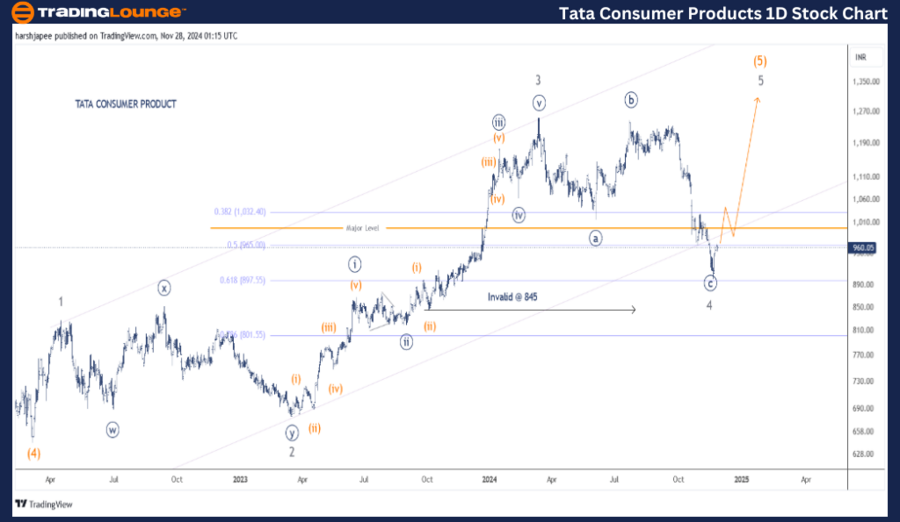

Tata Consumer Product Elliott Wave Analysis (1D Chart)

Tata Consumer Product Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4

Details:

- Minor Wave 4 appears to have completed as a zigzag pattern, potentially near the 900 level.

- Minor Wave 5 is likely to commence soon, with the key invalidation point set at 845.

TATA CONSUMER PRODUCT Daily Chart Technical Analysis and Potential Elliott Wave Counts

The TATA CONSUMER PRODUCT daily chart suggests a probable Minor Wave 4 bottom around the 900 mark. If accurate, the next target for Minor Wave 5 is projected to be between the 1400 and 1500 levels.

- The stock found a bottom near the 640 lows in March 2022, ending Minute Wave (4) Orange.

- Since then, a clear three-wave progression has unfolded in the form of Minor Waves 1, 2, and 3.

- Minor Wave 2: Completed as an expanded flat.

- Minor Wave 4: Developed as a flat structure.

Assuming the proposed count holds, the stock is expected to break above the 1400 level. However, the invalidation point for this count lies around 840-845, corresponding to Minor Wave 1 termination.

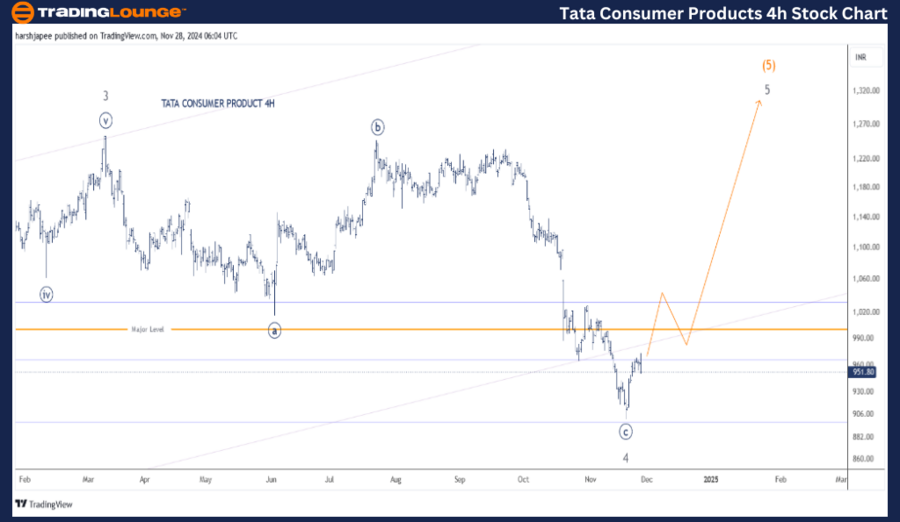

TradingLounge – TATACONSUM Elliott Wave Technical Analysis (4H Chart)

TATA CONSUMER PRODUCT 4-Hour Chart Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4

Details:

- Minor Wave 4 has likely unfolded as a zigzag pattern, bottoming near the 900 level.

- A move above 1028 would confirm bullish momentum, with invalidation still around 845.

TATA CONSUMER PRODUCT 4H Chart Technical Analysis and Potential Elliott Wave Counts

The TATA CONSUMER PRODUCT 4H chart highlights a drop from the 1250 level in March 2024, marking the termination of Minor Wave 3.

- Wave 4 formed as a flat (3-3-5) pattern, likely bottoming around 900 in March 2024.

- If this wave count remains valid, Minor Wave 5 is underway, with a potential acceleration above 1028.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: MAHINDRA & MAHINDRA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

TATA CONSUMER PRODUCT is progressing higher within Minor Wave 5, targeting levels above 1400. The invalidation point remains firmly at 845.