XRPUSD Elliott Wave Analysis | TradingLounge Daily Chart

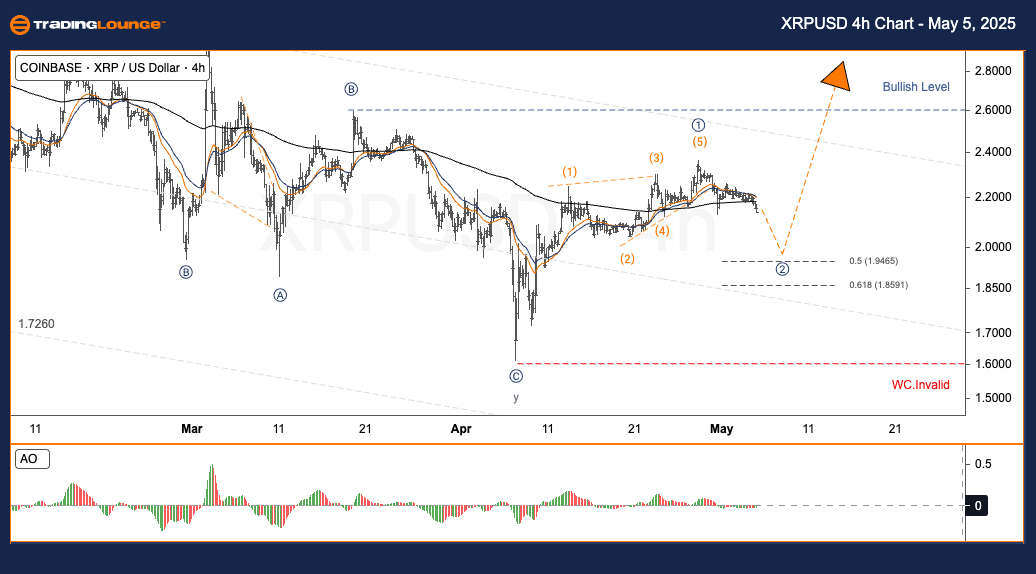

XRP/U.S. Dollar (XRPUSD) Daily Chart Analysis

XRPUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

XRP/U.S. Dollar (XRPUSD) Daily Trading Strategy

XRP price action has rebounded from the Wave (II) low at $1.7260, completing a full Wave ① impulse. XRPUSD is now correcting within Wave ②, aiming toward the key Fibonacci retracement zone between 0.5–0.618. A successful completion here could ignite Wave ③ — typically the most powerful rally phase in Elliott Wave sequences.

XRPUSD Trading Strategies

Strategy

Short-Term Traders (Swing Trade)

✅ Watch for XRP to enter the $1.86–$1.94 price zone and reverse — this could signal the start of Wave ③ and a potential long setup.

Risk Management

🟥 A price drop below $1.55 would invalidate the current Wave (II) low, implying an extended correction is underway and requiring a new wave count reassessment.

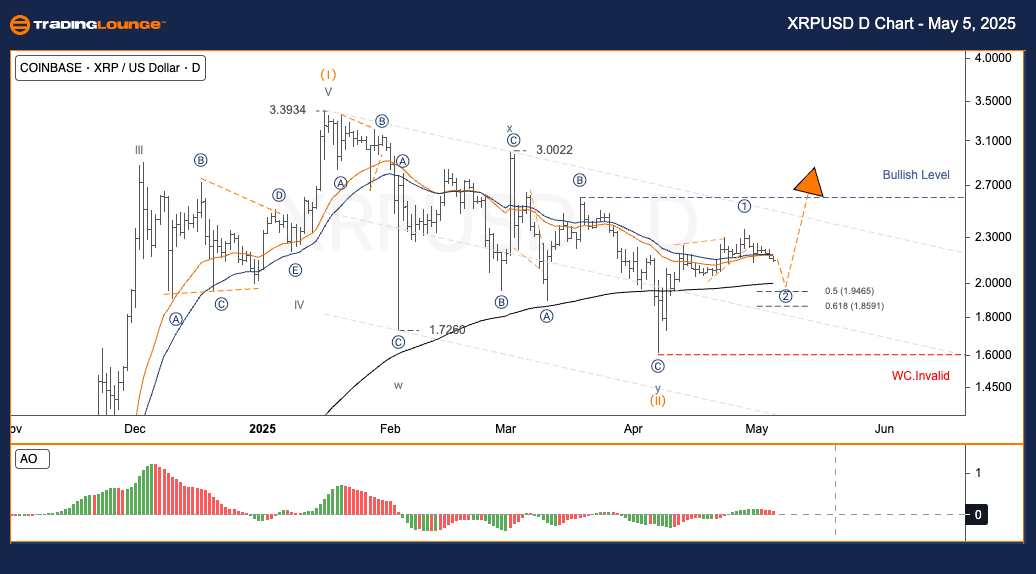

XRPUSD XRPUSD Elliott Wave Analysis | TradingLounge H4 Chart

XRP/U.S. Dollar (XRPUSD) 4-Hour Chart Analysis

XRPUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

XRP/U.S. Dollar (XRPUSD) H4 Trading Strategy

XRP has completed a bullish Wave ① structure after lifting from the Wave (II) low at $1.7260. The current correction, Wave ②, is unfolding and may finish near the Fibonacci 0.5–0.618 retracement levels. A strong Wave ③ rally is expected once this pullback is completed.

Trading Strategies

Strategy

Short-Term Traders (Swing Trade)

✅ A move into the $1.86–$1.94 region, followed by a bullish reversal, could provide a prime opportunity to catch Wave ③ early.

Risk Management

🟥 A price decline below $1.55 would suggest that Wave (II) correction is ongoing, signalling the need for caution and a revised analysis.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: SEIUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support