Welcome to Our Latest Elliott Wave Analysis for VanEck Semiconductor ETF (SMH) - May 30, 2024 This analysis offers a thorough examination of SMH's price movements using Elliott Wave Theory, aiding traders in identifying potential opportunities based on prevailing trends and market structure. We'll delve into insights from both daily and 4-hour charts to provide a holistic view of SMH's market behavior.

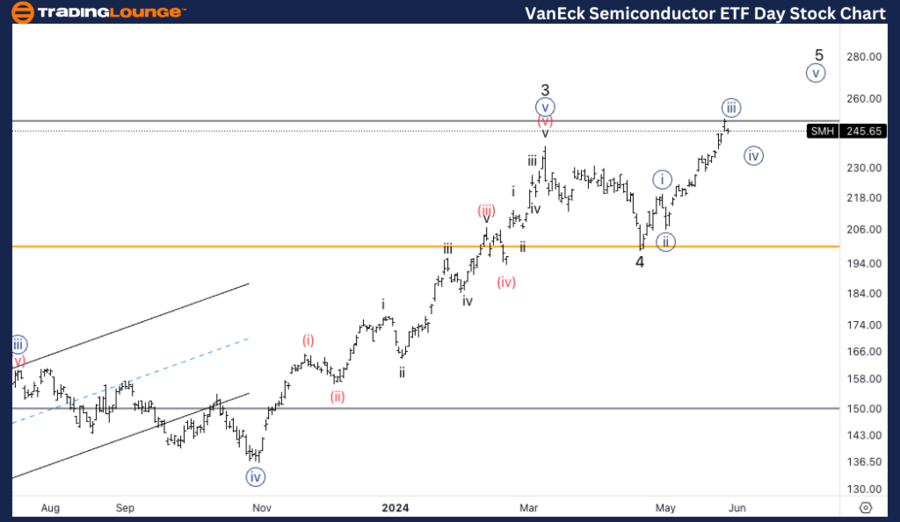

Trading Lounge SMH Elliott Wave Analysis - Daily Chart

VanEck Semiconductor ETF (SMH) Daily Chart Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor 5

Direction: Upside in Minor 5

Details: We have reached the Medium Level at $250, anticipating a potential wave {iv} of 5 to move sideways.

SMH Elliott Wave Technical Analysis – Daily Chart

In our Elliott Wave analysis of the VanEck Semiconductor ETF (SMH) on May 30, 2024, we note an impulsive trend characterized by a motive structure. SMH is currently in Minor wave 5, suggesting an upside movement. After reaching the Medium Level at $250, we expect a potential wave {iv} of 5 to move sideways. Traders should watch this key level for consolidation signs before the trend possibly continues upward.

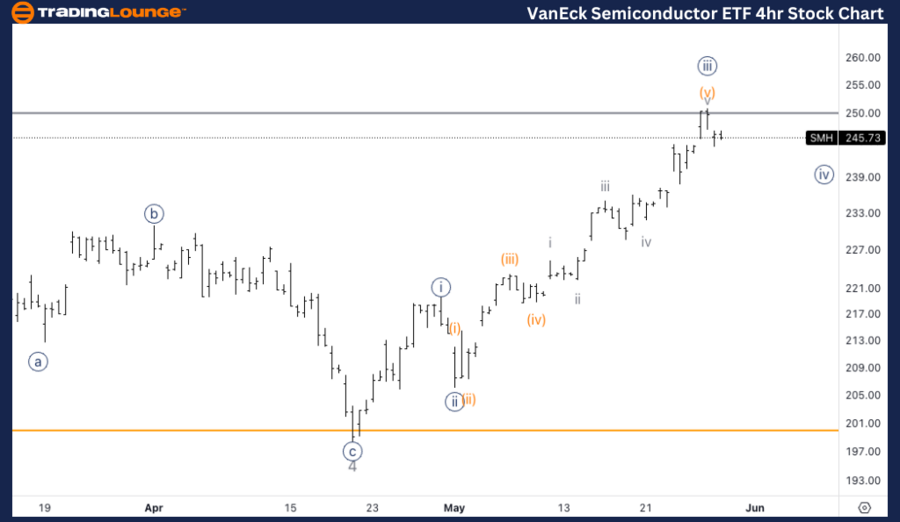

SMH Elliott Wave Analysis - Trading Lounge 4-Hour Chart

VanEck Semiconductor ETF (SMH) 4-Hour Chart Analysis

SMH Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor 5

Direction: Correction in wave {iv}

Details: The subcounts of wave {iii} suggest a top in wave {iii} at $250. Expecting a sideways wave {iv} before continuing higher towards MG2.

SMH Elliott Wave Technical Analysis – 4-Hour Chart

On the 4-hour chart, SMH follows an impulsive trend within a motive structure, specifically in Minor wave 5. The subcounts of wave {iii} indicate a potential top at $250. We anticipate a sideways movement in wave {iv} before resuming the upward trend towards MG2. This corrective phase provides an opportunity to reassess positions and prepare for the next bullish move.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous:NextEra Energy Inc., (NEE) Stocks Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support