ASX: COMPUTERSHARE LIMITED. - CPU Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with COMPUTERSHARE LIMITED. - CPU. We have identified that CPU will continue to push higher, as the price of CPU has not yet risen significantly, as updated in our Top 50 ASX Stocks service. And now we identify that CPU will continue to push higher towards the target of 27.08 as the immediate objective.

ASX: COMPUTERSHARE LIMITED. - CPU Elliott Wave Technical Analysis

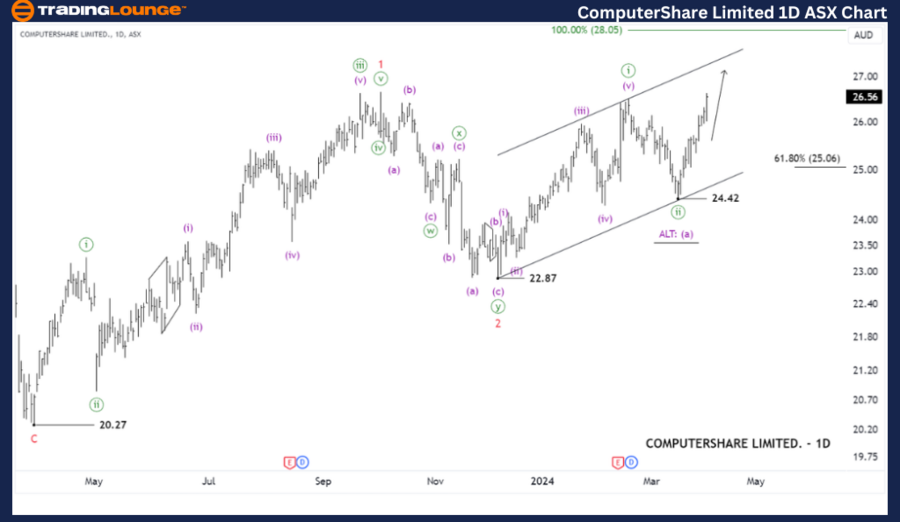

ASX: COMPUTERSHARE LIMITED. - CPU 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, red)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-green of Wave 3-red

Details: The short-term outlook suggests that wave 2-red appears to have bottomed out around 22.87, and wave 3-red is now unfolding. It subdivides into waves ((i)) and ((ii)) in green, and it seems they have completed. Now, wave ((iii)) in green is expected to resume its upward movement, with the price staying above 25.06 providing a significant advantage for this outlook.

Invalidation point: 22.87

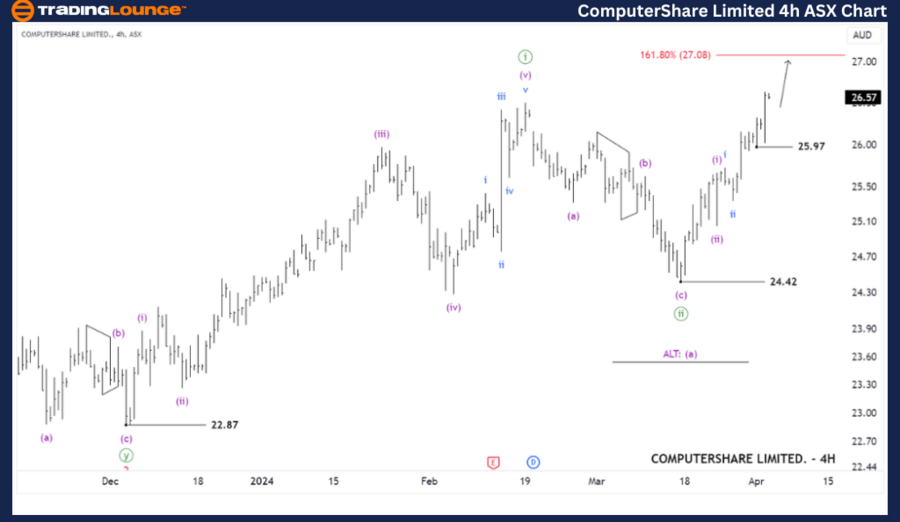

ASX: COMPUTERSHARE LIMITED. - CPU Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

Function: ajor trend (Minute degree, green)

Mode: Motive

Structure: Impulse

Position: Wave iii-blue of Wave (iii)-purple of Wave ((iii))-green

Details: The shorter-term outlook indicates that wave ((ii))-green bottomed out at a low of 24.42, and now wave ((iii))-green is unfolding to continue pushing higher, targeting an immediate objective around 27.08. Maintaining a price above 25.97 is an advantage and provides positive support for the continuation of this upward trend.

Invalidation point: 24.42

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: COMPUTERSHARE LIMITED. - CPU aims to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: COCHLEAR LIMITED - COH

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE!