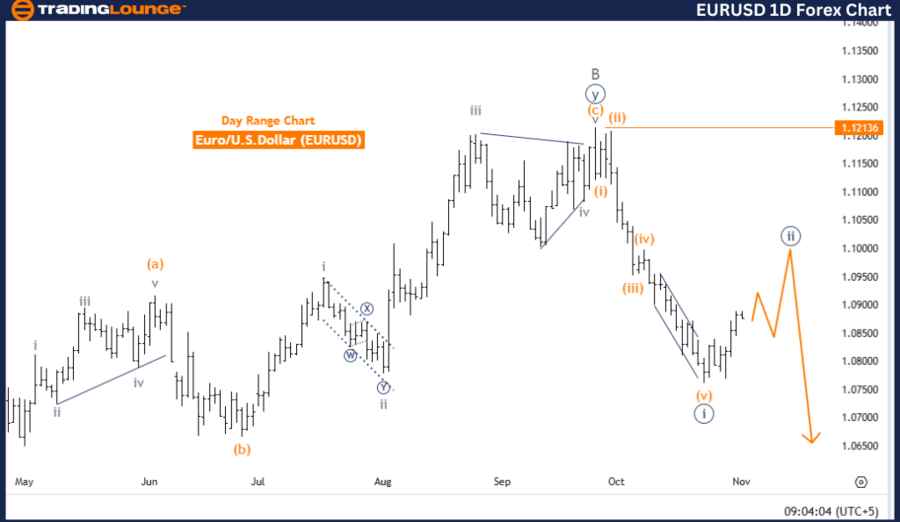

EURUSD Elliott Wave Analysis - Trading Lounge Daily Chart

Euro / U.S. Dollar (EURUSD) Daily Chart

EURUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave C

Direction of Next Lower Degree: Navy Blue Wave 3

Details: Navy blue wave 1 appears completed, with navy blue wave 2 currently active.

Wave Cancellation Level: 1.12136

The daily Elliott Wave analysis for EURUSD highlights a counter-trend scenario in a corrective phase. Current focus is on navy blue wave 2, indicating that navy blue wave 1 has likely concluded. This places the current wave within gray wave C of navy blue wave 2, suggesting that the corrective movement is progressing, potentially preparing for a continuation in the primary trend direction.

In Elliott Wave theory, wave 2 generally serves as a corrective counter-movement to the main trend. Once wave 2 finalizes, it’s anticipated that navy blue wave 3 could initiate, aligning with the primary trend direction. This transition from wave 2 into wave 3 is key for determining a potential shift towards the dominant trend in this analysis.

The critical wave cancellation level at 1.12136 remains a pivotal point; should prices exceed this threshold, the current wave interpretation would require reassessment, indicating a possible extension beyond the projected corrective phase.

In Summary: The EURUSD daily analysis portrays a counter-trend corrective structure where navy blue wave 2 is progressing. Following navy blue wave 1, the present gray wave C is expected to transition towards navy blue wave 3, aligned with the primary trend. The 1.12136 level acts as a validation point for this count, with movement beyond it prompting a potential reevaluation. This setup signals an ongoing corrective phase likely to resolve back into the main trend in upcoming waves.

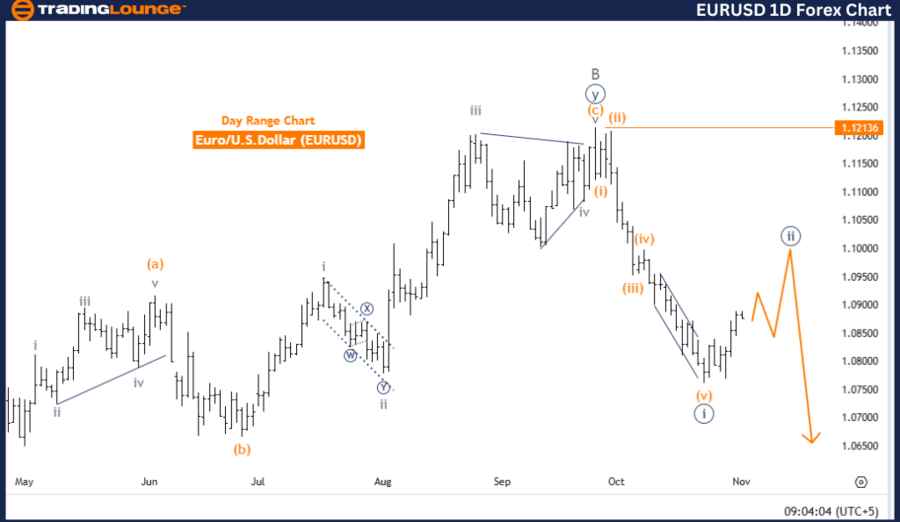

Euro / U.S. Dollar (EURUSD) 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave C

Direction of Next Lower Degree: Navy Blue Wave 3

Details: Navy blue wave 1 appears complete, with navy blue wave 2 now underway.

Wave Cancellation Level: 1.12136

The 4-hour Elliott Wave analysis of EURUSD reveals a counter-trend corrective mode, identified as navy blue wave 2 following the likely conclusion of navy blue wave 1. Currently positioned within gray wave C of navy blue wave 2, this configuration suggests a potential consolidation or correction phase before a probable return to the main trend direction as the subsequent wave series unfolds.

In the context of Elliott Wave theory, wave 2 corrections often run counter to the dominant trend. This implies the market may be setting up for the start of navy blue wave 3, expected to follow once wave 2 completes. The lower degrees align with navy blue wave 3, indicating a potential continuation of the main trend post-correction.

The wave cancellation level at 1.12136 is a crucial point in this analysis; a break above this level would invalidate the current wave interpretation for navy blue wave 2, necessitating a potential reevaluation of the wave count and an adjustment to the anticipated price trend.

In Summary: The EURUSD 4-hour analysis presents a counter-trend corrective structure within navy blue wave 2, signaling a temporary pullback. Completion of navy blue wave 2 may lead into navy blue wave 3, resuming the main trend. The 1.12136 level remains essential to validate this wave outlook, with movement beyond it suggesting an adjustment to the expected wave pattern. This setup reflects a corrective phase before a probable realignment with the primary trend in the subsequent waves.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AUDJPY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support