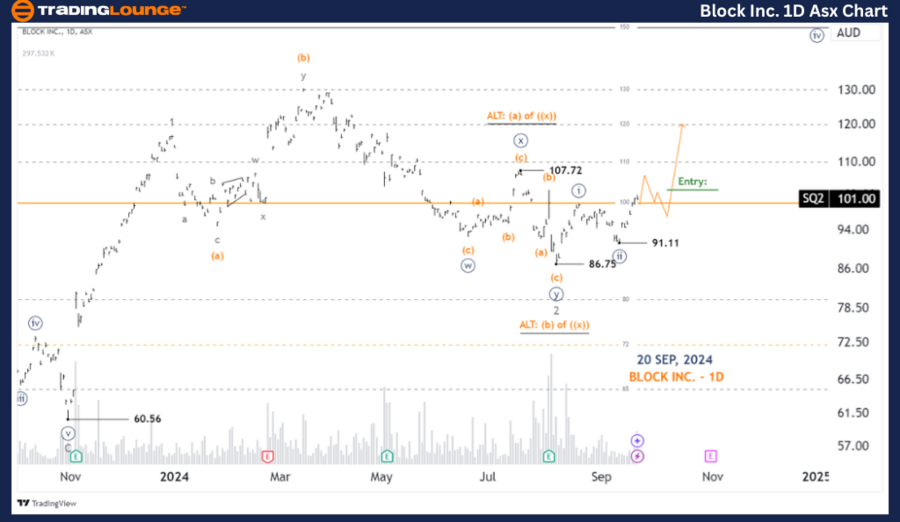

ASX: BLOCK INC. - SQ2 Elliott Wave Technical Analysis (1D Chart)

Greetings, today's Elliott Wave analysis provides an update on the Australian Stock Exchange (ASX) featuring BLOCK INC. - SQ2. We identify a potential bullish opportunity with wave (iii)-orange of wave ((iii))-navy.

ASX: BLOCK INC. - SQ2 1D Chart (Semilog Scale) Analysis

SQ2 Elliott Wave Technical Analysis

Function: Major trend (Minor degree, gray)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 3-grey

Details: Wave ((iii))-navy appears to be pushing higher, and to maintain this outlook, the price must stay above 91.11. A Long Trade Setup could be considered once we observe support around the Major Level of 100.00.

Invalidation Point: 91.11

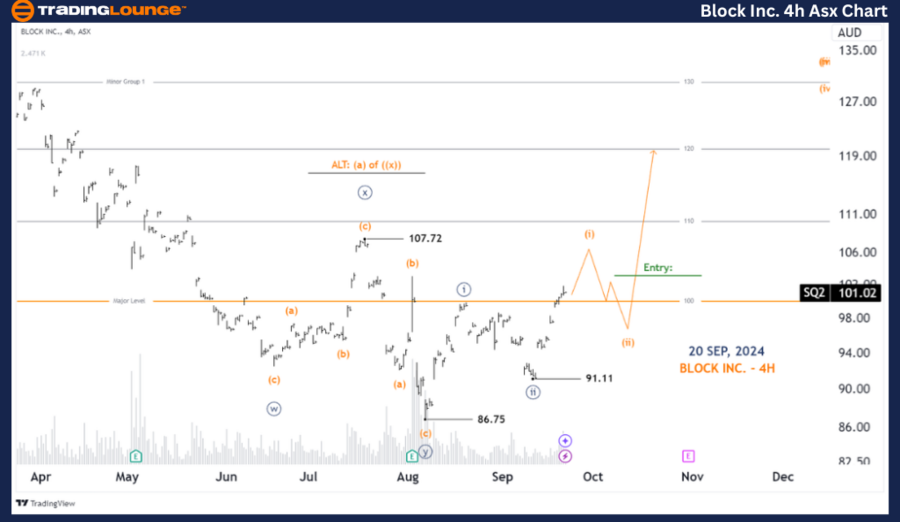

ASX: BLOCK INC. - SQ2 4-Hour Chart Analysis

Function: Major trend (Minor degree, gray)

Mode: Motive

Structure: Impulse

Position: Wave (i)-orange of Wave ((iii))-navy

Details: Starting from the low at 86.75, wave 3-grey is progressing higher. This move divides into wave (i)-orange of wave ((iii))-navy. Wave (i)-orange might push a bit higher before wave (ii)-orange retraces lower. Then, wave (iii)-orange of wave ((iii))-navy should resume the upward movement. A Long Trade Setup can be considered at support from the Major Level 100.00.

Invalidation Point: 91.11

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: BLOCK INC. - SQ2 highlights key market trends and offers insights into potential trading opportunities. We provide specific price points for validation and invalidation of our wave count, improving the reliability of our forecast. By combining these factors, we aim to offer traders an objective and professional perspective on current market conditions.