Visa Inc. (V) Elliott Wave Analysis: A Detailed Technical Outlook

This article delves into the Elliott Wave Analysis of Visa Inc. (V) using insights from the daily and 1-hour charts to evaluate current trends and project future price movements.

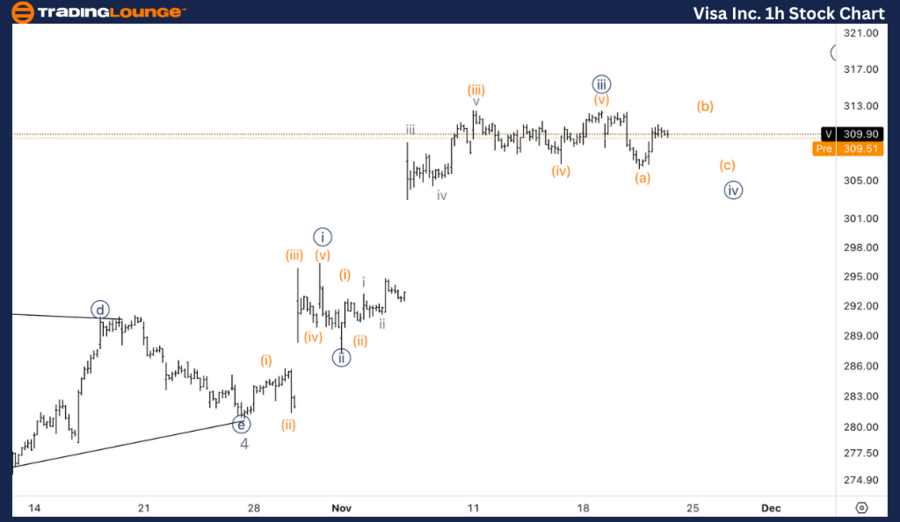

Visa Inc. V Elliott Wave Analysis: TradingLounge Daily Chart

Visa Inc. (V) Daily Chart Analysis

Visa Inc. (V) Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iv} of 5

Direction: Upside in wave {v} of 5

Details: Visa Inc. is currently in wave {iv} of the larger fifth wave, indicating a phase of consolidation near the MinorGroup1 level around $310. This is a typical corrective wave, and once it concludes, we anticipate an upward move into wave {v}, completing the motive structure.

V Elliott Wave Technical Analysis: Daily Chart Breakdown

Visa is consolidating as part of wave {iv}, hovering near $310, the MinorGroup1 level. This phase suggests a corrective pattern before progressing to the final wave {v}. Key confirmation of this move lies in observing how the price behaves during the current consolidation. Upon completion, wave {v} should aim to finalize the fifth wave of this overall motive trend.

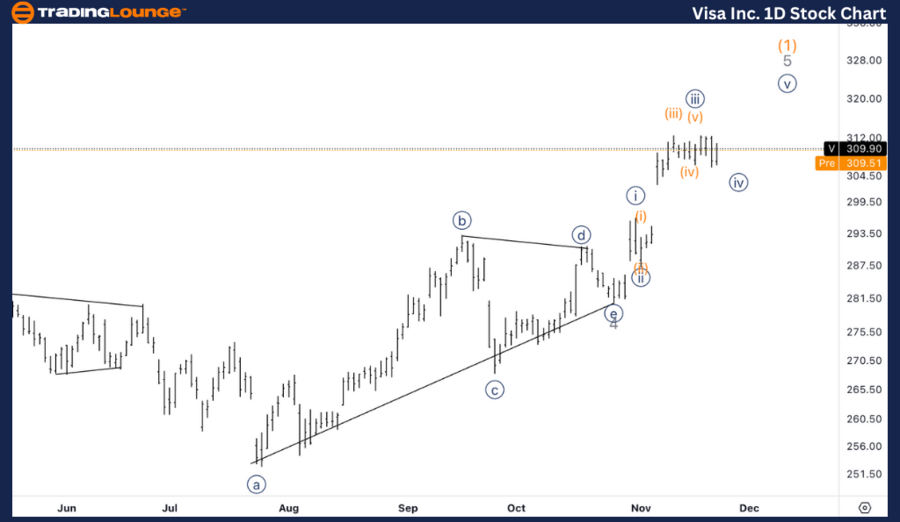

V Elliott Wave Analysis: TradingLounge 1-Hour Chart

Visa Inc. (V) 1H Chart Analysis

V Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (a) of {iv}

Direction: Completion in wave {iv}

Details: Visa appears to be in the process of completing wave (a) within wave {iv}, with indications of a three-wave structure in this segment. A potential pullback into wave (b) is expected, followed by a downward move into wave (c) to conclude wave {iv}. Alternatively, there is a chance that wave {iv} has already concluded, as the price is aligning with the previous wave (iv) area. This increases the probability of an impending wave {v} initiation.

V Elliott Wave Technical Analysis: 1-Hour Chart Breakdown

The 1-hour chart analysis shows Visa completing wave (a) of corrective wave {iv}, characterized by a potential three-wave move. The likelihood of a pullback in wave (b) is significant, which would set the stage for a decline into wave (c). However, if wave {iv} has already been completed, the next phase could see the start of wave {v}, pushing the price higher.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Deere & Co. (DE) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support