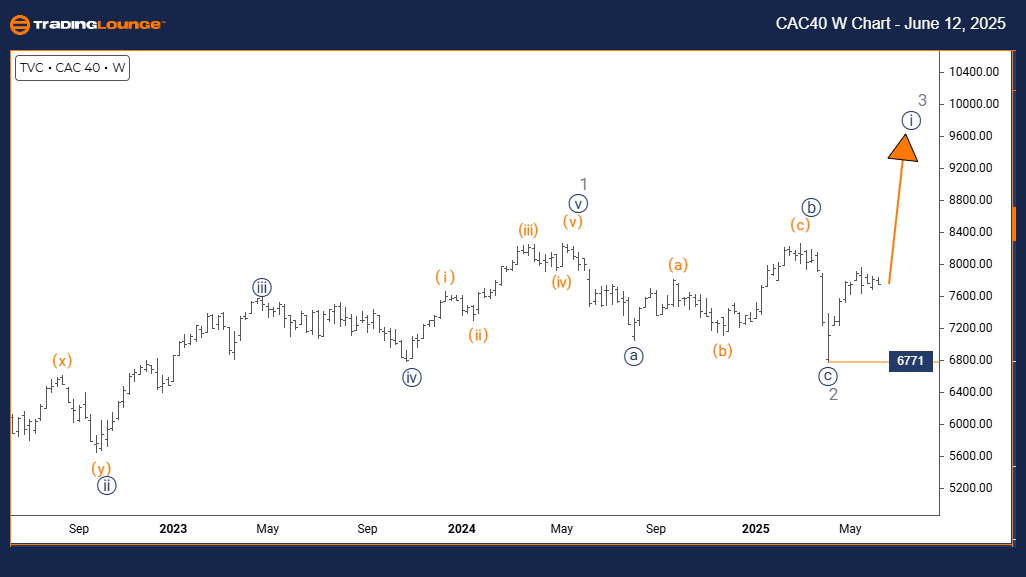

CAC 40 (France) Elliott Wave Analysis – Trading Lounge Day Chart

CAC 40 Index Day Chart Analysis

CAC 40 (France) Wave Technical Review

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange Wave 1 seems completed; Orange Wave 2 is developing.

Wave Cancel Invalidation Level: 6771

The CAC 40 Index daily Elliott Wave forecast identifies a counter-trend corrective structure. This analysis reflects that the index is currently forming Orange Wave 2, embedded within Navy Blue Wave 1, indicating a short-term retracement inside a larger bullish framework.

Orange Wave 1 appears finalized, with Orange Wave 2 progressing. Typically, this type of wave corrects part of the prior advance and leads into Orange Wave 3, which should align with the main trend. Traders should keep an eye on price behavior that signals the end of Orange Wave 2, which may lead to a bullish continuation.

Market conditions suggest a possibility of sideways or moderately bearish action during this corrective stage. The critical level for wave count invalidation is 6771. A drop below this threshold would nullify the current wave configuration, prompting a reevaluation of the Elliott structure.

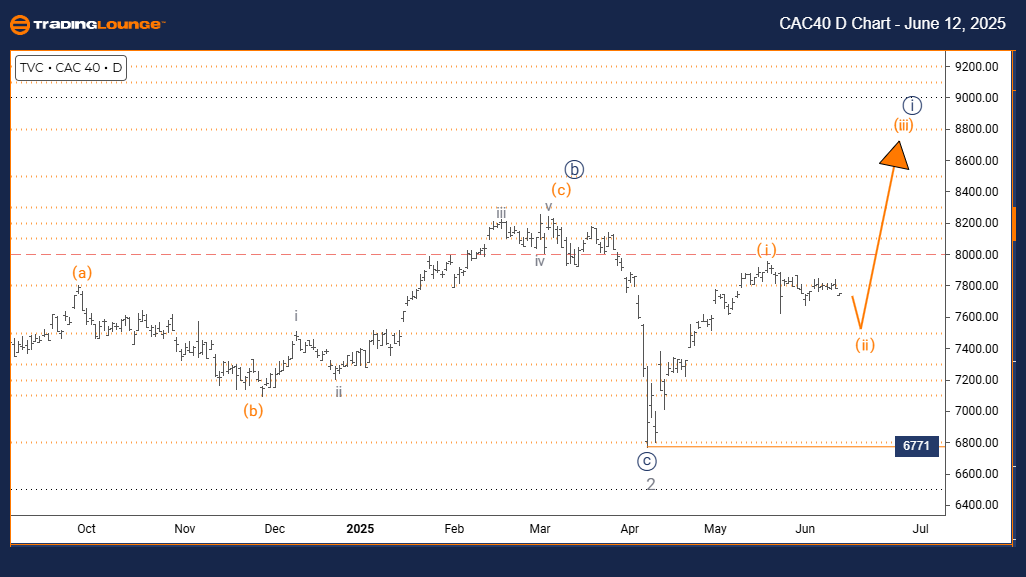

CAC 40 (France) Elliott Wave Analysis – Trading Lounge Weekly Chart

CAC 40 (France) Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 is complete; Navy Blue Wave 1 of Gray Wave 3 is unfolding.

Wave Cancel Invalidation Level: 6771

The weekly Elliott Wave analysis of the CAC 40 Index reveals a bullish momentum within an impulsive pattern. The index is currently tracing Navy Blue Wave 1 inside the larger structure of Gray Wave 3, signaling the early stages of a notable upward trend.

Gray Wave 2 appears completed, and the formation of Navy Blue Wave 1 indicates a new impulse phase. This wave count suggests the potential for further gains. The upcoming focus will be on Navy Blue Wave 2, which typically introduces a correction before further bullish action.

As long as the price remains above 6771, the bullish Elliott Wave outlook stays valid. Any move beneath this level would question the existing wave count and call for a revised analysis. Until then, the technical structure points to continued upside for the CAC 40 Index.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NIFTY 50 INDEX Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support