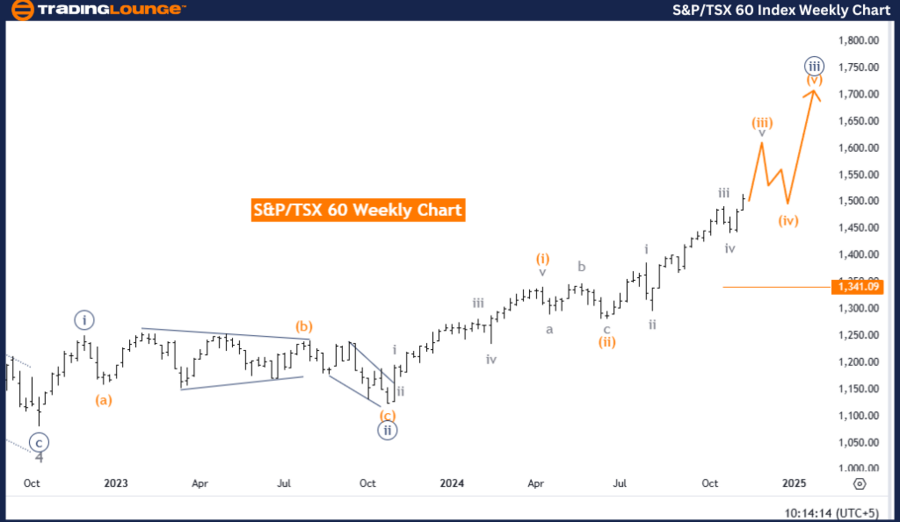

S&P/TSX 60 Elliott Wave Analysis - Trading Lounge Daily Chart

S&P/TSX 60 Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Gray Wave 5

Position: Orange Wave 3

Direction (Next Lower Degrees): Orange Wave 4

Details

The S&P/TSX 60 daily chart analysis from Trading Lounge showcases a consistent upward trend within the Canadian stock index. The ongoing structure exhibits an impulsive Elliott Wave pattern, with Gray Wave 5 actively progressing as part of Orange Wave 3. This formation suggests a continuation of bullish momentum in the market.

- Gray Wave 4 of Orange Wave 3 has completed, paving the way for Gray Wave 5 to extend further gains.

S&P/TSX Elliott Wave Theory Insights

Key Level for Wave Invalidation

-

Critical Level: 1,442.18

If the index falls to or below 1,442.18, the current wave count becomes invalid. Such a move would signify a weakening in bullish momentum and could mark a potential trend reversal.

This invalidation point is crucial for traders as it serves as a checkpoint for market strength. A breach of this level would necessitate a reanalysis of the Elliott Wave structure and potentially a strategic pivot.

Summary and Market Outlook

This level remains a critical marker for evaluating the strength and sustainability of the bullish trend in the S&P/TSX 60 index.

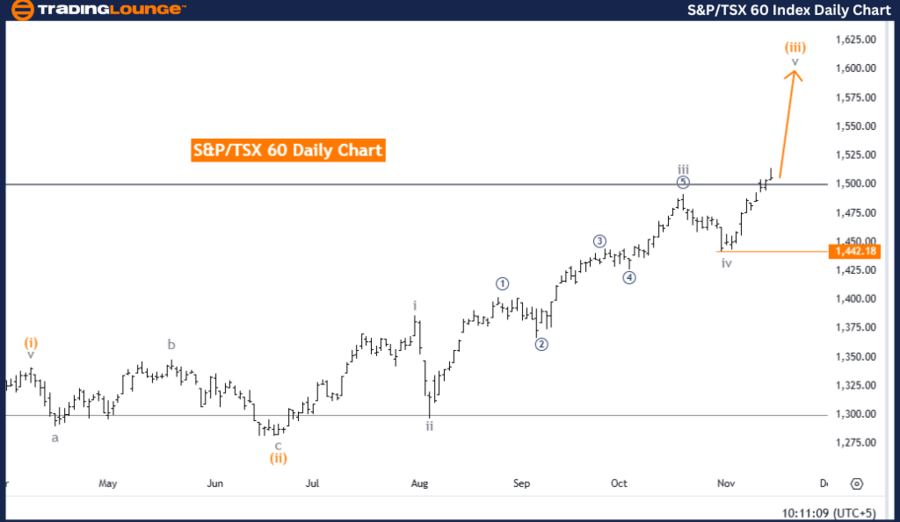

S&P/TSX 60 Elliott Wave Analysis - Trading Lounge Weekly Chart

S&P/TSX 60 Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Navy Blue Wave 3

Position: Gray Wave 5

Direction (Next Lower Degrees): Navy Blue Wave 4

Details

The S&P/TSX 60 weekly chart analysis by Trading Lounge reflects a persistent upward trend in the Canadian stock index. This movement aligns with an impulsive Elliott Wave structure, where Navy Blue Wave 3 is currently active. Within this broader wave, Gray Wave 5 is progressing, reinforcing the bullish outlook.

Following the conclusion of Navy Blue Wave 2, the emergence of Navy Blue Wave 3 signifies a dominant upward trend. This wave structure indicates potential for further gains as the bullish momentum continues.

S&P/TSX 60 Elliott Wave Theory Insights

Key Level for Wave Invalidation

-

Critical Level: 1,341.09

A decline to or below 1,341.09 invalidates the current wave count, potentially signaling a weakening trend or a reversal in market direction.

This level is vital for traders to assess market momentum and strength. A breach could prompt a re-evaluation of the Elliott Wave sequence, indicating possible changes in market dynamics.

Summary and Market Outlook

This critical level serves as a reference for validating the ongoing strength and persistence of the bullish trend in the S&P/TSX 60 index.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: IBEX 35 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support