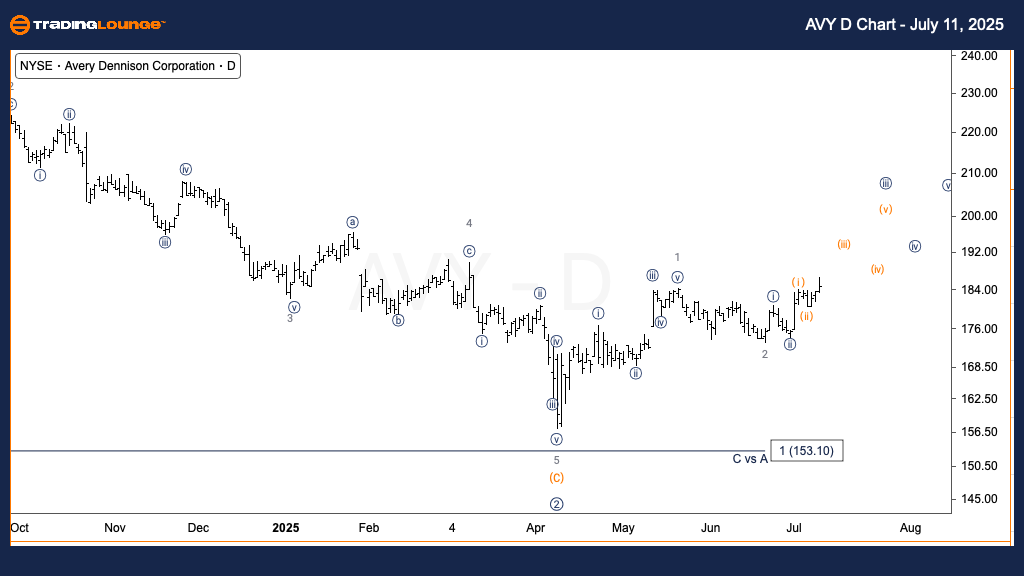

Avery Dennison Corp. (AVY) – Elliott Wave Analysis | Trading Lounge Daily Chart

AVY Daily Chart Analysis – Technical Overview

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave 3 of (1)

Direction: Upside into wave 3

Details: The stock has breached the prior downtrend from wave (C), signaling a potential breakout into wave 3.

The daily Elliott Wave chart of Avery Dennison Corp. (AVY) indicates a possible initiation of a strong upward impulsive wave sequence. It appears that the corrective phase—wave (C)—has ended, with the stock price surpassing the declining trendline. This move strengthens the case for entry into wave 3 of (1), a segment traditionally associated with accelerated price action. Given wave 3’s typical strength in Elliott Wave structures, this setup suggests a bullish medium-term forecast for AVY.

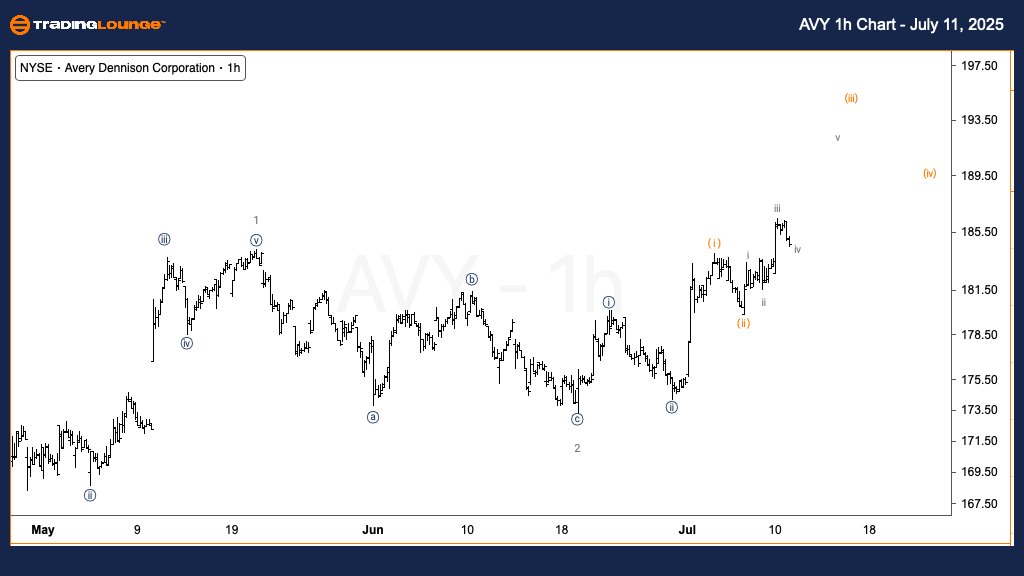

Avery Dennison Corp. (AVY) – Elliott Wave Analysis | Trading Lounge 1-Hour Chart

AVY 1-Hour Chart Analysis – Technical Overview

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave (iii) of {iii}

Direction: Upside in wave (iii)

Details: The move likely continues within wave (iii) of {iii}, though a top in wave (v) of {i} could hint at a corrective wave {ii} ahead.

The 1-hour Elliott Wave analysis of AVY highlights sustained bullish momentum, with the price action aligning with wave (iii) of {iii}. This formation supports the ongoing strength in the stock’s impulsive pattern. However, an alternate wave count implies the advance could be nearing a top at wave (v) of {i}, which might lead to a larger corrective pullback in wave {ii}. Investors and traders should remain alert for either continued bullish validation or early signals of a corrective phase developing.

Technical Analyst: Alessio Barretta

Visit: TradingLounge.com for detailed analysis and market updates.

Previous: The Boeing Company (BA) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support