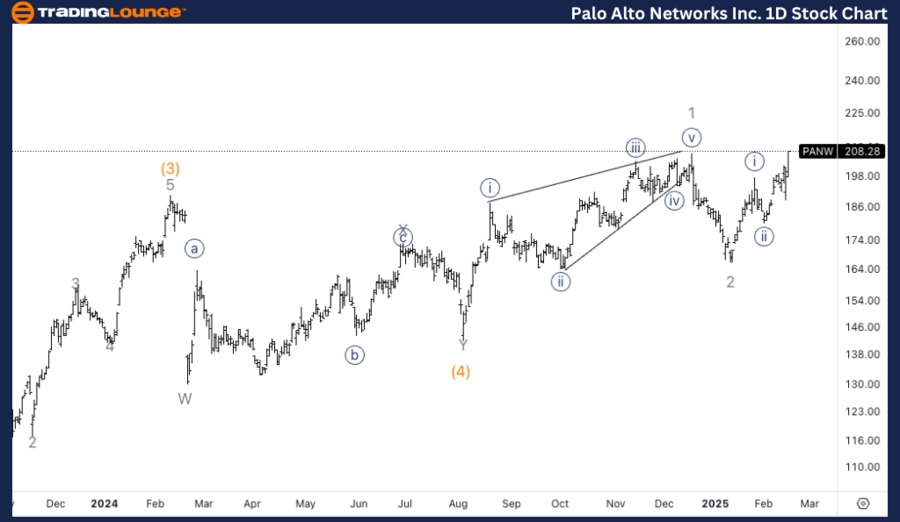

Palo Alto Networks Inc. (PANW) – Elliott Wave Daily Chart Analysis

PANW Elliott Wave Technical Analysis

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave 3 of (5)

Direction: Upside into wave 3

Details:

Palo Alto Networks Inc. (PANW) is demonstrating strong bullish momentum within wave 3, following a leading diagonal in Minor wave 1. The stock’s next key resistance level is set at $300, signaling further upside potential. This aligns with Elliott Wave principles, indicating an extended rally in wave 3.

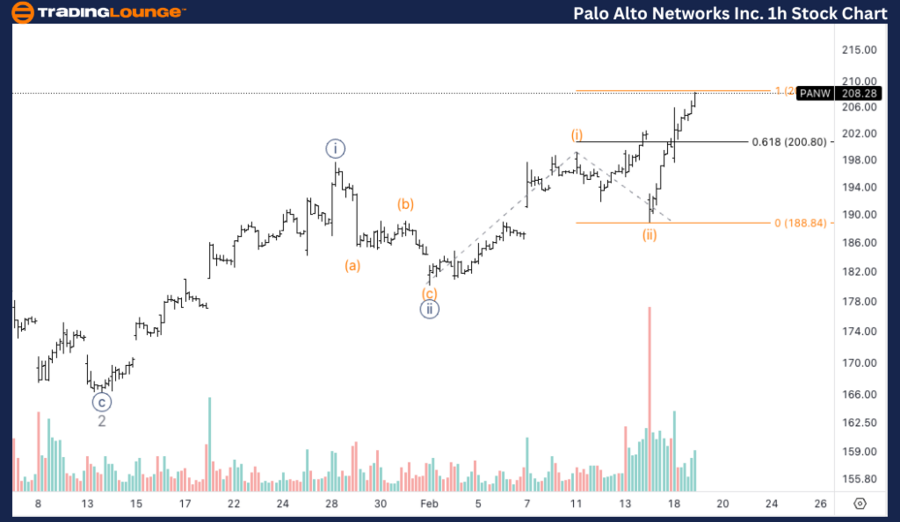

Palo Alto Networks Inc. (PANW) – Elliott Wave 1-Hour Chart Analysis

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave (iii) of {iii}

Direction: Upside into wave (iii) of {iii}

Details:

A high-volume breakout above $200 has confirmed the continuation of the bullish trend. The 1.618 Fibonacci extension of wave (iii) versus wave (i) projects a short-term target of $220, supporting additional upward momentum. The structure suggests a strong rally in the near term, aligning with the Elliott Wave framework for impulsive moves.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Netflix Inc. (NFLX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support