The Coca-Cola Company, Elliott Wave Technical Analysis

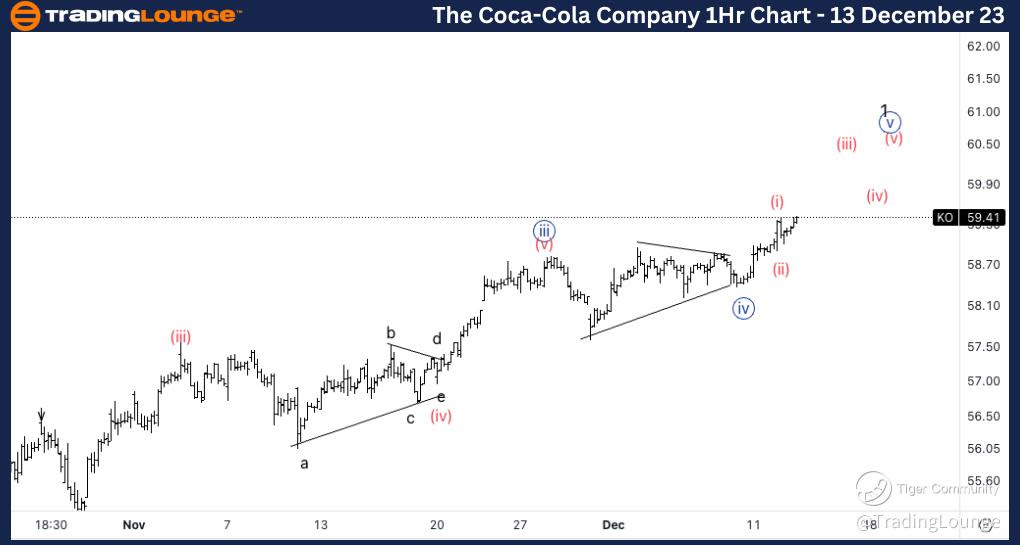

The Coca-Cola Company, (KO:NYSE): 4h Chart 13 December 23

KO Stock Market Analysis: We are looking for further upside into wave 1 as we seem to be unfolding into a five wave move. At this point we could be getting close to a top as we are reaching 60$, with upside potential up to 65$.

KO Elliott Wave Count: Wave {v} of 1.

KO Technical Indicators: Above all averages.

KO Trading Strategy: Looking for longs into wave {v}.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

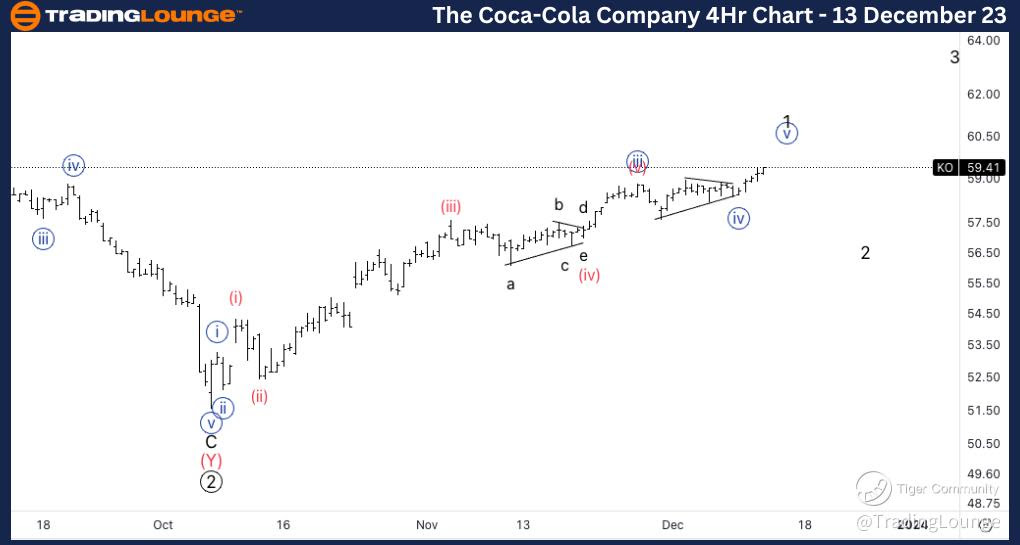

The Coca-Cola Company, KO: 1-hour Chart 13 December 23

The Coca-Cola Company, Elliott Wave Technical Analysis

KO Stock Market Analysis: As you can see from this lower timeframe count we could have completed wave (ii) of {v} as we are resuming higher into wave (iii) of {v} from which we could expect acceleration higher.

KO Elliott Wave count: Wave (iii) of {v}

KO Technical Indicators: Above all averages.

KO Trading Strategy: Looking for longs within wave {v}.