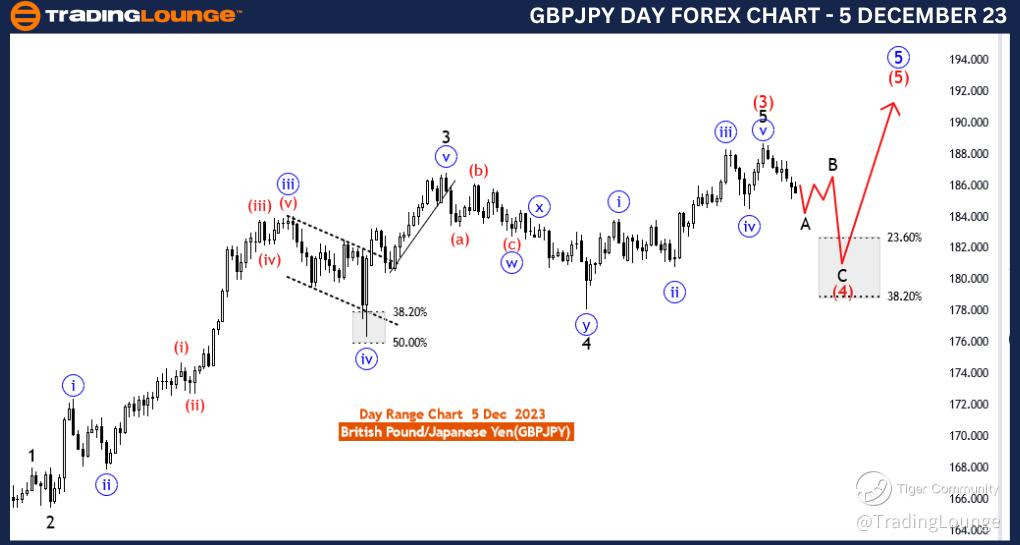

GBPJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart, 5 December 23

British Pound/Japanese Yen(GBPJPY) 4 Hour Chart

GBPJPY Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: A of red wave 4

Position: red wave 4

Direction Next Higher Degrees: B of 4

Details:, Black wave A of 4 is in play , after that b of 4 expected. Wave Cancel invalid level:188.657

The "GBPJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart" for December 5, 2023, provides insights into the British Pound/Japanese Yen (GBPJPY) currency pair within a four-hour timeframe. The technical analysis is grounded in Elliott Wave principles, offering a comprehensive understanding of the current market dynamics.

The identified "Function" is "Counter Trend," indicating that the analysis is focused on discerning movements contrary to the prevailing trend. In this context, the emphasis is likely on a corrective phase within the broader trend, presenting opportunities for traders to navigate potential reversals or retracements.

The specified "Mode" is "Corrective," highlighting the nature of the current market movement. Corrective waves are characterized by temporary price adjustments or sideways movements, suggesting a deviation from the primary trend.

The primary "Structure" under examination is "A of red wave 4," indicating that the focus is on a specific sub-wave (A) within the broader corrective structure (red wave 4). This detailed analysis allows for a nuanced understanding of the ongoing correction.

The designated "Position" is "red wave 4," providing information about the wave's location within the larger degree of correction. This suggests a focus on the specific phase of the broader corrective pattern.

The directional guidance for "Next Higher Degrees" is "B of 4," indicating an anticipation of the next upward wave within the larger corrective structure (red wave 4). This provides traders with insights into the expected progression of the correction.

Regarding "Details," the analysis notes that "Black wave A of 4 is in play." This suggests that the current phase involves the unfolding of the A wave within the larger corrective structure (red

wave 4). Additionally, it mentions that after the completion of A, the expectation is for "b of 4," signifying the anticipation of the subsequent sub-wave.

In conclusion, the GBPJPY Elliott Wave Analysis on the 4-hour chart for 5 December 23, offers a detailed examination of a corrective phase (A of red wave 4) within the broader trend. Traders are provided with insights into the current wave position, the expected next wave (B of 4), and key levels for wave cancellation.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!

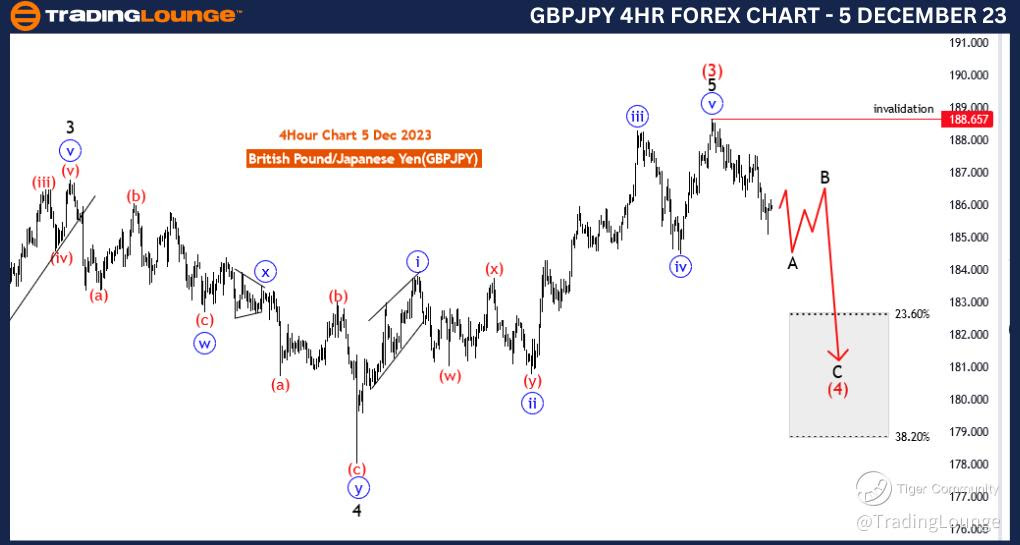

GBPJPY Elliott Wave Analysis Trading Lounge Day Chart, 5 December 23

British Pound/Japanese Yen(GBPJPY) Day Chart

GBPJPY Elliott Wave Technical Analysis

Function: Trend

Mode: Corrective as wave 4

Structure: abc likely zigzag

Position: main blue wave 5

Direction Next Higher Degrees: red wave 5 of 5

Details:, red wave 4 as correction is in play after that red wave 5 of 5 will start .

The "GBPJPY Elliott Wave Analysis Trading Lounge Day Chart" for 5 December 23, delves into the technical analysis of the British Pound/Japanese Yen (GBPJPY) currency pair within a daily timeframe. Utilizing Elliott Wave principles, the analysis aims to provide traders with a comprehensive understanding of the current market dynamics.

The identified "Function" is "Trend," highlighting the primary focus of the analysis within the context of the broader market trend. This suggests that the overarching trend is considered the dominant force, providing valuable insights for traders.

The specified "Mode" is "Corrective as wave 4," emphasizing the corrective nature of the current market movement. Corrective phases involve temporary price adjustments or sideways movements, and the mention of "wave 4" indicates the specific degree of correction within the Elliott Wave framework.

The primary "Structure" is described as "abc likely zigzag," indicating that the ongoing correction is likely unfolding in a zigzag pattern characterized by three sub-waves labeled as 'a,' 'b,' and 'c.' Zigzag corrections are a common Elliott Wave structure.

The designated "Position" is identified as "main blue wave 5," providing traders with information about the current position within the larger degree of the Elliott Wave pattern. This specific focus allows for a detailed analysis of the ongoing correction.

The directional guidance for "Next Higher Degrees" is "red wave 5 of 5," suggesting an anticipation of the next upward wave within the larger Elliott Wave structure. This guidance provides traders with insights into the expected progression of the corrective pattern.

Regarding "Details," the analysis notes that "red wave 4 as correction is in play," confirming the current corrective phase. It further states that "after that red wave 5 of 5 will start," indicating the expectation of the subsequent upward wave within the larger degree of correction.

In summary, the GBPJPY Elliott Wave Analysis on the daily chart for 5 December 23, focuses on a corrective phase labeled as "wave 4" within the broader trend context. The analysis provides detailed information about the structure of the correction, the current wave position, and the anticipated next wave within the Elliott Wave framework.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!