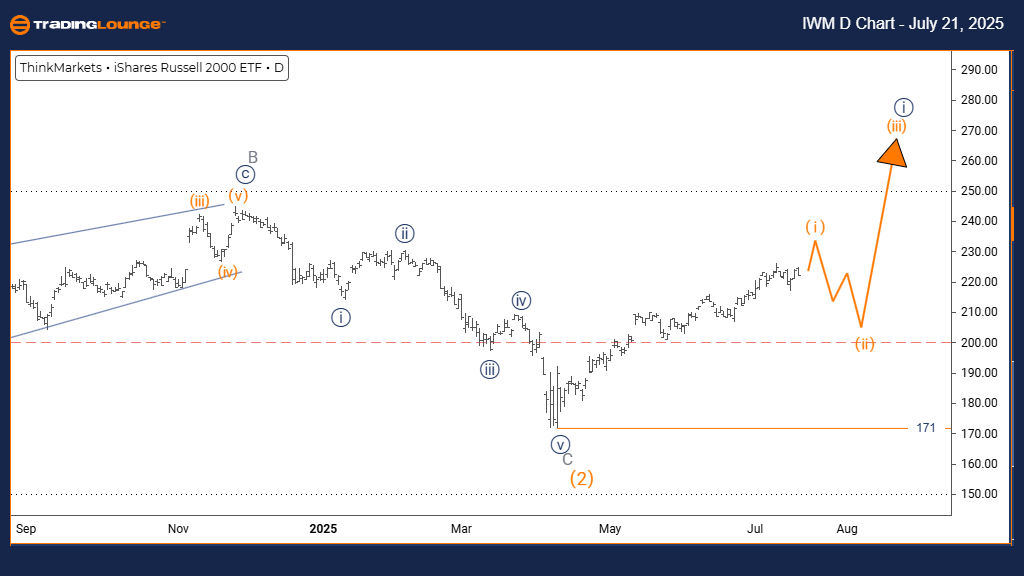

RUSSELL 2000 Elliott Wave Analysis – Trading Lounge Daily Chart

RUSSELL 2000 – Daily Chart Analysis

RUSSELL 2000 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 1

POSITION: Navy Blue Wave 1

DIRECTION OF NEXT LOWER DEGREES: Orange Wave 2

Wave Cancel Invalidation Level: 171

DETAILS: Orange Wave 1 of Navy Blue Wave 1 is currently unfolding, marking the onset of a potential bullish phase.

The daily chart of the Russell 2000 Index shows an emerging bullish trend backed by impulsive Elliott Wave structure. Orange Wave 1 is forming as part of Navy Blue Wave 1, indicating the initiation of a new upward leg. This setup reflects increasing price strength and solid momentum, key signs of improving market sentiment.

Technical indicators support a breakout from previous consolidation. Orange Wave 1 defines the beginning and intensity of the trend, reinforcing its sustainability. The key invalidation level is placed at 171 — any move below this would challenge the current wave scenario.

The Russell 2000 forecast suggests the index has exited its corrective pattern and entered a bullish phase. A typical retracement in Orange Wave 2 is expected upon Wave 1's completion. Traders should look for end-of-wave signals to prepare for the next movement in the Elliott Wave cycle.

This technical roadmap provides actionable insight for navigating the current market structure. The visible impulsive sequence and sustained higher highs validate growing market interest and momentum. Risk is clearly defined by the 171 invalidation point, aiding traders in managing exposure during possible pullbacks.

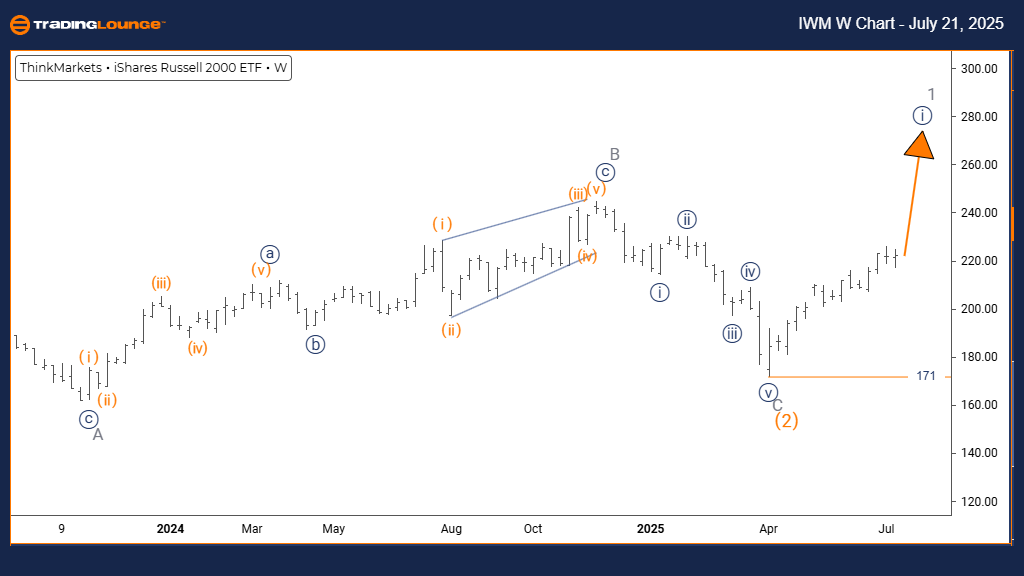

RUSSELL 2000 Elliott Wave Analysis – Trading Lounge Weekly Chart

RUSSELL 2000 – Weekly Chart Analysis

RUSSELL 2000 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 1

DIRECTION OF NEXT LOWER DEGREES: Navy Blue Wave 2

Wave Cancel Invalidation Level: 171

DETAILS: With Orange Wave 2 likely completed, Navy Blue Wave 1 within Gray Wave 1 is now progressing.

The weekly chart analysis of the Russell 2000 Index illustrates the continuation of a bullish trend supported by impulsive Elliott Wave structure. The advance of Navy Blue Wave 1 within Gray Wave 1 signals the early stages of a more extensive upward cycle.

This impulsive wave phase indicates sustained interest, especially from institutional investors focusing on small-cap equities. The progression of Navy Blue Wave 1 underpins the broader bullish outlook, while the 171 invalidation level remains a critical point for maintaining the wave count's integrity.

The current market conditions show a transition from a corrective phase into a new impulse wave. Monitoring the structure of Navy Blue Wave 1 will help traders identify the trend’s strength. Following this, a corrective pullback in Navy Blue Wave 2 can be expected.

For long-term strategy, this Elliott Wave structure provides a solid basis for evaluating the Russell 2000 forecast. The visible impulsive trend supports a continuation of bullish behavior, and adherence to the 171 invalidation level provides clarity for risk management and technical validation.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Bovespa Index Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support