BLOCK, INC – XYZ (SQ2) Elliott Wave Technical Analysis - TradingLounge

Greetings,

This updated Elliott Wave analysis of BLOCK, INC – XYZ (ASX:SQ2) highlights a strengthening bullish trend. Current patterns suggest wave 3) (orange degree) could potentially push the price toward the 125.44–159.74 range. This outlook defines essential price targets and support levels that reinforce the bullish scenario for ASX:SQ2.

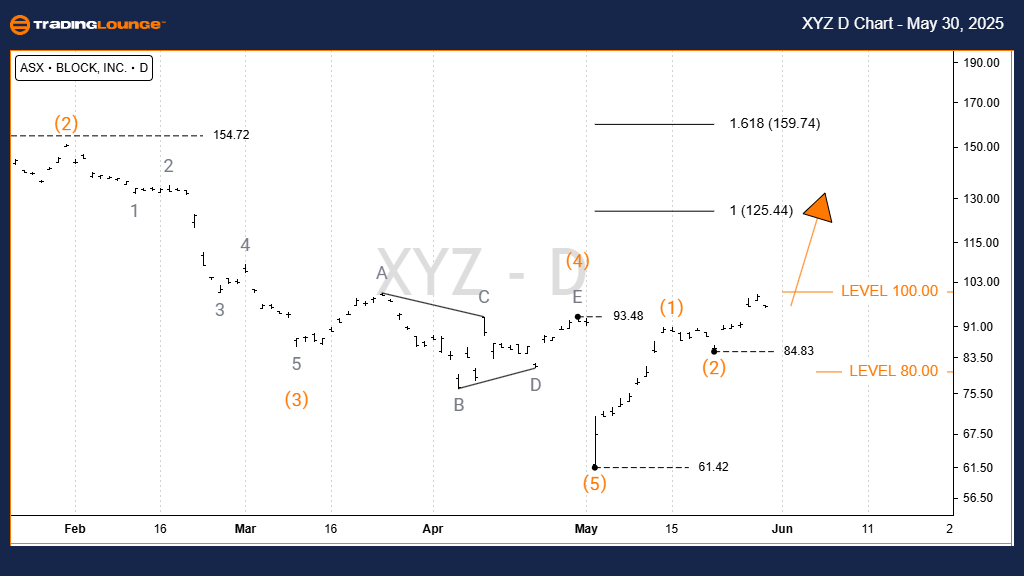

BLOCK, INC – XYZ (SQ2) Technical Overview – 1D Chart (Semilog Scale)

Function: Major Trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3) – orange

Analysis Highlights:

The stock likely completed wave 1) – orange around the 61.42 level. Wave 2) – orange has probably ended near 84.83. Now, wave 3) – orange is unfolding, with upside targets set between 125.44 and 159.74. The positive trend projection remains intact as long as the price stays above the 84.83 support threshold.

Critical Invalidation Level: 84.83

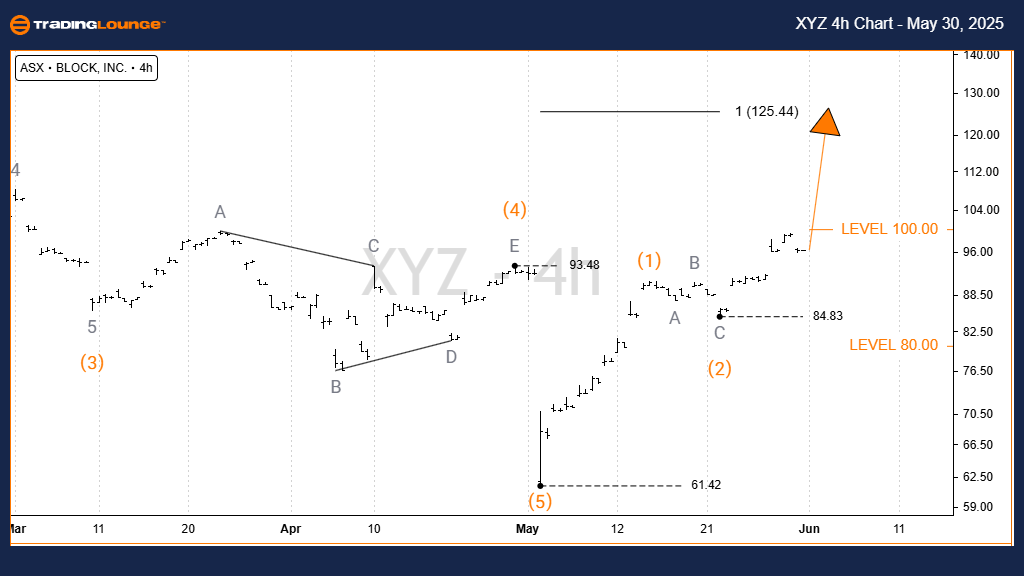

BLOCK, INC – XYZ (SQ2) Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

4-Hour Chart Breakdown:

Function: Major Trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3) – orange

Chart Insights:

The 4-hour time frame aligns with the daily chart outlook. Wave 1) – orange likely finalized at 61.42, and wave 2) – orange concluded around 84.83. Currently, wave 3) – orange is taking shape, aiming for the projected 125.44–159.74 range. This upward trajectory holds, provided the price remains above the critical 84.83 level.

Key Invalidation Point: 84.83

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: ASX: NEM Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave outlook for BLOCK, INC – XYZ (SQ2) outlines a bullish market structure with favorable trade setups. By identifying important price zones and wave patterns, this analysis supports strategic trading decisions. Traders can rely on this structure-based approach to navigate the ASX:SQ2 market environment with confidence.