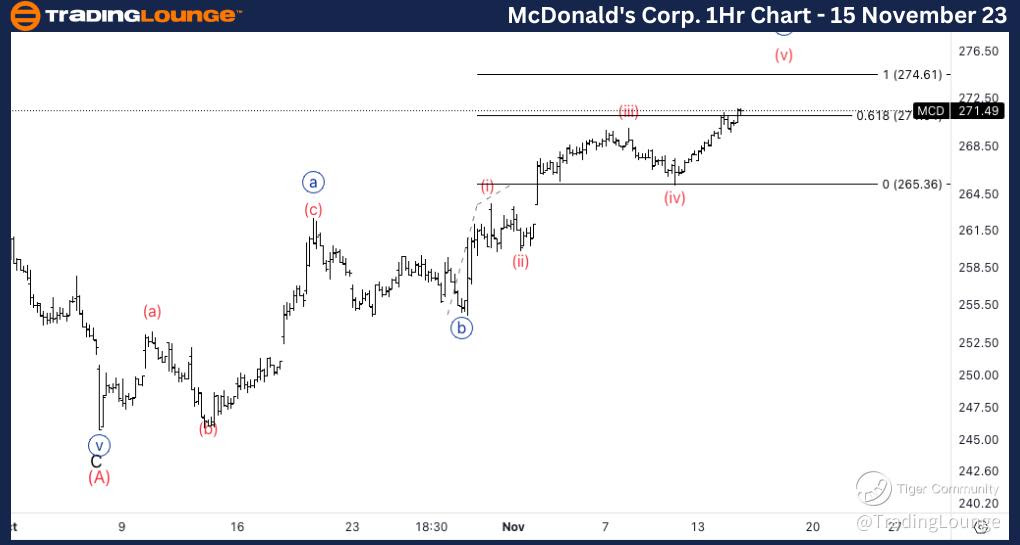

McDonald’s Corp., (MCD:NYSE): 4h Chart 15 November 23

MCD Stock Market Analysis: Looking for upside from the 245$ bottom to be corrective as we could see McDonald’s in a much larger degree correction. Looking for a top soon, potentially reaching 280$ first.

MCD Elliott Wave Count: Wave {c} of A.

MCD Technical Indicators: Below 200EMA.

MCD Trading Strategy: Looking for short term longs on the way up to 280$.

TradingLounge Analyst: Alessio Barretta

Source : Tradinglounge.com get trial here!

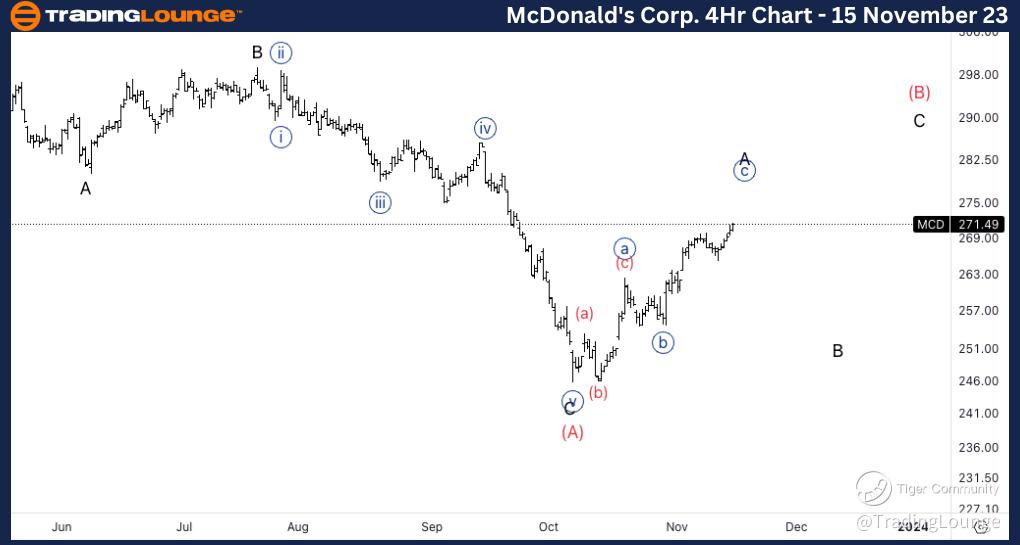

McDonald’s Corp., MCD: 1-hour Chart 15 November 23

McDonald’s Corp., Elliott Wave Technical Analysis MCD Stock Market Analysis: Looking for continuation higher into wave (v), as equality with wave (i) stands at 274$ and 1.618 {c} vs. {a} stands at 283$.

MCD Elliott Wave count: Wave (v) of {v}.

MCD Technical Indicators: Above all averages.

MCD Trading Strategy: Looking for short term longs on the way up to 280$.