Crude Oil WTI Elliott Wave Technical Analysis

Crude oil WTI's recent bullish momentum signals an exciting opportunity for traders. Leveraging Elliott Wave Theory, we dive deep into the market dynamics, offering valuable insights for those aiming to capitalize on this trend reversal.

WTI Elliott Wave Technical Analysis:

Function - Counter-trend

Mode - Corrective

Structure - Zigzag

Position - Blue wave x of Y of red wave (B)

Direction - Upwards for blue wave y of Y of (B)

Details - Bullish response shows the probable end of blue wave x of Y. Blue y of Y is progressing and expected above 82

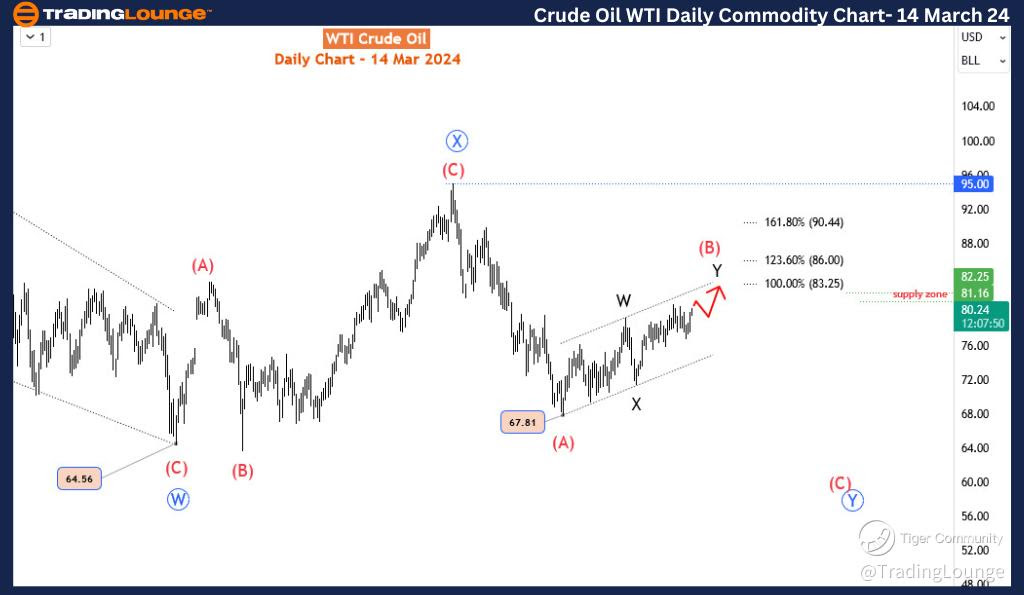

WTI (West Texas Intermediate) crude oil closed on a bullish note on the 13th of March and has continued its upward trajectory, inching closer to surpassing the 80.85 resistance level as it moves towards higher price levels. Through a comprehensive analysis using Elliott Wave Theory, we can anticipate further upward movement in the context of a bullish correction from the low of 67.81 to the high of 83.2. Understanding the dynamics of this move is crucial for traders seeking opportunities to enter the market before the broader bearish trend resumes.

Examining the daily chart reveals a long-term trend that suggests a corrective pattern unfolding, likely forming a zigzag wave structure labeled as (A), (B), and (C) of blue wave Y. This corrective phase constitutes the third leg of a larger double zigzag pattern that commenced back in March 2022. Presently, the market is undergoing an upward movement, identified as a double zigzag wave (B) originating from the low of 67.81, with a projected target of 83.25, representing an equal leg extension.

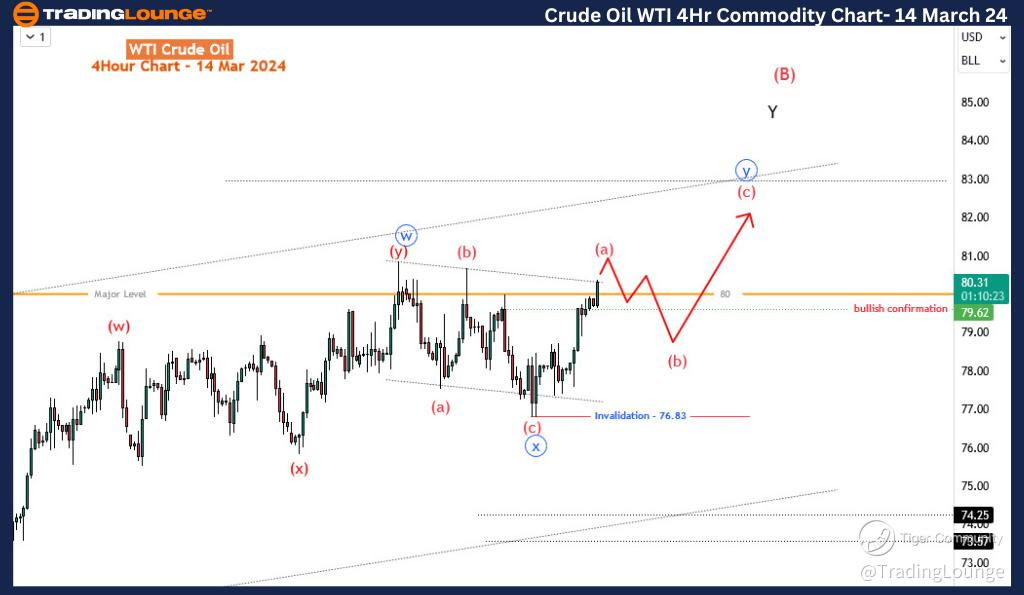

Crude Oil Elliott Wave Analysis Trading Lounge 4 Hour Chart, 14 March 24

Crude Oil WTI 4-hour Chart Analysis

Zooming into the H4 timeframe, it becomes apparent that wave (B) is unfolding as a double zigzag pattern denoted by blue waves w-x-y (circled). Waves w and x have likely concluded, with the latter terminating around 76.83. The ongoing phase, blue wave y, is anticipated to extend further in another double zigzag pattern, aiming for the 83.2 target. Despite encountering resistance around the key psychological level of 80, there's a growing expectation for a breakout above it in the near future.

Traders should anticipate a potential wave (b) pullback upon the completion of wave (a). Should this correction materialize, it could provide traders with an opportunity to enter the market for wave (c), targeting the 83.25 level, with the invalidation level set at 76.83. This intricate analysis offers insights into the probable trajectory of WTI crude oil prices, enabling traders to strategically position themselves in the market amidst the ongoing wave dynamics.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Copper

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.