CAC 40 (France) Elliott Wave Analysis - TradingLounge Day Chart

CAC 40 (France) Elliott Wave Technical Analysis

CAC 40 Technical Details

Function: Bearish Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 3

Direction Next Higher Degrees: Gray Wave 4

Details: Gray wave 2 appears complete. Currently, gray wave 3 of orange wave 3 is developing.

Wave Cancel Invalidation Level: 7618.09

CAC 40 Analysis Overview

This Elliott Wave analysis for the CAC 40 Index focuses on the daily chart, highlighting a bearish trend. The market is in an impulsive mode, characterized by strong downward momentum.

- Primary Wave Structure: Gray wave 3, initiated after the completion of gray wave 2, indicates the continuation of the bearish phase.

- Current Position: Gray wave 3 is unfolding within orange wave 3. This stage marks the intensification of the downward trajectory.

- Future Projection: Following the completion of gray wave 3, a transition to gray wave 4, a corrective phase, is anticipated.

CAC 40 Key Level for Invalidation

-

The invalidation level is set at 7618.09.

-

If the index surpasses this threshold, the current wave count and bearish outlook will be invalidated.

- This level is crucial for risk management and confirms the ongoing bearish impulsive phase.

Summary

-

Bearish Trend: The CAC 40 index remains in a bearish phase, with gray wave 3 actively developing as part of orange wave 3.

-

Momentum: The completion of gray wave 2 marked the beginning of this impulsive decline.

-

Validation: The bearish outlook remains intact below the invalidation level of 7618.09.

- Projection: Continued downward movement in gray wave 3 is expected, followed by a corrective gray wave 4 phase.

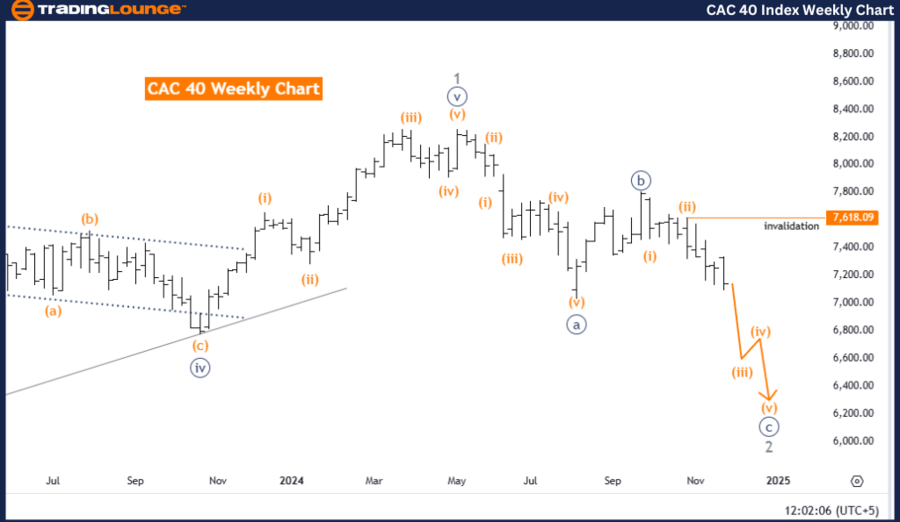

CAC 40 (France) Elliott Wave Analysis - TradingLounge Weekly Chart

CAC 40 (France) Elliott Wave Technical Analysis

CAC 40 Technical Overview

Function: Counter Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave C

Direction Next Higher Degrees: Orange Wave 4

Details: Orange wave 2 appears complete; orange wave 3 of 3 is currently developing.

Wave Cancel Invalidation Level: 7618.09

CAC 40 Analysis Overview

This weekly chart analysis uses Elliott Wave Theory to identify a counter-trend phase in the CAC 40 Index. The market remains in an impulsive mode, moving strongly within orange wave 3 as part of a broader corrective structure.

- Progression: The completion of orange wave 2 confirms the continuation of the current trend.

- Current Position: Navy blue wave C, a critical element of orange wave 3, is actively unfolding.

- Future Projection: Further downward movement is expected before transitioning to orange wave 4, which will serve as a corrective phase within the higher-degree wave structure.

CAC 40 Key Level for Invalidation

Summary

-

Counter-Trend: The CAC 40 index is in a counter-trend phase, with orange wave 3 actively unfolding after orange wave 2 completion.

-

Momentum: Navy blue wave C marks the ongoing impulsive movement within the structure.

-

Validation: The counter-trend outlook holds as long as the index remains below the invalidation level of 7618.09.

- Projection: Further development in orange wave 3 is expected before transitioning into a corrective phase in orange wave 4.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TASI Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support