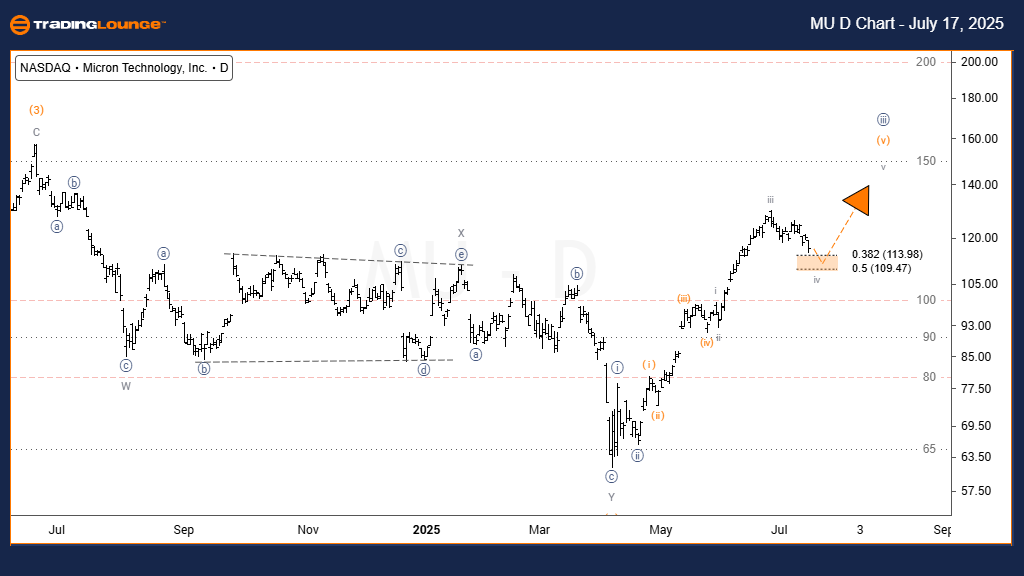

Micron Technology Inc (MU) Elliott Wave Forecast – Trading Lounge Daily Chart

Micron Technology Inc (MU) Daily Chart Overview

MU Elliott Wave Technical Analysis

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave (v) of {v}

Direction: Uptrend

Details: Price expected to advance toward wave (v) upon completion of wave iv

On the daily chart, Micron Technology Inc. (MU) is following a clear impulsive Elliott Wave structure. The stock has completed wave iii of (v) and is currently correcting through wave iv. This pullback is likely to reach the 38.2% to 50% Fibonacci retracement of wave iii.

Once wave iv completes, technical forecasts suggest a potential surge through wave v of (v), concluding the broader wave (v) of {iii} cycle. Traders and investors should observe these Fibonacci levels closely, as they may offer bullish opportunities ahead of the expected final leg upward in this motive wave structure.

Micron Technology Inc (MU) – Elliott Wave Forecast (Weekly Chart)

MU US Stock Technical Analysis Overview – Trading Lounge

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave (5) of {5}

Direction: Uptrend

Details: Price advancing within wave (5) of {5}, aiming for the upper boundary of a parallel trend channel

In the weekly chart, Micron Technology Inc. (MU) maintains a strong uptrend and trades within a structured parallel channel. Following the completion of wave {4} as a double zigzag corrective pattern, MU initiated wave {5}, which is progressing with impulsive characteristics.

Currently unfolding wave (5) is projected to test the upper resistance of the channel, a logical target for this final wave advance. Any short-term pullbacks may present favorable buying setups, as long as the impulsive structure remains intact. The broader trend remains bullish, supported by the ongoing wave development.

Technical Analyst: Dhiren Pahuja

Visit: TradingLounge.com for detailed analysis and market updates.

Previous: Coinbase (COIN) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support