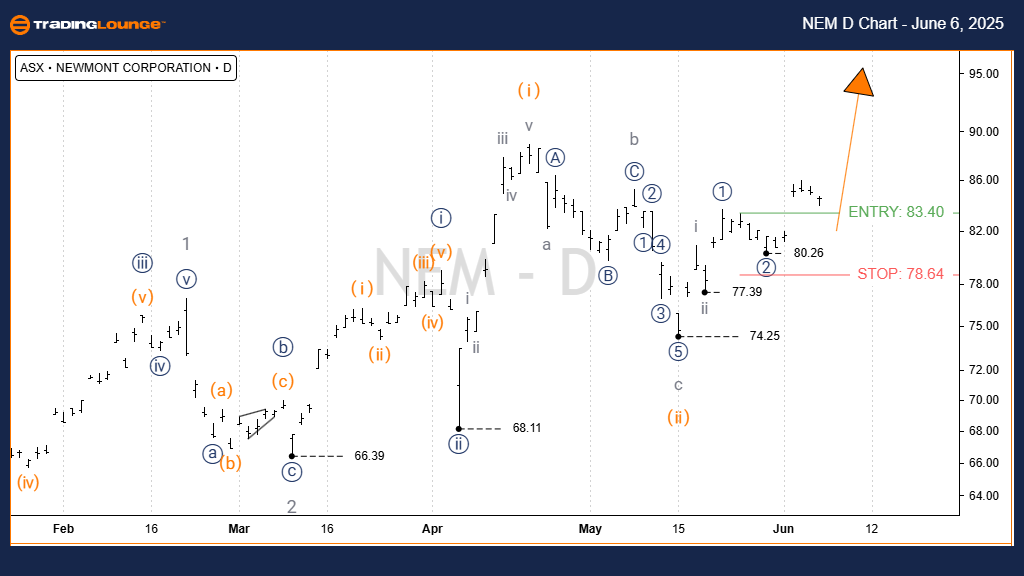

ASX: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis – TradingLounge (1D Chart)

Overview:

In this Elliott Wave analysis of Newmont Corporation (ASX: NEM), we observe continued bullish momentum on the daily timeframe. The market is currently advancing within Wave iii) – orange, a sub-wave of Wave iii)) – navy, which itself forms part of the broader Wave 3 – grey. This structure aligns with a standard impulsive motive wave. We outline precise bullish targets and key invalidation levels to help traders navigate this trending setup.

ASX: NEWMONT CORPORATION Technical Analysis – 1D Chart (Semilog Scale)

Function: Major Trend (Minor Degree – Grey)

Mode: Motive

Structure: Impulse

Current Position: Wave iii) – orange of Wave iii)) – navy of Wave 3 – grey

Key Insight:

Wave ii) – orange most likely ended as a completed zigzag correction (a, b, c – grey) around the 74.25 low. From this base, Wave iii) – orange has resumed its upward trajectory. A significant resistance level and target zone lies around the 100.00 price mark.

Invalidation Point: 74.25

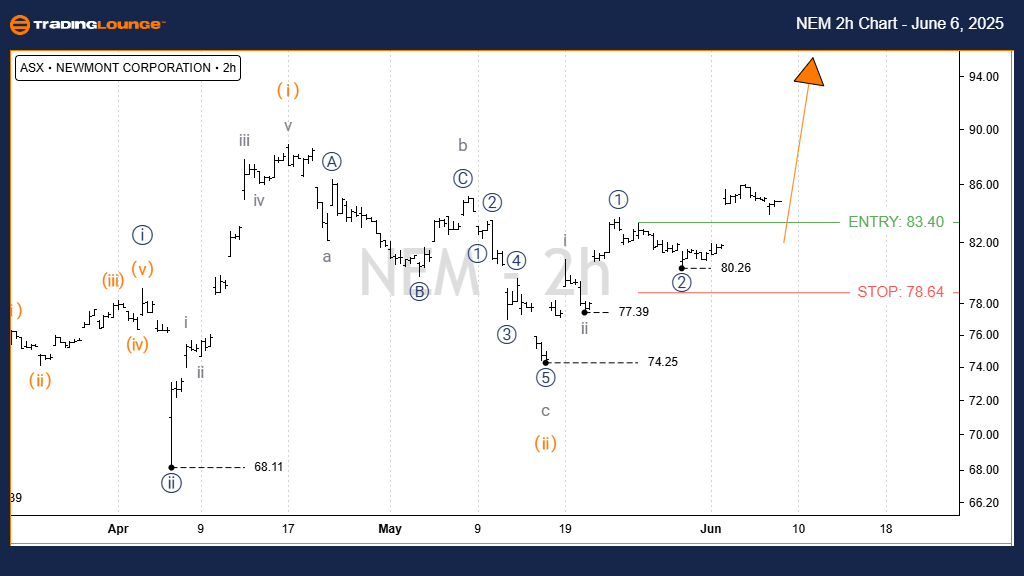

ASX: NEWMONT CORPORATION Elliott Wave Analysis – TradingLounge (4-Hour Chart)

Short-Term Trend Confirmation:

The 4-hour chart supports the bullish continuation scenario outlined in the daily timeframe. The impulsive wave count is consistent across both timeframes, reinforcing our projected price targets.

NEM Technical Analysis – 4-Hour Chart

Function: Major Trend (Minor Degree – Grey)

Mode: Motive

Structure: Impulse

Current Position: Wave iii) – orange of Wave ((iii)) – navy of Wave 3 – grey

Key Insight:

In the shorter timeframe, Wave iii) – orange continues to progress, pushing towards a nearby target around 90.00. The broader target for the entire wave structure remains at 100.00, assuming bullish conditions persist.

Invalidation Point: 74.25

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This dual timeframe Elliott Wave analysis for ASX: NEM highlights both intermediate and near-term bullish scenarios, offering clarity on key resistance and invalidation levels. Traders can utilize these insights for strategic entries and exits in line with the prevailing upward trend.