Corn Elliott Wave Technical Analysis

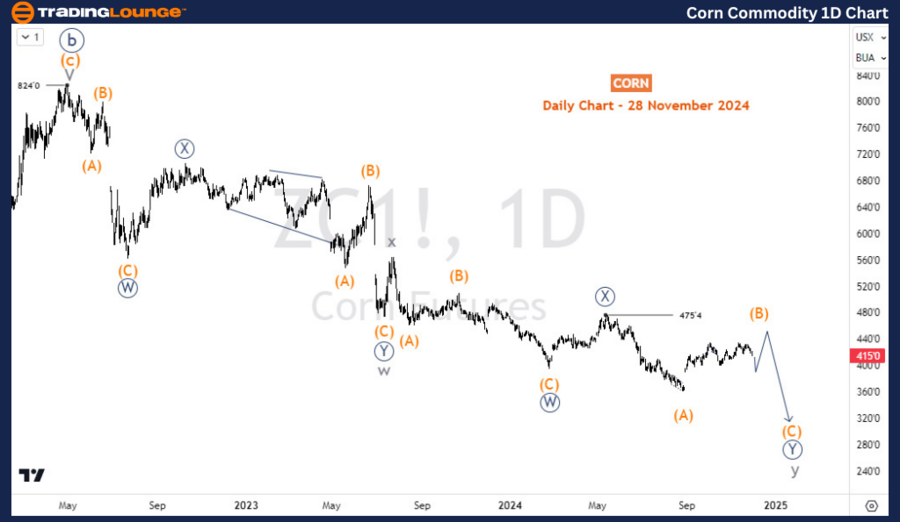

The analysis of corn price action continues to indicate a bearish outlook, especially while resistance holds below the $475 mark. The ongoing bearish sequence, which began in April 2022, seems to be correcting the prior impulse rally from April 2020 to April 2022.

Corn Long-Term View

Corn prices remain in a long-term bearish corrective phase that started in July 2012. This phase is part of a broader correction of the diagonal 5-wave sequence initiated in the 1970s. Corrective patterns, excluding triangles, generally consist of three waves:

- Wave 1: Completed in April 2020 after an extended decline.

- Wave 2: Marked by strong upward rallies, peaking in April 2022.

The current decline, which began in April 2022, likely represents Wave 3. Projections suggest this wave could extend toward the $295 level. Therefore, the overall corrective phase remains incomplete, supporting further downside movement in the longer term.

Corn Daily Chart Analysis

On the daily chart, the focus shifts to the third leg of the bearish corrective cycle. Beginning at $824, this third leg has been unfolding into a double zigzag structure:

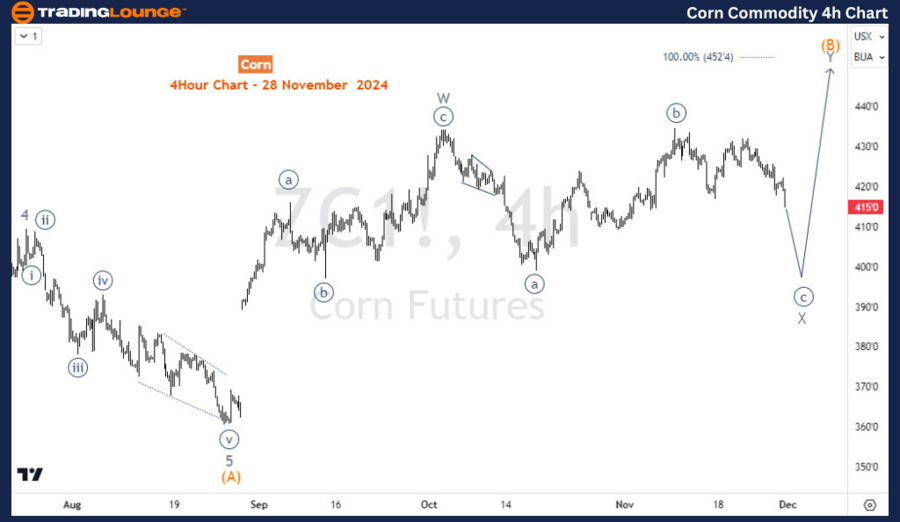

The H4 chart highlights that Wave (B) may be forming a double zigzag structure, with the price currently within the second wave of this sequence.

Corn H4 Chart Analysis

In the shorter time frame of Wave (B):

In the coming weeks, prices are likely to remain volatile and range-bound, with neither bulls nor bears exerting sustained dominance. This choppy market environment may persist as the structure continues to develop.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cocoa Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support