MARA Holdings, Inc (MARA) Elliott Wave Analysis (Daily Chart)

MARA Technical Analysis Overview – Trading Lounge

MARA Holdings, Inc (MARA) Elliott Wave Technical Analysis

Function: Trend

Mode: Corrective

Structure: Corrective

Position: Wave (a) of ©

Direction: Upside in Wave (a)

Details: Anticipating upward movement to $20, followed by $23 – signalling potential completion of Wave (a)

MARA Daily Chart Analysis

MARA Holdings, Inc (NASDAQ: MARA) appears to be in the final leg of Wave (a) within a broader Elliott Wave corrective pattern labeled ©. Current technical indicators suggest bullish momentum aiming for the $20 resistance level, with further extension to $23. This development would indicate the completion of the first phase of the correction. Once Wave (a) is finalized, traders should prepare for Wave (b), which may present short-term trading opportunities in the ongoing correction.

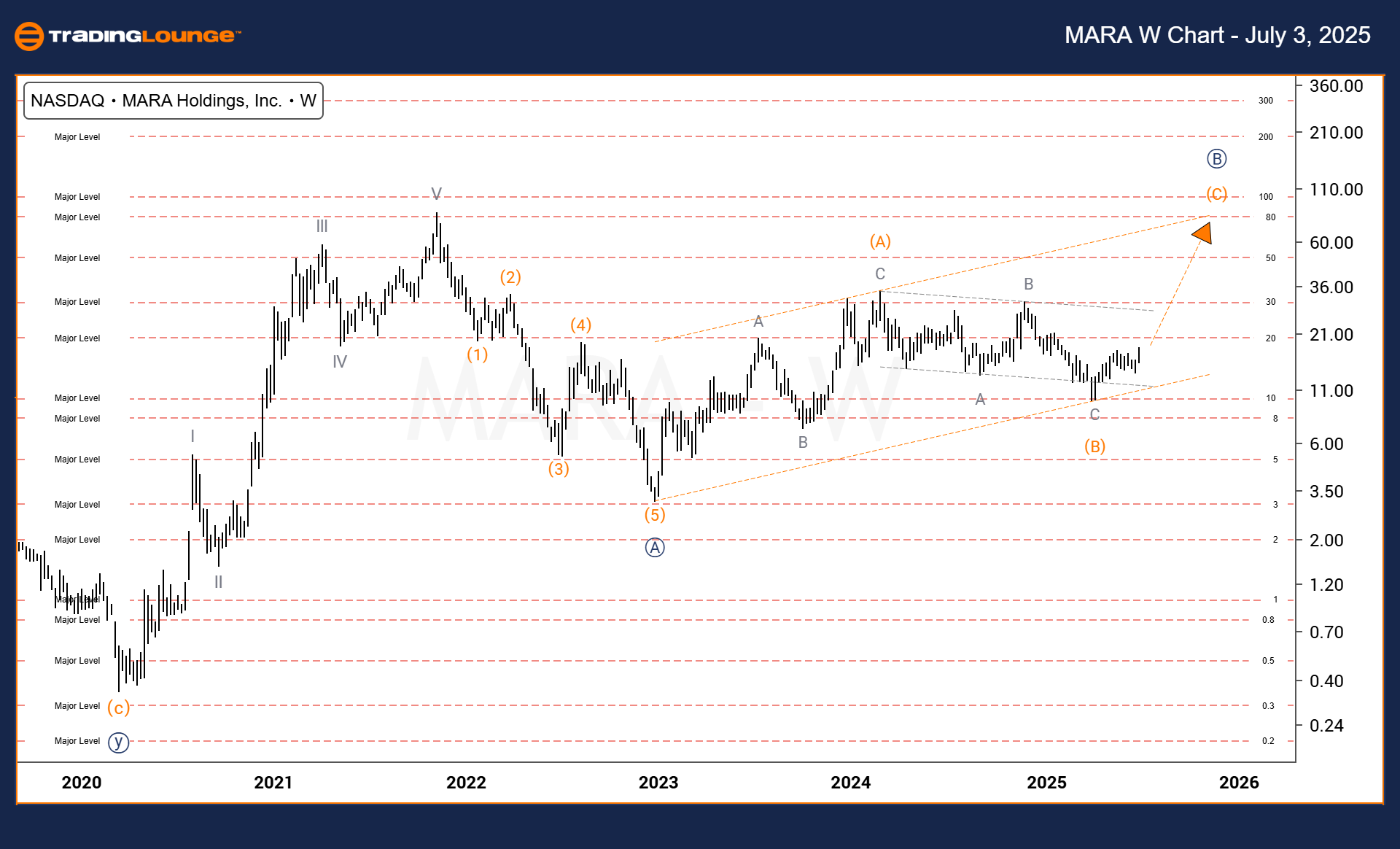

MARA Holdings, Inc (MARA) – Elliott Wave Analysis (Weekly Chart)

MARA Stock Technical Analysis Overview – Trading Lounge

Function: Counter Trend

Mode: Corrective

Structure: Corrective

Position: Wave (C) of Ⓑ

Direction: Upside into Wave (C)

Details: Wave (C) approaching key resistance along upper boundary of parallel channel

Weekly Chart Analysis

On the weekly timeframe, MARA Holdings, Inc (MARA) is advancing within a corrective phase identified as Wave (C) of Wave Ⓑ. The price action is nearing the upper resistance line of a defined parallel channel, indicating that Wave (C) is approaching maturity. While the broader movement remains bullish, this resistance zone could act as a turning point or consolidation area. Traders should watch for reactions around this level to evaluate short-term volatility and identify trading setups.

Technical Analyst: Dhiren Pahuja

Visit: TradingLounge.com for detailed analysis and market updates.

Previous: IonQ, Inc. (IONQ) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support