Wheat Elliott Wave Technical Analysis

Wheat has extended its rally from the July 2024 lows, potentially signaling the start of a more significant bullish correction that could last several weeks. However, until the price breaks out of the current diagonal range and surpasses the May 2024 high, traders should remain cautious of a potential sell-off in the last quarter of 2024.

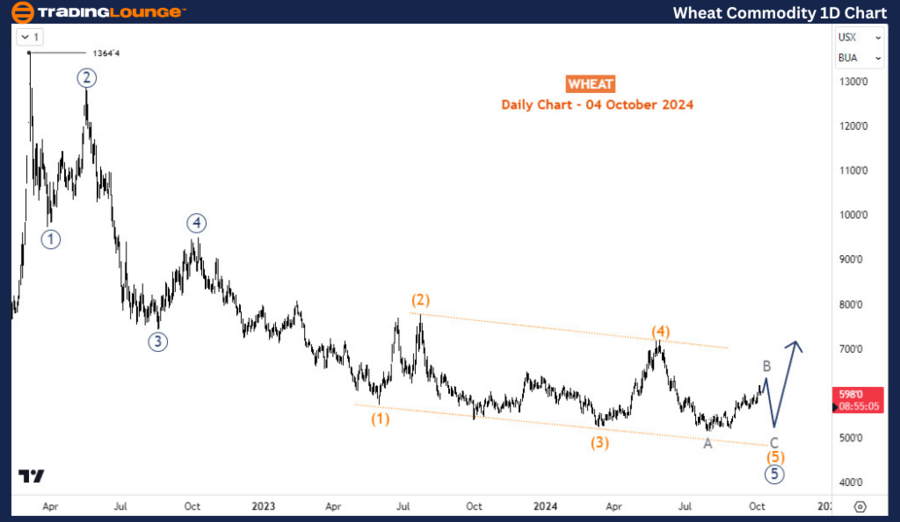

Wheat Commodity Daily Chart Analysis

The fifth wave, labeled as wave 5 (circled) in the primary degree, is currently forming an ending diagonal pattern. This diagonal is part of wave (5), which is expected to unfold in three sub-waves. Currently, wave (5) is in its second phase—wave B—marked by the recent bounce from July's low. Once this structure is complete, a further decline is anticipated, leading to the final leg of the pattern, known as wave C of (5). After wave (5) concludes, a retracement of the entire decline, which started from 1366, could occur over several months.

Alternatively, it’s possible that wave (5) has already completed. If the current recovery continues above wave (4), which corresponds to the May 2024 high, it will confirm that wave (5) of 5 (circled) ended at the July 2024 low. In this scenario, a stronger recovery correcting the entire bearish impulse from March 2022 is likely. However, until this occurs, one more leg lower for wave C of (5) should be considered after the current wave B bounce completes.

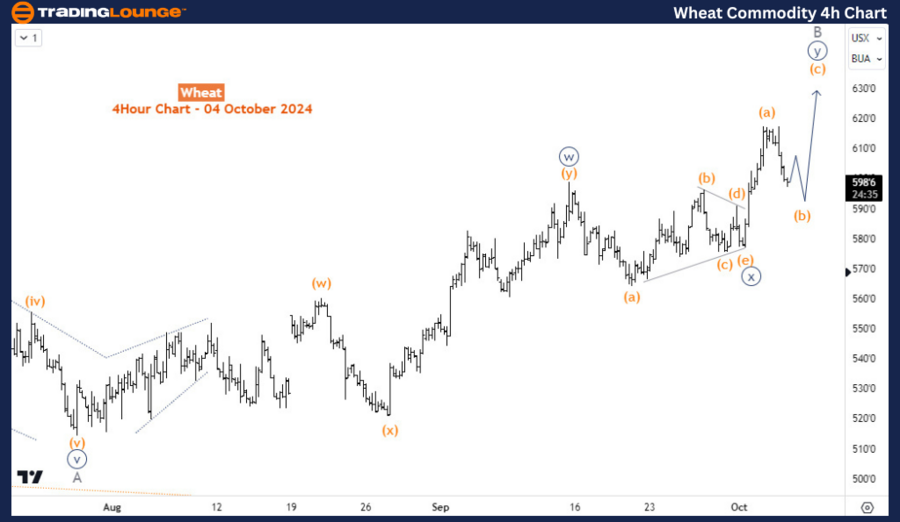

Wheat Commodity H4 Chart Analysis

Wave B of (5) is extending higher within a double zigzag structure. Waves ((w)) and ((y)) of B are complete. Currently, the price is in wave (b) of ((y)) of B. At least one more upward leg, wave (c) of ((y)) of B, is expected in the short term.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: GX Uranium ETF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support