Greetings,

Our Elliott Wave forecast today centers on BHP GROUP LIMITED (ASX: BHP), traded on the Australian Stock Exchange (ASX). Current analysis suggests the third wave (Wave 3 – navy) may be gaining upward momentum. This technical update outlines the short-term Elliott Wave outlook, key bullish trend indicators, and potential entry points for traders, including a defined invalidation level.

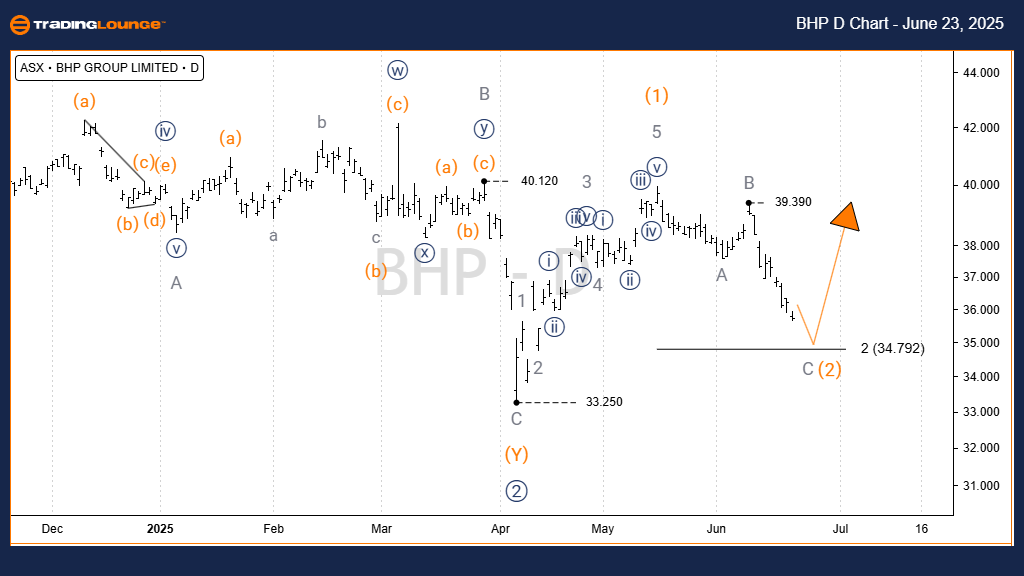

ASX: BHP Elliott Wave Analysis - TradingLounge 1-Day Chart

ASX: BHP GROUP LIMITED – BHP (1-Day Chart, Semilog Scale) Technical Analysis

ASX: BHP GROUP LIMITED – BHP Elliott Wave Technical Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3) – orange

Details: Wave 2) – navy appears to have ended, with Wave 3) – navy potentially in progress. This larger wave subdivides into Wave 3) – orange, which could push toward the 40.00 price target. In the near term, we may observe a minor pullback to 34.792 (Wave 2) – orange), followed by a breakout above 39.390, confirming the Wave 3) – orange advance.

Invalidation Point: 33.25

Confirmation Point: 39.390

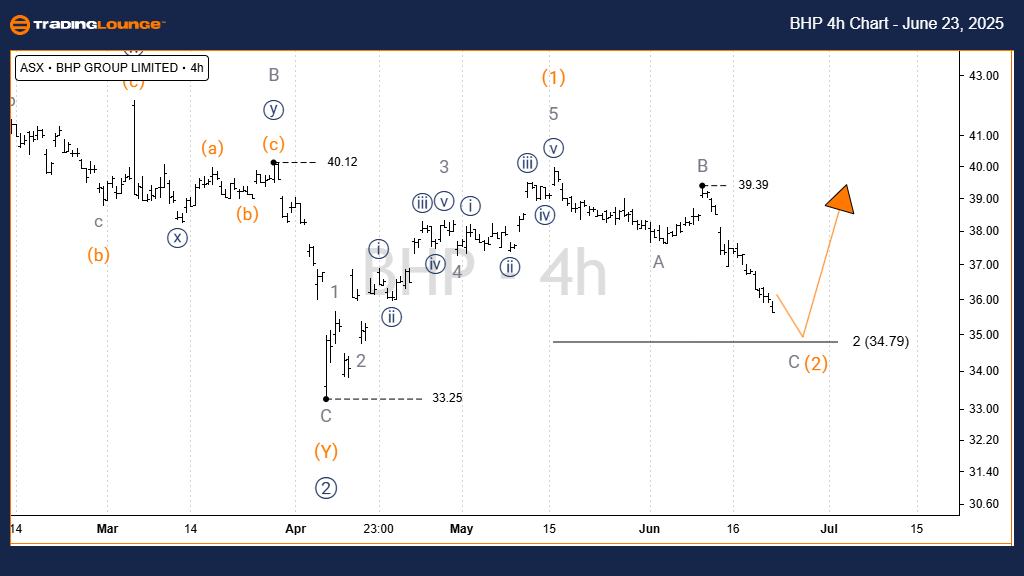

ASX: BHP GROUP LIMITED – BHP Elliott Wave Technical Analysis (4-Hour Chart)

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3) – orange

Details: Wave 2) – orange is likely nearing completion, based on a full ABC corrective pattern (waves A, B, C – grey). Wave C – grey is closing in on a key support zone near 34.792. A reversal from this area followed by a break above 39.390 would validate the start of Wave 3) – orange.

Invalidation Point: 33.83 (original value adjusted from 84.83 due to likely error)

Confirmation Point: 39.390

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NORTHERN STAR RESOURCES LTD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis for ASX: BHP GROUP LIMITED (BHP) provides a strategic view of the short-term market structure, highlighting price zones that could trigger bullish continuation. Monitoring the confirmation and invalidation levels enhances confidence in our current wave count and supports informed trading decisions. Our aim is to deliver objective and data-driven market insights to help traders navigate the ASX effectively.