Analog Devices Inc., Elliott Wave Technical Analysis

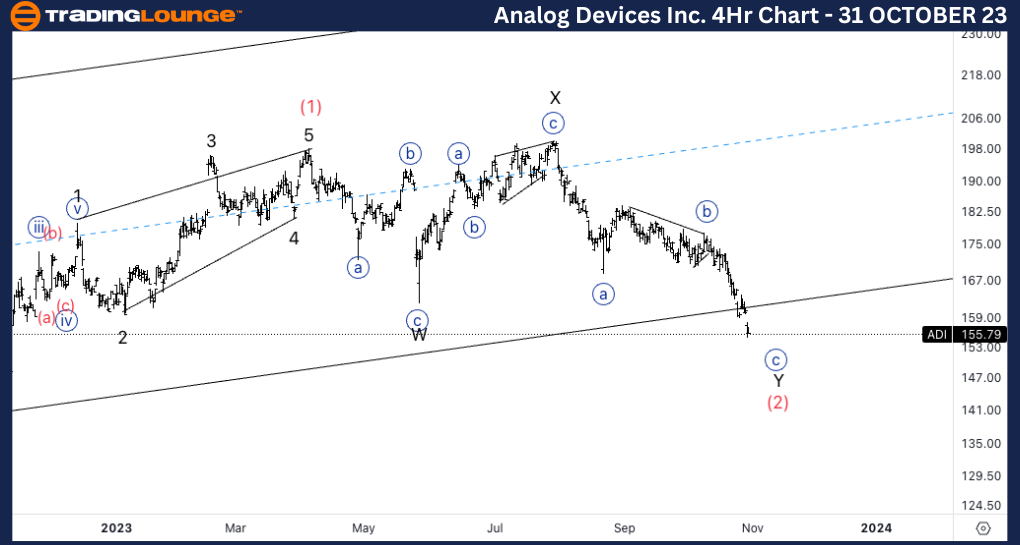

Analog Devices Inc., (ADI:NASDAQ): 4H Chart, 31 October 23

ADI Stock Market Analysis: We have been looking for a wave (2) to take place and we seem to be in the final stages of the correction. We seem to have had a complex correction as we continued to move in three wave structures.

ADI Elliott Wave Count: Wave Y of (C).

ADI Technical Indicators: Below all averages.

ADI Trading Strategy: Looking for longs into wave 1 of (1).

TradingLounge Analyst: Alessio Barretta

Source : Tradinglounge.com get trial here!

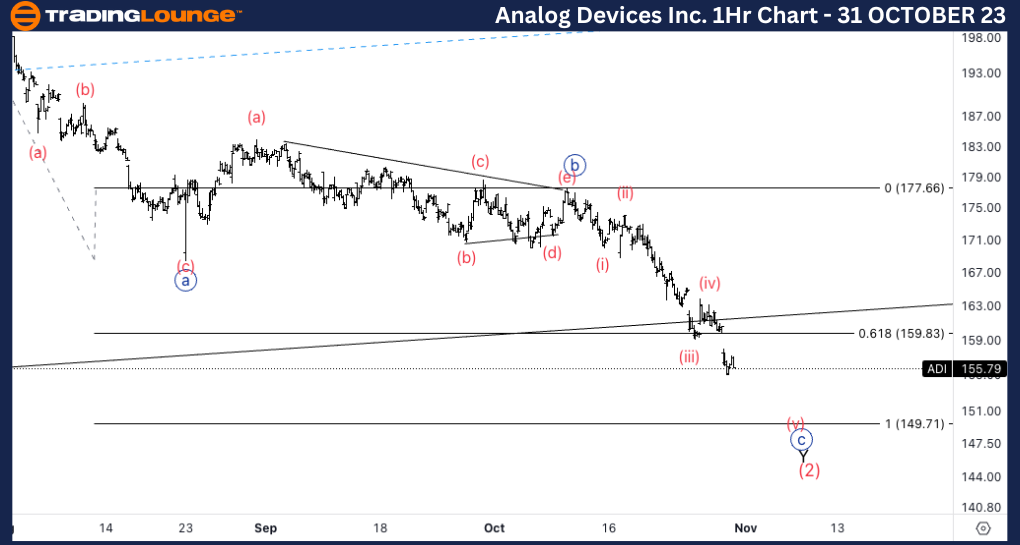

Analog Devices Inc., ADI: 1-hour Chart, 31 October 23

Analog Devices Inc., Elliott Wave Technical Analysis

ADI Stock Market Analysis: Looking for more downside into wave {c} of Y as we have found resistance on the 61.8% of Y vs. W.

ADI Elliott Wave count: Wave (v) of {c}.

ADI Technical Indicators: Below all averages.

ADI Trading Strategy: Looking for shorts into wave (v) toward equality of Y and W.