Welcome to Our Latest Elliott Wave Analysis for Walmart Inc. (WMT) - August 12, 2024

This Elliott Wave analysis provides a detailed examination of Walmart Inc.'s (WMT) price movements as of August 12, 2024. Utilizing Elliott Wave Theory, this analysis aims to help traders pinpoint potential trading opportunities based on the current market trends and structures. We’ll explore insights from both the daily and 4-hour charts to deliver a thorough understanding of WMT's market behavior.

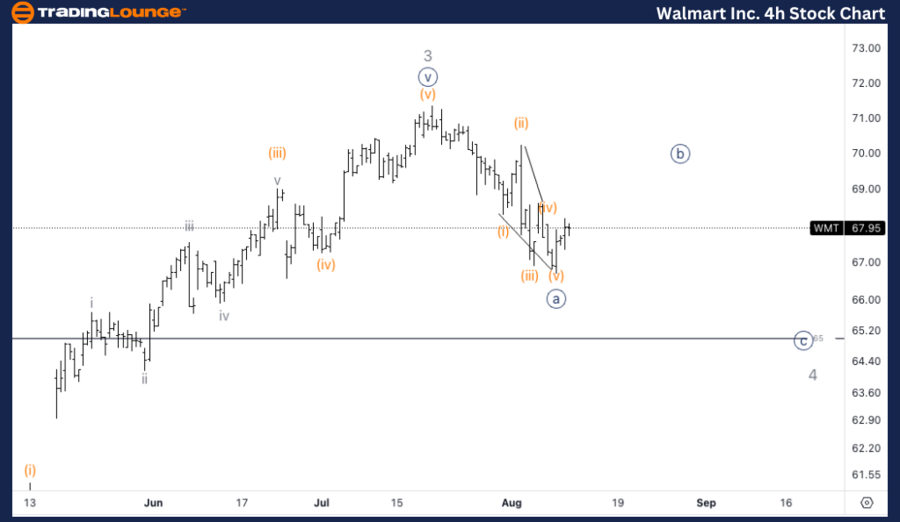

WMT Elliott Wave Analysis - Daily Chart

Walmart Inc. (WMT) Daily Chart Analysis

WMT Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Minor Wave 4

Direction: Downside in Wave 4

Details: After reaching a high of $72, WMT is projected to continue its decline into wave 4. The anticipated downside target for this wave is the Medium Level at approximately $65, where support might be found. Traders should monitor for signs of a bottom forming near this level before considering long positions.

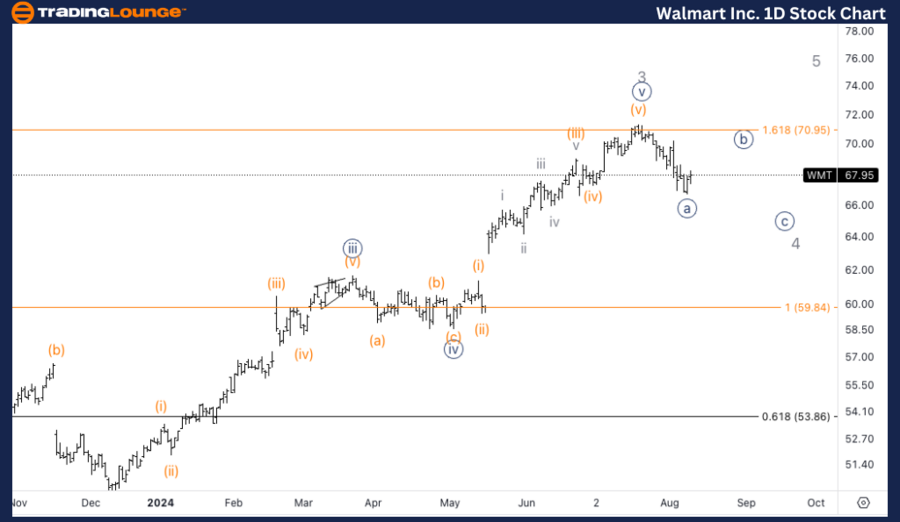

WMT Elliott Wave Analysis - 4H Chart

Walmart Inc. (WMT) 4H Chart Analysis

WMT Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Minute Wave {a}

Direction: Bounce in Wave {b}

Details: WMT appears to have completed wave {a} of the zigzag correction and is expected to experience a bounce in wave {b}. This bounce could ideally reach around $69, corresponding to wave (ii) of the previous diagonal. After this bounce, the price is anticipated to decline further into wave {c}, completing the correction in wave 4.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Eli Lilly & Co. (LLY) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support