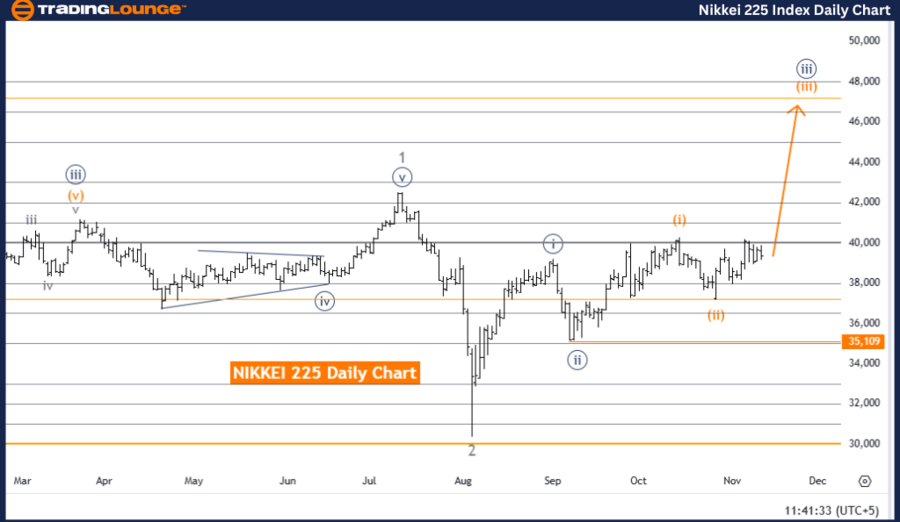

NIKKEI 225 (N225) Elliott Wave Analysis Trading Lounge Day Chart

NIKKEI 225 (N225) Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction Next Higher Degrees: Orange Wave 3 (Started)

Details: Orange Wave 2 appears completed; Orange Wave 3 is now active.

Wave Cancel Invalidation Level: 35,109

The NIKKEI 225 Elliott Wave analysis on the daily chart reflects a bullish trend driven by an impulsive wave pattern. The primary focus is on Orange Wave 3, signaling a positive market outlook as it unfolds within the Navy Blue Wave 3 structure.

Wave Structure and Key Insights

- The completion of Orange Wave 2 confirms the activation of Orange Wave 3, aligning with a strong upward trajectory.

- Orange Wave 3 is typically associated with significant price movement in the direction of the prevailing trend.

Invalidation Level

- An invalidation level has been identified at 35,109.

- A decline to or below this threshold would invalidate the progression of Orange Wave 3, suggesting the need to reassess the wave framework and potentially signaling a trend shift.

Summary

The current analysis projects a bullish outlook for the NIKKEI 225, with Orange Wave 3 driving the impulsive wave structure within Navy Blue Wave 3. Traders should monitor price levels closely, especially around the 35,109 invalidation level, as a breach could indicate a reversal or correction.

NIKKEI 225 (N225) Elliott Wave Analysis Trading Lounge Weekly Chart

NIKKEI 225 (N225) Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 3

Position: Gray Wave 3

Direction Next Higher Degrees: Navy Blue Wave 3 (Continuing)

Details: Navy Blue Wave 2 appears completed; Navy Blue Wave 3 is now active.

Wave Cancel Invalidation Level: 35,109

The weekly analysis of the NIKKEI 225 underscores a bullish trajectory, emphasizing the progression of Navy Blue Wave 3 within Gray Wave 3. This impulsive wave pattern reinforces a sustained upward movement, reflecting positive sentiment and long-term growth potential.

Wave Structure and Key Insights

- The completion of Navy Blue Wave 2 has led to the activation of Navy Blue Wave 3, an essential phase within the Elliott Wave framework.

- Wave 3 is often characterized by the strongest and most extensive price movement, affirming a robust upward trend in the NIKKEI 225.

Invalidation Level

- The invalidation level for this wave structure is set at 35,109.

- A drop to or below this level could interrupt the progression of Navy Blue Wave 3, signaling a shift in sentiment or the start of a corrective phase.

Summary

The NIKKEI 225 continues to display a bullish outlook, with Navy Blue Wave 3 driving the impulsive trend within Gray Wave 3. Traders should pay close attention to the 35,109 invalidation level, as any breach may indicate a disruption in the bullish framework, requiring a reassessment of market dynamics.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: RUSSELL 2000 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support