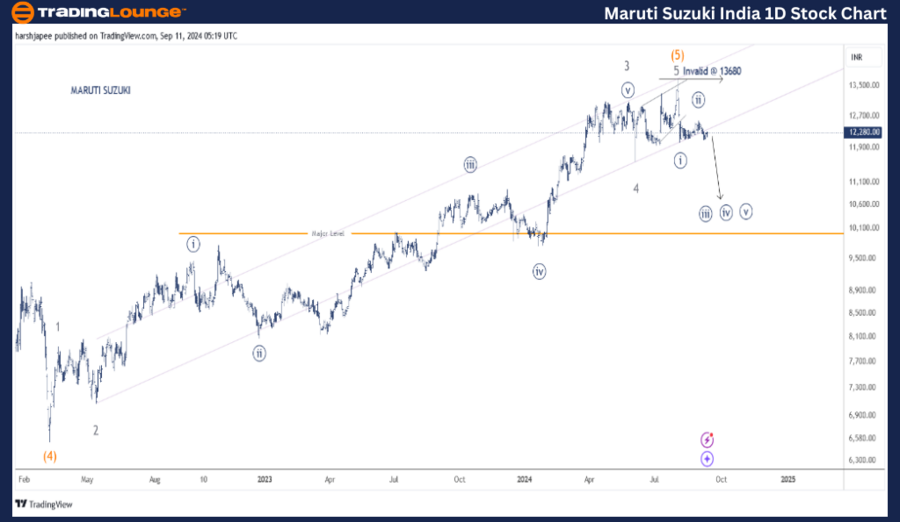

MARUTI SUZUKI INDIA – MARUTI (1D Chart) Elliott Wave Technical Analysis

Maruti Suzuki Elliott Wave Technical Analysis

Function: Counter Trend Lower (Intermediate degree, orange)

Mode: Corrective

Structure: Impulse, within a larger degree Wave A

Position: Minute Wave ((ii)) Navy complete

Details: Minute Wave ((ii)) appears complete just below the 12700-800 zone. Additionally, Minute Wave ((iii)) Navy seems to be progressing.

Invalidation point: 13680-85

Maruti Suzuki Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart for Maruti Suzuki indicates that a significant top was established around the 13680-85 zone, registered on August 01, 2024. Since then, the stock has declined, breaking through the 12040 level, identified as Minute Wave ((i)), followed by a shallow retracement toward the 12600-700 range, potentially completing Minute Wave ((ii)).

Previously, the stock completed an impulse wave from the 6500 to the 13680 levels, labeled as Intermediate Wave (5) Orange. Minor Waves 1 through 5 Grey also completed, with Wave 5 ending as a diagonal.

With Minute Waves ((i)) and ((ii)) likely set around 12040 and 12600-700, the bearish trend could resume, pushing Minute Wave ((iii)) lower towards the 9500 mark in the medium term.

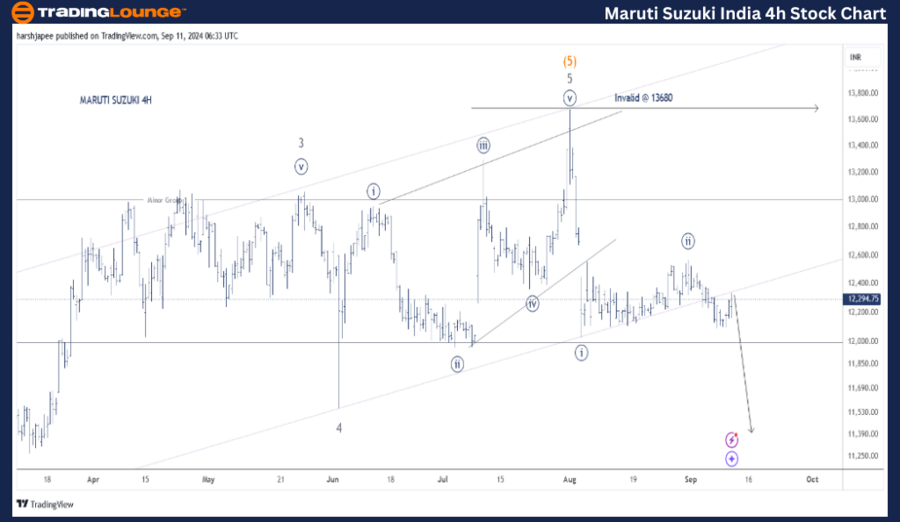

MARUTI SUZUKI INDIA – MARUTI (4H Chart) Elliott Wave Technical Analysis

Maruti Suzuki Elliott Wave Technical Analysis

Function: Counter Trend Lower (Intermediate degree, orange)

Mode: Corrective

Structure: Impulse, within a larger degree Wave A

Position: Minute Wave ((ii)) Navy complete

Details: Minute Wave ((ii)) appears complete just below the 12700-800 zone. Additionally, Minute Wave ((iii)) Navy seems to be progressing. Alternatively, prices may move sideways briefly before Minute Wave ((ii)) terminates.

Invalidation point: 13680-85

Maruti Suzuki 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4-hour chart for Maruti Suzuki emphasizes the lower degree waves within Minor Wave 5 Grey. Minute Waves ((i)) through ((v)) Navy complete the ending diagonal of Minor Wave 5 near the 13680 level, followed by a sharp decline.

Currently, Minute Wave ((i)) is identified around 12040, while Minute Wave ((ii)) is near the 12600-700 zone. If this count holds, Minute Wave ((iii)) is underway against the 13680 high.

Conclusion:

Maruti Suzuki is likely progressing within Minute Wave ((iii)) Navy, part of Minor Wave 1 Grey, against the 13680 level

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Eicher Motors Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support