USD/CAD Elliott Wave Analysis Trading Lounge Day Chart

Discover actionable insights into the U.S. Dollar/Canadian Dollar (USD/CAD) currency pair through Elliott Wave analysis. This comprehensive review covers both day and 4-hour charts, providing valuable information for traders seeking to navigate potential market movements.

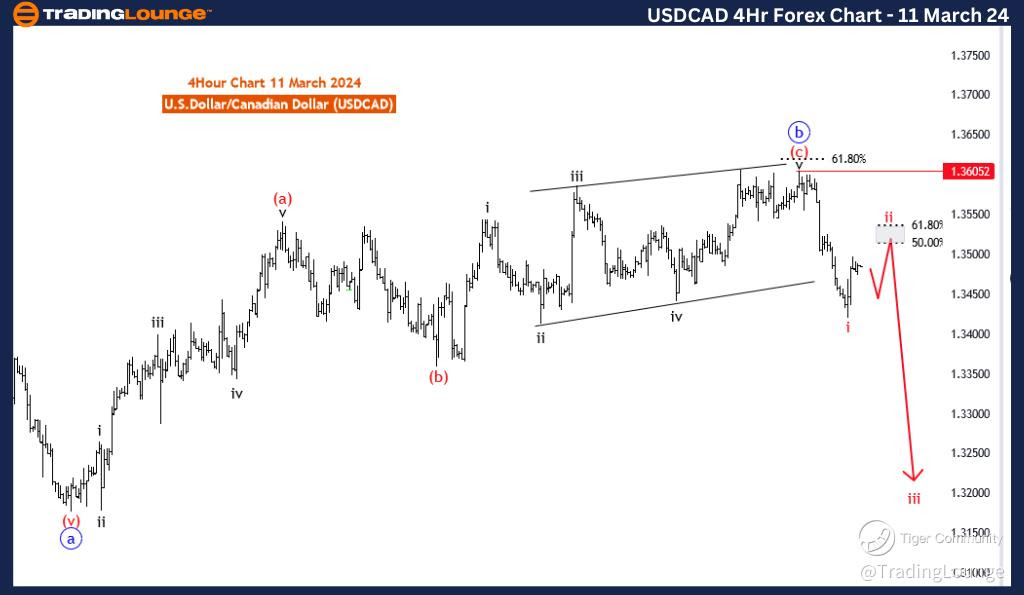

U.S.Dollar /Canadian Dollar (USD/CAD) Day Chart Analysis

USD/CAD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Blue wave C

POSITION: Black wave Y

DIRECTION NEXT LOWER DEGREES: blue wave C (started)

DETAILS: Blue wave B of Y looking completed at 1.36052. Now blue wave C of Y is in play. Wave Cancel invalid level:1.36052

The USD/CAD Elliott Wave Analysis for the day chart on 11 March 24, provides a comprehensive outlook for the U.S. Dollar/Canadian Dollar currency pair, leveraging Elliott Wave principles to anticipate potential market movements.

The analysis begins by categorizing the identified "FUNCTION" as "Counter Trend." This implies a strategic approach aimed at capitalizing on corrective movements against the predominant trend. In this context, the expectation is for a temporary reversal or retracement within the broader market trend.

The specified "MODE" is "Corrective," indicating the current phase characterized by corrective price movements. Corrective phases often involve adjustments or sideways movements rather than sustained directional trends.

The "STRUCTURE" is defined as "Blue wave C," signaling the current wave within the larger Elliott Wave count. Blue wave C is a corrective wave that is expected to unfold as part of a broader correction.

The "POSITION" is identified as "Black wave Y," denoting the placement of the current corrective wave within the overarching Elliott Wave structure. Black wave Y represents a higher-degree corrective pattern.

"DIRECTION NEXT LOWER DEGREES" is highlighted as "blue wave C (started)," suggesting the initiation of the corrective phase at a lower degree. This implies a continuation of the corrective structure within the Elliott Wave framework.

In the "DETAILS" section, it is mentioned that "Blue wave B of Y looking completed at 1.36052." This indicates the completion of the preceding corrective wave, and now, "Blue wave C of Y is in play," signifying the beginning of the next phase of the correction.

The "Wave Cancel invalid level" is set at 1.36052. This level serves as a critical reference point, and any breach beyond it would invalidate the current wave count, necessitating a reassessment of the analysis.

In summary, the USD/CAD Elliott Wave Analysis for the day chart on 11 March 24, suggests a counter-trend corrective approach. The focus is on the unfolding correction labeled as Blue wave C of Y, with a keen eye on the Wave Cancel invalid level at 1.36052 for potential shifts in the wave count and trend dynamics.

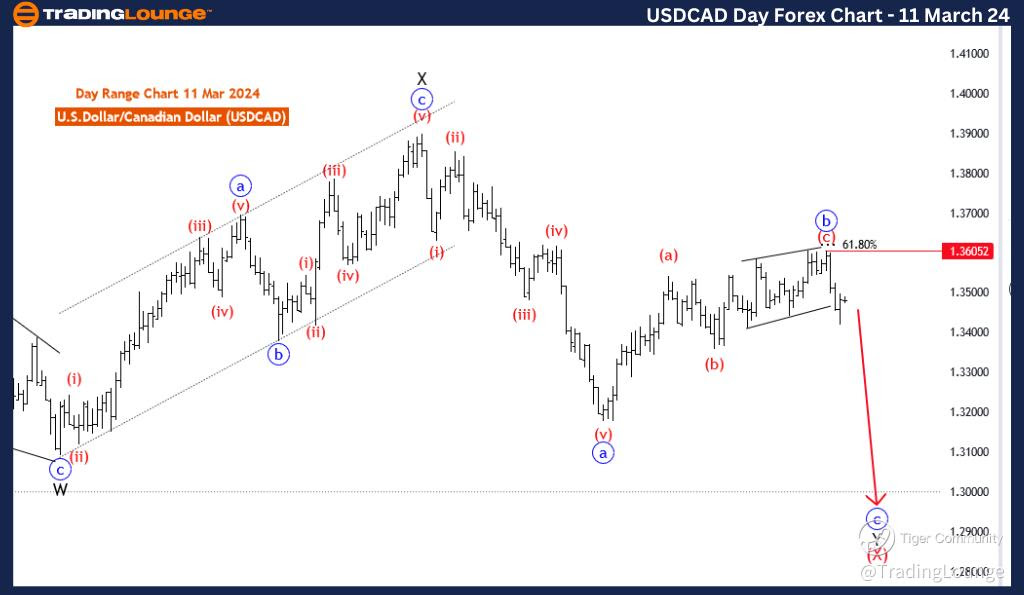

USD/CAD Elliott Wave Analysis Trading Lounge 4 Hour Chart, 11 March 24

U.S.Dollar /Canadian Dollar (USD/CAD) 4 Hour Chart Analysis

USD/CAD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Red wave 2

POSITION: Blue wave C

DIRECTION NEXT LOWER DEGREES: red wave 3 of C

DETAILS: After red wave 1 now red wave 2 is in play as a correction. Wave Cancel invalid level:1.36052

The USD/CAD Elliott Wave Analysis for the 4-hour chart on 11 March 24, provides insights into potential price movements in the U.S. Dollar/Canadian Dollar currency pair. Utilizing Elliott Wave principles, the analysis aims to decipher evolving patterns and project likely future trends.

The identified "FUNCTION" is "Counter Trend," indicating a strategy that seeks to capitalize on corrective movements against the prevailing trend. This suggests an expectation of a temporary reversal or retracement in the market, as opposed to a sustained impulsive move.

The specified "MODE" is "Corrective," highlighting the current phase of price action characterized by corrective movements. Corrective phases typically involve price adjustments or sideways movements rather than strong, directional trends.

The described "STRUCTURE" is "Red wave 2," signifying the current correction within the broader Elliott Wave count. Red wave 2 represents a corrective wave within the primary downtrend.

The specified "POSITION" is "Blue wave C," indicating the placement of the current corrective wave within the overarching Elliott Wave structure. Blue wave C is part of the corrective pattern and is expected to unfold as part of the broader correction.

Regarding "DIRECTION NEXT LOWER DEGREES," the analysis emphasizes "Red wave 3 of C," anticipating the continuation of the corrective phase. This implies an expectation of further downside movement following the completion of the ongoing correction.

In the "DETAILS" section, it is mentioned that "after red wave 1, now red wave 2 is in play as a correction." This underscores the corrective nature of the current market dynamics.

The "Wave Cancel invalid level" is set at 1.36052. This level serves as a critical reference point, and a breach beyond it would invalidate the current wave count, necessitating a reassessment of the analysis.

In summary, the USD/CAD Elliott Wave Analysis for the 4-hour chart on 11 March 24, suggests a counter-trend corrective approach. The focus is on the unfolding correction labeled as red wave 2, with an anticipation of further downside movement in red wave 3 of C. The Wave Cancel invalid level at 1.36052 is identified as a key level for monitoring potential shifts in the wave count and trend dynamics.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: British Pound/ Australian Dollar (GBPAUD)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.