Analog Devices Inc. (ADI) is exhibiting a strong bullish trend according to the latest Elliott Wave analysis. Here’s a detailed breakdown of the current market scenario based on the daily and 4-hour charts.

ADI Elliott Wave Analysis Trading Lounge: Daily Chart Insights

Analog Devices Inc., (ADI) Daily Chart Overview

Elliott Wave Technical Analysis for ADI

Function: Trend Identification

Mode: Impulsive Movement

Structure: Motive Sequence

Current Position: Minute wave {iii}

Projected Direction: Upward Movement in Minute {iii}

Key Resistance Level: Anticipating a major resistance at the $250 mark, which aligns with MG1 trading strategies.

ADI Elliott Wave Technical Analysis – Daily Chart

The daily chart for ADI reveals that the stock is in Minute wave {iii}, part of an impulsive move. The next significant level to watch is the Medium Level at $250, which is expected to provide strong resistance. As ADI trades within MG1, this level becomes a critical point for potential price action. Traders should be aware of this resistance zone and monitor the price behavior closely as it approaches $250.

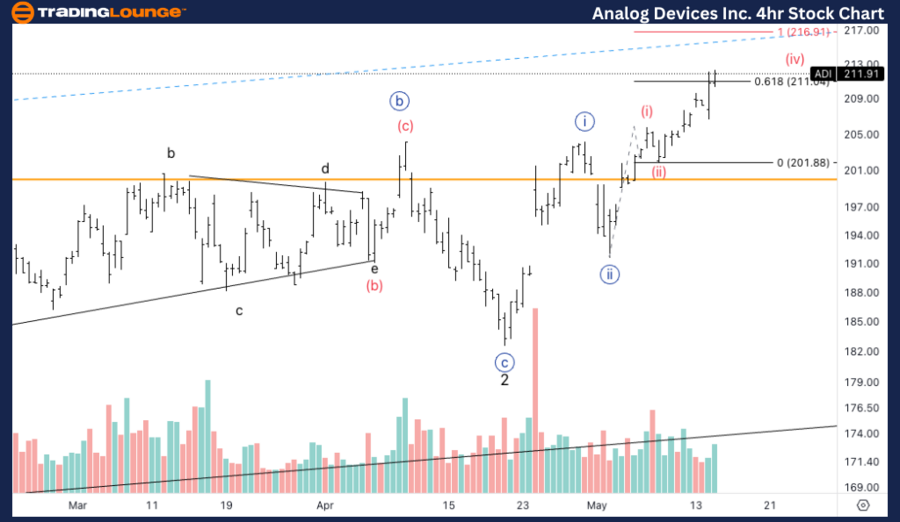

ADI Elliott Wave Analysis Trading Lounge: 4-Hour Chart Review

Analog Devices Inc., (ADI) 4-Hour Chart Examination

Elliott Wave Technical Analysis for ADI

Function: Trend Analysis

Mode: Impulsive Behavior

Structure: Motive Phase

Current Position: Wave (iii) of {iii}

Trend Direction: Continuing Wave (iii)

Volume Analysis: Strong volume indicators support a bullish trend, with expectations of sustained upward momentum.

ADI Elliott Wave Technical Analysis – 4Hr Chart

The 4-hour chart complements the daily analysis by highlighting that ADI is in wave (iii) of Minute wave {iii}. The volume analysis suggests that the bullish trend is well-supported, indicating a likely continuation higher. This wave structure confirms the impulsive nature of the current market move, reinforcing the bullish outlook.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Eaton Corp. PLC, (ETN) Stock Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support