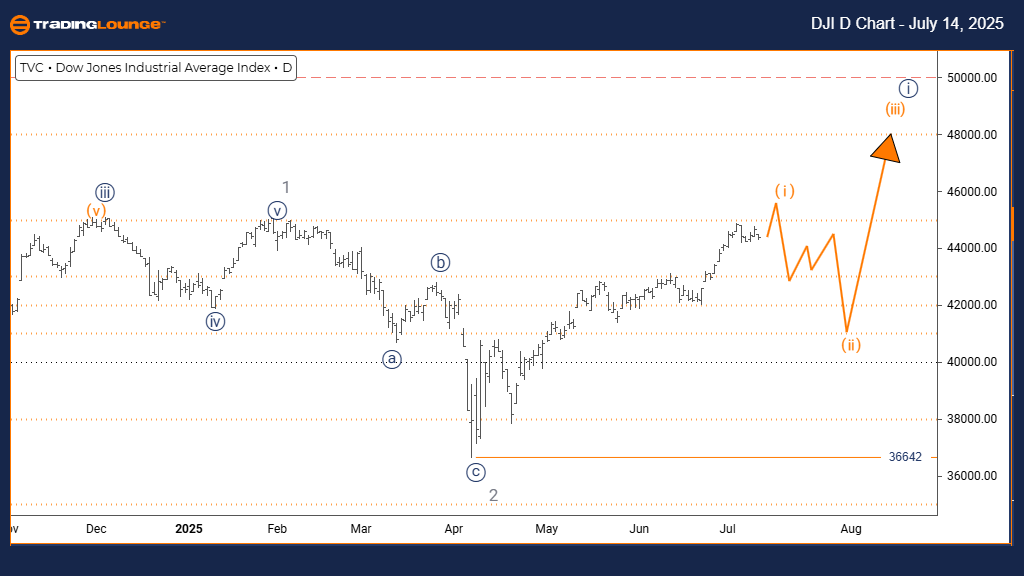

DOW JONES Elliott Wave Analysis – Trading Lounge Day Chart

DJI Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 1

Direction (Next Lower Degrees): Orange Wave 2

Details: Gray wave 2 seems complete; orange wave 1 of navy blue wave 1 is active.

Invalidation Level: 36642

The Dow Jones Industrial Average daily chart indicates the start of a new bullish Elliott Wave cycle. The market is progressing through orange wave 1, nested within the larger navy blue wave 1, signaling a possible continuation of upward momentum after the end of gray wave 2.

This impulsive wave formation reflects strong buying pressure and a consistent pattern of higher highs and higher lows. The anticipated corrective phase, orange wave 2, is likely to follow, offering traders a technical opportunity to enter the trend after orange wave 1 confirms completion.

The key technical level of 36642 acts as an invalidation point. A drop below this level would negate the current wave count and warrant a reassessment. Until then, this setup offers a valid framework for trend-following strategies and may mark the early stages of a prolonged bullish run.

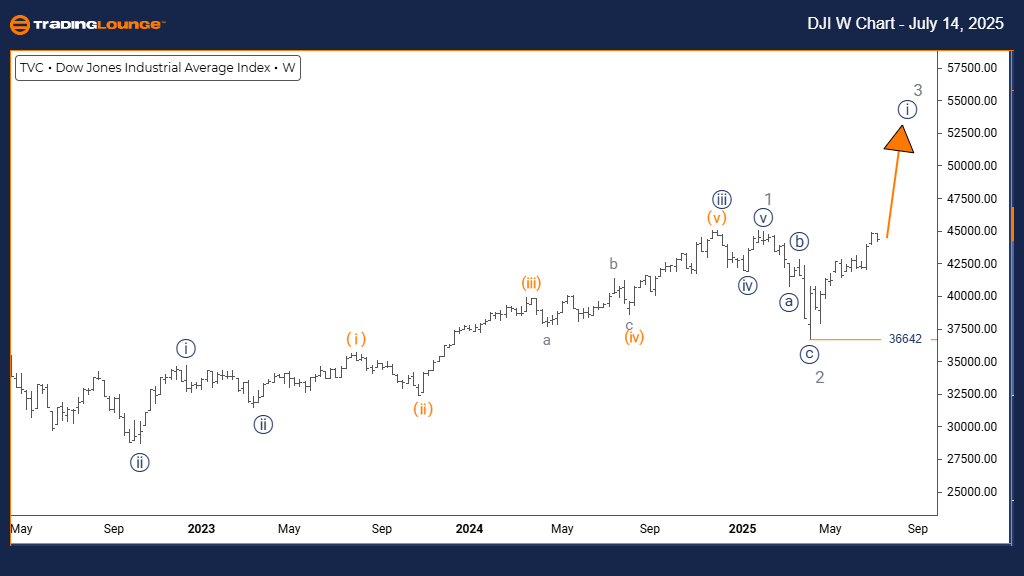

DOW JONES Elliott Wave Analysis – Trading Lounge Weekly Chart

DJI Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 3

Direction (Next Lower Degrees): Navy Blue Wave 2

Details: Gray wave 2 appears finished; navy blue wave 1 of gray wave 3 is unfolding.

Invalidation Level: 36642

The weekly Dow Jones chart highlights a bullish Elliott Wave pattern, with the index transitioning into navy blue wave 1 of a more significant gray wave 3. This phase often delivers the strongest market movement within Elliott Wave theory.

The impulsive structure reveals strong bullish momentum, underpinned by aggressive buying and elongated wave formations. Following the completion of navy blue wave 1, a pullback forming navy blue wave 2 is expected. This retracement could provide an advantageous entry into the broader trend.

The 36642 support level serves as the invalidation line. As long as prices remain above this level, the bullish interpretation stays intact. The chart setup implies a likely continuation of the long-term uptrend, with substantial upside potential in line with the nature of wave 3 extensions.

This analysis can guide Elliott Wave traders in aligning their strategies with the dominant upward trend, while remaining cautious of short-term corrections that might create low-risk trading opportunities.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: S&P/TSX 60 index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support