Welcome to Our Latest Elliott Wave Analysis for QUALCOMM Inc. (QCOM) as of June 12, 2024 This analysis provides a detailed examination of QCOM's price movements using Elliott Wave Theory, aiming to help traders identify potential opportunities based on current trends and market structure. We will cover insights from both the daily and 4-hour charts to offer a comprehensive perspective on QCOM's market behavior.

QCOM Elliott Wave Analysis Trading Lounge Daily Chart

QUALCOMM Inc. (QCOM) Daily Chart Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Intermediate (3)

Direction: Top in (3)

Details: Looking for a continuation higher as we are trading above TL2 at $200.

QCOM Elliott Wave Technical Analysis

In our Elliott Wave analysis of QUALCOMM Inc. (QCOM), we observe an impulsive trend characterized by a Motive wave structure. QCOM is currently positioned in Intermediate wave (3), indicating a continuation higher as we trade above the key trend line (TL2) at $200. The analysis suggests that we are in the latter stages of wave (3), with the potential to reach higher levels as the trend unfolds. Traders should watch for further upside movements and monitor key resistance levels to gauge the strength of the current trend and prepare for potential profit-taking opportunities as we approach the completion of wave (3).

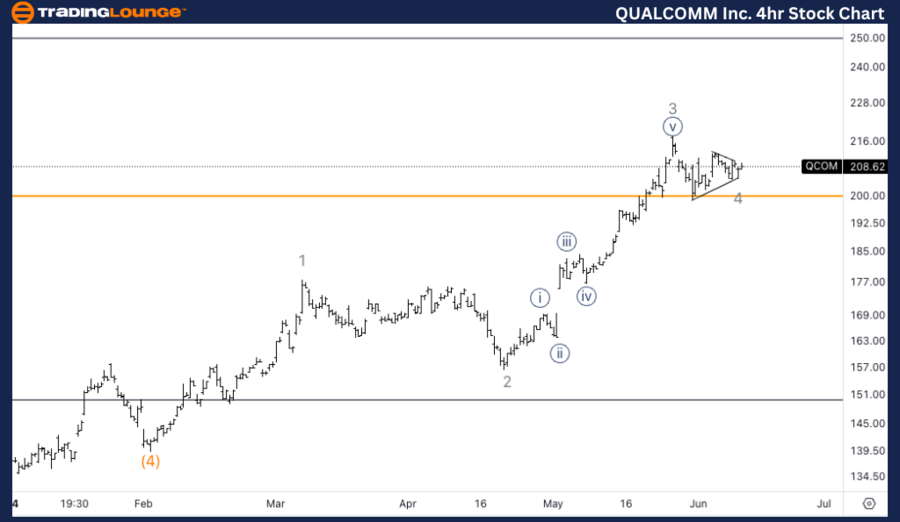

QCOM Elliott Wave Analysis Trading Lounge 4Hr Chart

QUALCOMM Inc. (QCOM) 4Hr Chart Analysis

QCOM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 5

Direction: Upside in wave 5

Details: It seems like we are completing or have completed a triangle in wave 4 and we could now be targeting medium level at $250.

QCOM Elliott Wave Technical Analysis

On the 4-hour chart, QCOM is following an impulsive trend within a Motive wave structure, specifically in wave 5. The current analysis indicates that QCOM may be completing or has already completed a triangle in wave 4. This pattern suggests a consolidation phase before a breakout higher. With the completion of wave 4, QCOM is now targeting the medium level at $250. Traders should observe this breakout from the triangle as a confirmation for entering long positions, with an eye on $250 as a potential target for wave 5.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Caterpillar Inc. (CAT) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support