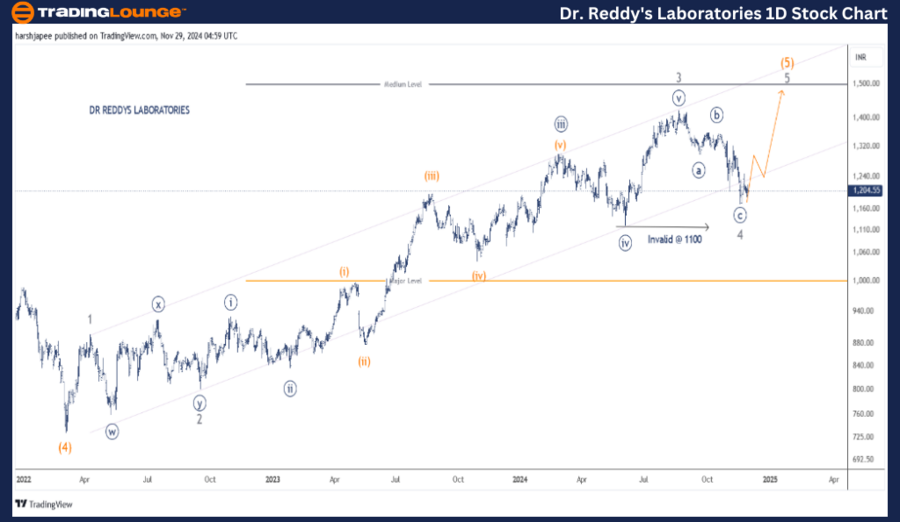

DR REDDY'S LABORATORIES – DRREDDY (1D Chart) Elliott Wave Technical Analysis

DRREDDY Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Minor degree, Grey)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4

Details: The structure appears to have shifted, as the Zigzag correction seems complete around the 1150–1160 mark. If this analysis holds, Minor Wave 5 is expected to be underway against the 1100 invalidation point.

Invalidation Point: 1100

DR. REDDY’S LABORATORIES Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart of DR. REDDY’S LABORATORIES suggests a continuation of the larger degree uptrend as long as prices stay above the critical 1100 level. Minor Wave 5 of Intermediate Wave (5) Orange is potentially unfolding. However, a sustained break below the 1100 mark would necessitate a revision of the Elliott Wave counts.

Previously, the stock experienced a significant decline, bottoming out at 730, marking the termination of Intermediate Wave (4). From that point, an impulse wave appears to be progressing. Minor Waves 1 through 4 are already in place. Assuming this count is accurate, Minor Wave 5 is poised to resume higher shortly.

Alternate Scenario:

The stock might have completed its impulsive sequence near the 1420 mark and could now be reversing lower. A decisive break below 1100 would signal a potential major top, requiring a reassessment of the wave structure.

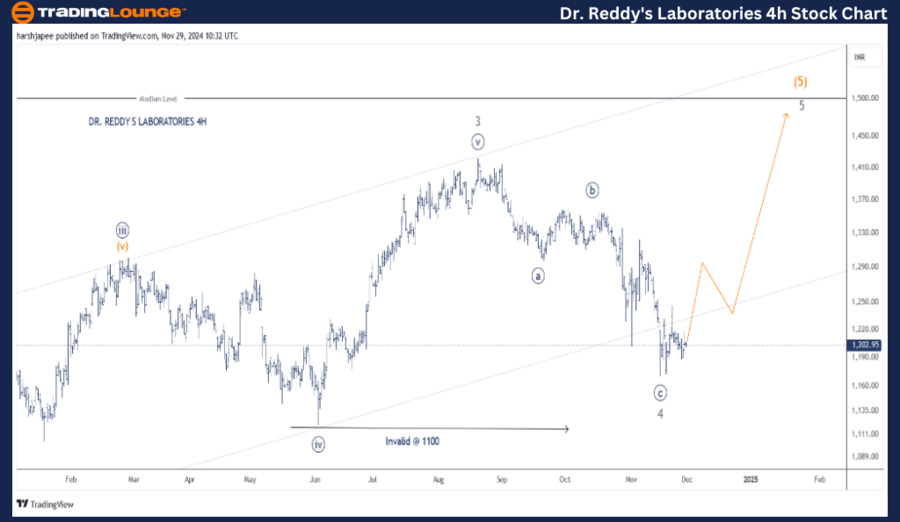

DR REDDY'S LABORATORIES – DRREDDY (4H Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Minor degree, Grey)

Mode: Motive

Structure: Impulse

Position: Minor Wave 4

Details: The Zigzag correction on the 4H chart appears complete around the 1150–1160 zone. If accurate, Minor Wave 5 should now be progressing higher, maintaining the 1100 invalidation level.

Invalidation Point: 1100

DR. REDDY’S LABORATORIES 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart of DR. REDDY’S LABORATORIES offers insights into the sub-waves post-Minor Wave 3, which peaked near 1420 in August 2024. Wave 4 unfolded as a Zigzag correction, potentially completing around 1170. However, it could form another shallow low before resuming the upward trend.

If the current structure remains intact, prices are likely to stay above the critical 1100 level, which corresponds to the prior Minor Wave ((iv)) Navy. This would set the stage for a continued rally towards and potentially beyond the 1420 level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Tata Consumer Product Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

The analysis indicates that DR. REDDY’S LABORATORIES may have completed its Zigzag correction around the 1170 mark. If this interpretation is correct, Minor Wave 5 is anticipated to resume its upward trajectory shortly. For traders, the 1100 mark remains the key invalidation level, while targets near 1420 or higher could be in play.