Elliott Wave Analysis of WTI Crude Oil: Bearish Trends and Key Levels to Watch

WTI Elliott wave analysis

Function - Counter-trend

Mode - Corrective

Structure - Impulse for wave 1

Position - Wave 1

Direction - Wave 1 is still in play

Details - Price could currently be in the blue wave ‘iv’ bounce or 2nd sub-wave of blue wave ‘iii’. The two scenarios support an extension lower for as much as the price remains below 81.07.

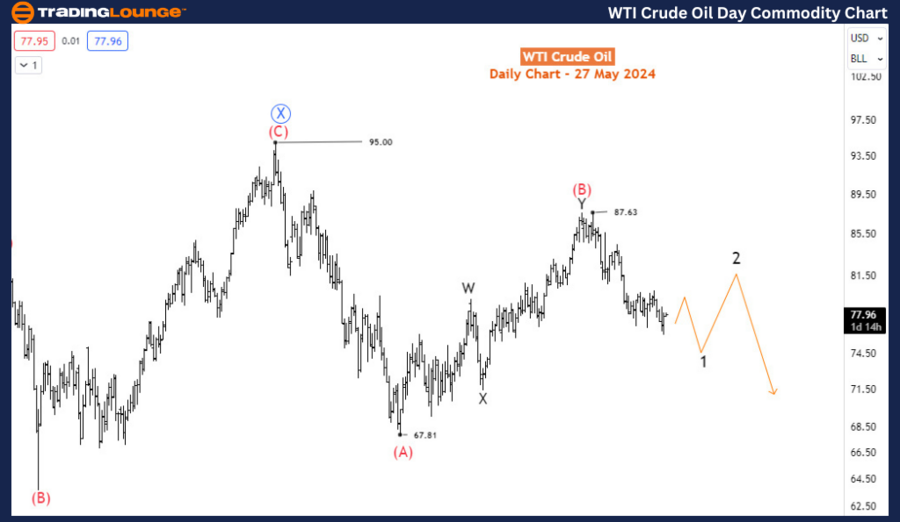

Since April 2024, the West Texas Intermediate (WTI) crude oil market has been descending into an impulse wave. This indicates that the recovery from the December 2023 low has likely concluded, and prices may extend lower, potentially falling below that previous low in the coming weeks. The long-term outlook for WTI remains bearish. With medium-term price movements now aligning with this outlook, it might be prudent for buyers to reconsider their positions and switch sides on this commodity.

Analyzing the daily chart,

The blue wave X of the primary degree reached its peak at 95 in September 2023. Prior to this, the preceding blue wave W commenced at 130.9 in March 2022 and concluded with a double zigzag structure at 64.56 in March 2023. From the peak at 95, we have been tracking the blue wave Y, which subdivides into an (A)-(B)-(C) zigzag pattern. The high of 87.63 confirmed wave (B), and the current decline is part of wave (C). The impulse wave declining from 87.63 can be identified as wave 1 of (C). This decline has been further detailed on the H4 chart.

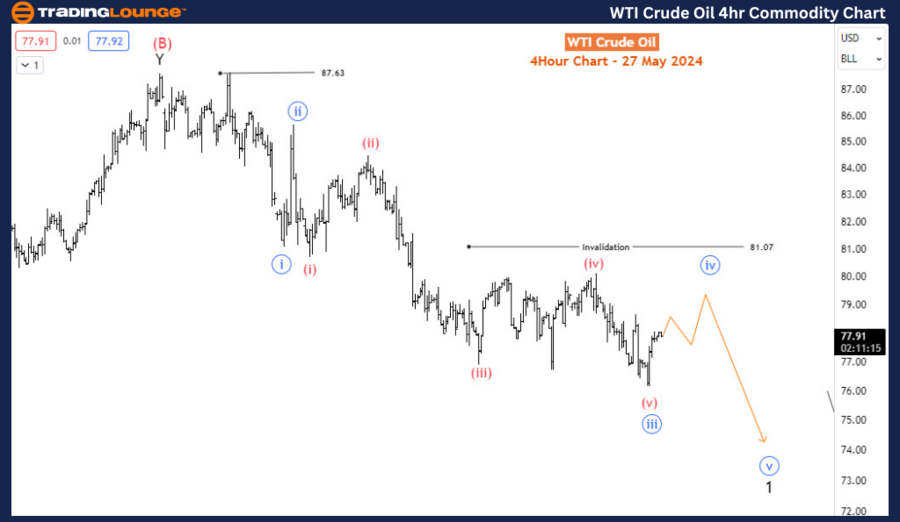

Examining the H4 Chart

On the H4 chart, the price action is currently undergoing an upward correction within blue wave iv of 1. If the price remains below 81.07, we can anticipate further selling pressure, which would complete blue wave v of 1 before a more significant corrective bounce in wave 2 begins. However, if the ongoing minor recovery surpasses 81.07, it would suggest that wave 1 has already concluded, and the price is now in wave 2. The ultimate invalidation point for this analysis is at 87.63; as long as prices remain below this level, sellers should maintain control in the medium term.

Conclusion:

To summarize, the WTI crude oil market's recent price movements suggest a continuation of the downtrend initiated in April 2024. The completion of the recovery phase from the December 2023 low, coupled with the formation of an impulse wave, points towards further downside potential. Traders should closely monitor the key levels of 81.07 and 87.63 to confirm the ongoing wave structure and make informed trading decisions. As long as the price stays below 87.63, the bearish outlook remains valid, and sellers are likely to dominate in the medium term.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold (XAUUSD) Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support