SEIUSD Elliott Wave Analysis | TradingLounge Daily Chart

Sei/U.S. Dollar (SEIUSD) Daily Chart Analysis

SEIUSD Elliott Wave Technical Overview

Objective: Continuation of Bullish Trend

Wave Approach: Motive Wave Pattern

Wave Formation: Impulse Wave Setup

Current Market Phase: Corrective Wave 2

Next Move Forecast: Start of Higher Degree Impulse

Invalidation Threshold: Specified Below

SEIUSD Daily Trading Strategy

After completing a clean five-wave advance (①) around the $0.32 resistance level, SEI/USD entered a corrective A–B–C Zigzag pattern marking wave ②. This retracement is nearing a key Fibonacci zone, hinting that the downtrend may soon reverse.

Short-Term Trading Strategy

Tactical Setup: Designed for active swing traders

Entry Signal: A confirmed breakout above $0.220 signals the beginning of wave ③. Entry should be timed with upward price confirmation.

Risk Management: A price drop below $0.130 invalidates the current Elliott Wave outlook.

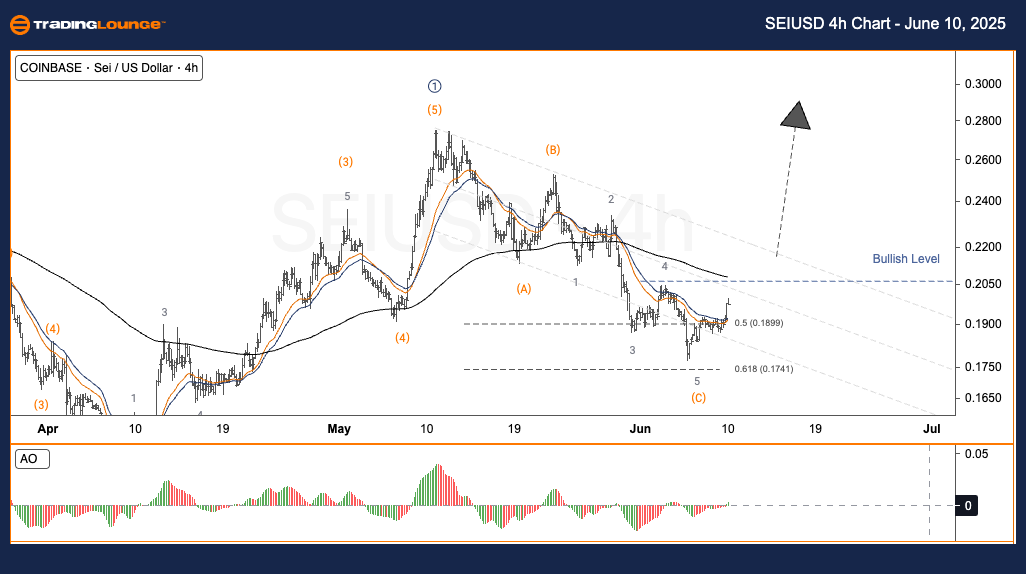

SEIUSD Elliott Wave Analysis | TradingLounge H4 Chart

Sei/U.S. Dollar (SEIUSD) 4-Hour Chart Analysis

SEIUSD Elliott Wave Technical Overview

Objective: Bullish Continuation Expected

Wave Structure: Motive Wave

Wave Pattern: Impulsive Move

Market Status: Currently in Wave 2

Anticipated Direction: Higher Wave Progression

Invalidation Point: Clearly Marked

SEIUSD H4 Trading Strategy

The SEI/USD chart has confirmed a five-wave structure (①) peaking close to $0.32. Presently, it's correcting in a typical A–B–C Zigzag formation, forming wave ②. This correction is stabilizing near a notable Fibonacci support level, increasing potential for bullish continuation.

Swing Trade Setup

- Strategy Focus: Suitable for short-term and swing trades

- Trigger Level: Watch for a breakout past $0.220 as validation of wave ③ start. Entry should follow confirmation signals.

- Stop-Loss Guide: Any move below $0.130 invalidates the wave forecast.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DOTUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support