GX URA Elliott Wave Analysis: Unveiling the Uranium Market Opportunity

GX Uranium ETF Commodity Elliott Wave Technical Analysis

The Global X Uranium ETF (GX URA) offers investors broad exposure to the uranium sector, focusing on companies involved in uranium mining, exploration, and production worldwide. With nuclear energy gaining prominence as a cleaner power source, the rising demand for uranium positions the GX URA ETF as a compelling choice for investors seeking to capitalize on the sector's growth potential.

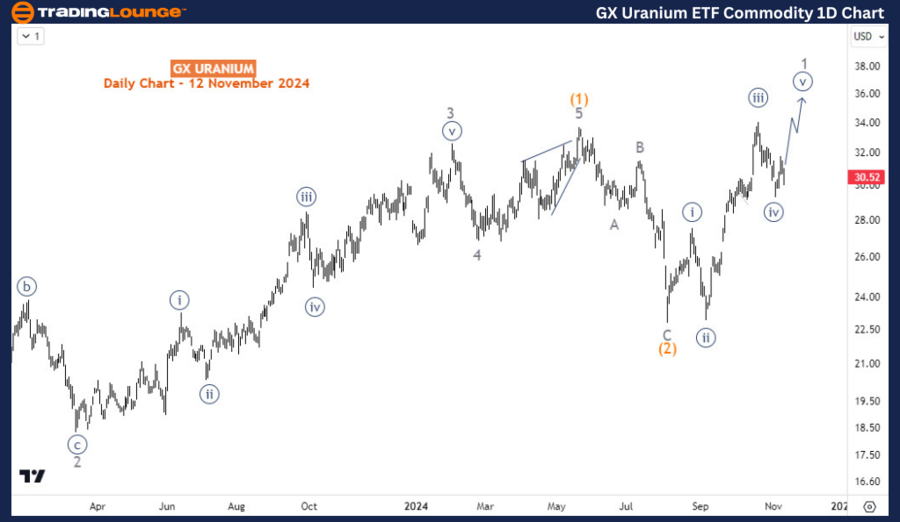

The ETF has maintained a bullish trend since March 2020, consistently making higher highs and higher lows. Its previous peak in May 2024 was surpassed in October following a 10-week corrective pullback from May's high.

GX Uranium ETF Daily Chart Analysis

After reaching a significant low in November 2021, the ETF formed an impulsive wave A (circled) of the primary degree, marking the initial phase of a larger corrective structure. A corrective pullback for wave B (circled) followed, ending in July 2022. Subsequently, an impulsive wave structure emerged, culminating in May 2024 as wave (1) of C (circled). A pullback formed wave (2), as observed on the daily chart.

Currently, the rally that began on August 5, 2024, appears to be the start of wave 1 of (3), signaling a continuation of the bullish trend. With wave 1 still in progress, the chart suggests significant upside potential remains as the correction plays out.

GX Uranium ETF H4 Chart Analysis

The H4 chart reveals that wave 1 of (3) is still developing. The price has completed wave ((iv)) of 1, with further rallies expected in wave ((v)) of 1, potentially targeting $35 before a larger corrective pullback in wave 2.

Key Takeaways:

- The GX URA ETF continues to exhibit a bullish Elliott Wave structure, pointing to growth opportunities.

- The rally beginning in August 2024 suggests the start of a new impulsive wave, signaling further potential upside.

- Near-term price targets indicate potential movement toward $35 before a larger pullback.

By tracking these Elliott Wave patterns, investors can gain deeper insights into the uranium market and the opportunities presented by GX URA.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Copper Commodity Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support