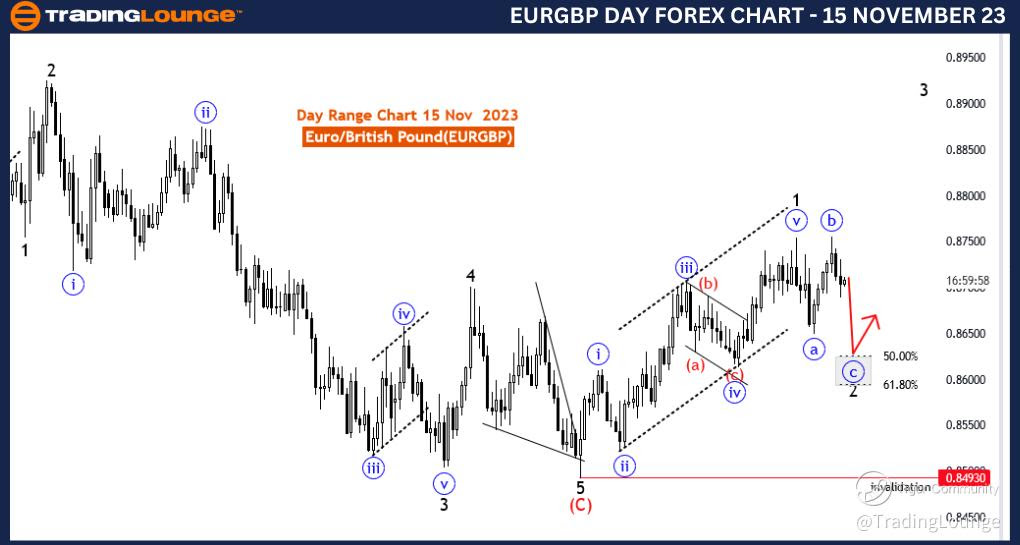

EURGBP Elliott Wave Analysis Trading Lounge Day Chart, 15 November 23

Euro/British Pound(EURGBP) Day Chart

EURGBP Elliott Wave Technical Analysis

Function: Counter Trend

Mode: corrective

Structure: Flat

Position: Black wave 2

Direction Next Higher Degrees:black wave 3

Details:after blue wave 5 of 1 corrective wave 2 is in play and likely to end between fib level 50.00 to 61.80 . Wave Cancel invalid level: 0.84930

The "EURGBP Elliott Wave Analysis Trading Lounge Day Chart" dated 15 November 23, offers an in-depth examination of the Euro/British Pound (EURGBP) currency pair using Elliott Wave theory on the daily chart. This analysis aims to provide traders with insights into potential longer-term price movements.

The identified "Function" is labeled as "Counter Trend," signaling that the analysis is situated within a corrective phase rather than aligning with the dominant trend. This indicates a temporary reversal or consolidation in the market against the larger trend.

The "Mode" is described as "Corrective," suggesting that the current market dynamics involve price movements counter to the overall trend. Corrective waves typically indicate a period of price retracement or consolidation within a broader trend.

The "Structure" is recognized as a "Flat." Flats are corrective patterns characterized by three waves labeled as A, B, and C, each with specific internal structures. This identification assists traders in understanding the nature of the current corrective pattern.

The "Position" is specified as "Black wave 2," indicating that the ongoing corrective structure is part of a broader wave count labeled as 2.

Concerning the "Direction Next Higher Degrees," the analysis points to "black wave 3," suggesting that once the current corrective wave (Black wave 2) is complete, the expectation is for a new trend to emerge, labeled as black wave 3.

In terms of "Details," the report notes that "after blue wave 5 of 1, corrective wave 2 is in play and likely to end between fib level 50.00 to 61.80." This indicates that the current corrective wave is expected to conclude within a specified Fibonacci retracement level range, providing traders with a target area for potential reversals.

The "Wave Cancel invalid level" is set at 0.84930, indicating the level at which the current wave count would be considered invalid. This level serves as a critical reference for traders to assess the accuracy of the current wave structure.

In summary, the EURGBP Elliott Wave Analysis on the daily chart suggests a corrective pattern, specifically a Flat labeled as Black wave 2. Traders are advised to monitor the completion of this corrective structure and be prepared for potential trend resumptions labeled as black wave 3. The specified invalidation level provides a reference point for evaluating the validity of the current wave count.

Technical Analyst : Malik Awais

Source : Tradinglounge.com get trial here!

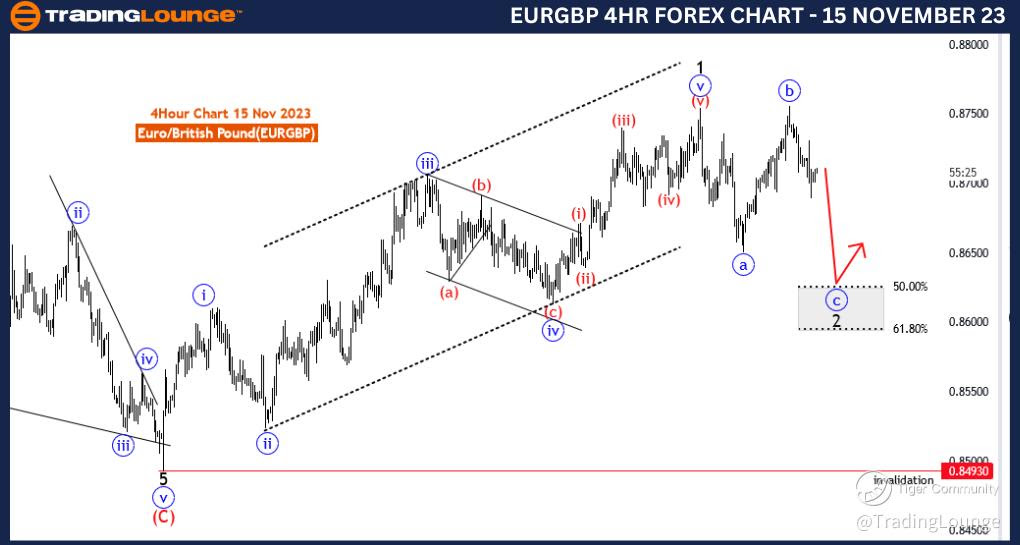

EURGBP Elliott Wave Analysis Trading Lounge 4 Hour Chart, 15 November 23

Euro/British Pound(EURGBP) 4 Hour Chart

EURGBP Elliott Wave Technical Analysis

Function: Counter Trend

Mode: corrective

Structure: Flat

Position: Black wave 2

Direction Next Higher Degrees:black wave 3

Details:after blue wave 5 of 1 corrective wave 2 is in play and likely to end between fib level 50.00 to 61.80. Wave Cancel invalid level: 0.84930

The "EURGBP Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 15 November 23, provides a detailed examination of the Euro/British Pound (EURGBP) currency pair within the framework of Elliott Wave theory. This analysis, conducted on the 4-hour chart, is designed to offer traders insights into potential price movements in the short to medium term.

The identified "Function" is labeled as "Counter Trend," indicating that the analysis is situated within the context of a corrective phase rather than being aligned with the dominant trend. This suggests that the market is currently undergoing a temporary reversal against the larger trend.

The "Mode" is described as "Corrective," suggesting that the current market dynamics are characterized by price movements that are counter to the overall trend. Corrective waves are typically part of a larger pattern, providing traders with opportunities to identify potential reversals or pauses in the market.

The "Structure" is identified as a "Flat." Flats are corrective patterns consisting of three waves labeled as A, B, and C, with specific internal structures. Understanding the pattern helps traders anticipate potential price movements.

The "Position" is recognized as "Black wave 2," indicating that the current corrective structure is part of a broader wave count labeled as 2.

Concerning the "Direction Next Higher Degrees," the analysis suggests "black wave 3," indicating that once the ongoing corrective wave (Black wave 2) is complete, the expectation is for a new trend to emerge, labeled as black wave 3.

In terms of "Details," the report notes that "after blue wave 5 of 1 corrective wave 2 is in play and likely to end between fib level 50.00 to 61.80." This suggests that the current corrective wave is expected to conclude within a specified Fibonacci retracement level range, providing traders with a target area for potential reversals.

The "Wave Cancel invalid level" is set at 0.84930, indicating the level at which the current wave count would be considered invalid. This level is crucial for traders to monitor, as a breach could signify a deviation from the expected wave structure.

In summary, the EURGBP Elliott Wave Analysis on the 4-hour chart suggests a corrective pattern, specifically a Flat labeled as Black wave 2. Traders are advised to monitor the completion of this corrective structure and be alert to potential trend resumptions labeled as black wave 3. The specified invalidation level provides a reference point for assessing the accuracy of the current wave count.

Technical Analyst : Malik Awais

Source : Tradinglounge.com get trial here!