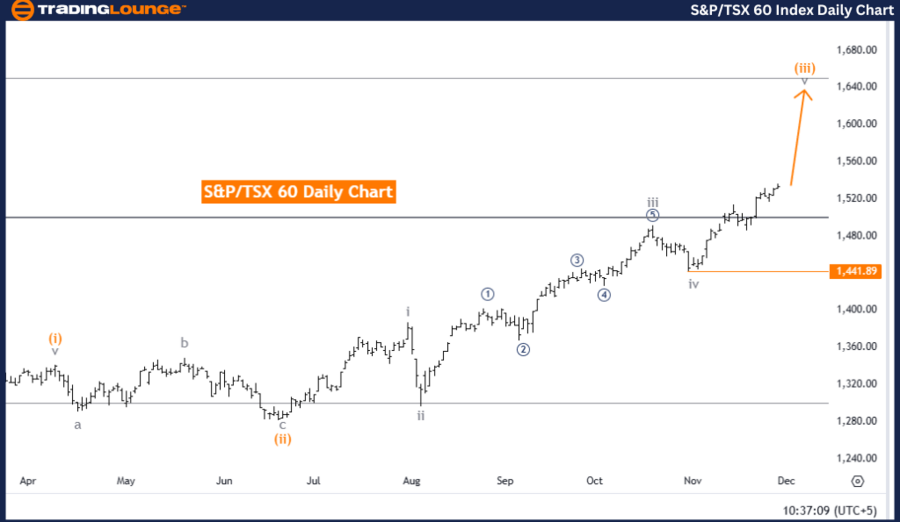

S&P/TSX 60 Elliott Wave Analysis - Trading Lounge Daily Chart

S&P/TSX 60 Elliott Wave Technical Analysis

Technical Details

Function: Bullish Trend

Mode: Impulsive

Structure: Gray wave 5

Position: Orange wave 3

Direction (Next Lower Degrees): Orange wave 4 (pending)

Details

This analysis evaluates the S&P/TSX 60 index on a daily chart utilizing Elliott Wave theory. The study identifies a bullish trend in impulsive mode, highlighting gray wave 5 within orange wave 3. The completion of gray wave 4 marked the initiation of gray wave 5, suggesting a continuation of the upward momentum.

Currently, the market is positioned within orange wave 3, specifically in its final phase—gray wave 5. This stage precedes the expected correction phase in orange wave 4, set at a lower degree of the wave cycle.

- Invalidation Level: 1,441.89

A decline to this level will invalidate the current wave count and bullish outlook, making it a critical level for both risk management and trend confirmation.

Summary

The Elliott Wave analysis confirms the S&P/TSX 60 index is in a bullish impulsive trend, with gray wave 5 active within orange wave 3. The initiation of gray wave 5 followed the completion of gray wave 4, reinforcing the bullish trajectory. As long as the index stays above the invalidation level of 1,441.89, the bullish outlook remains valid. Further upward momentum is expected before transitioning to orange wave 4's corrective phase.

S&P/TSX 60 Elliott Wave Analysis - Trading Lounge Weekly Chart

S&P/TSX 60 Elliott Wave Technical Analysis

Technical Details

Function: Bullish Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy Blue Wave 3

Direction (Next Lower Degrees): Orange wave 4 (upcoming)

Details

This analysis inspects the S&P/TSX 60 index on a weekly chart, applying Elliott Wave theory to identify a strong bullish trend. The current structure emphasizes orange wave 3, which has been progressing following the completion of orange wave 2, signalling sustained upward momentum.

The market is now within navy blue wave 3, which is part of the broader orange wave 3 structure. This represents a significant impulsive movement, with further gains anticipated before entering the correction phase of orange wave 4 at a lower degree.

- Invalidation Level: 1,441.89

Falling below this level will invalidate the bullish wave count, making it a key point for trend confirmation and risk management.

Summary

The Elliott Wave analysis for the weekly chart highlights a robust bullish trend in the S&P/TSX 60 index, with orange wave 3 advancing within navy blue wave 3. The conclusion of Orange Wave 2 confirmed the start of this strong impulsive movement. The bullish outlook holds as long as the index remains above the invalidation level of 1,441.89. Continued upward momentum is expected as orange wave 3 develops further, reinforcing the positive trend.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: CAC 40 (France) Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support