Gold Elliott Wave Analysis

Gold is anticipated to maintain its bullish trajectory, continuing the cycle that began in September 2022. The precious metal is aiming to complete the final leg of this upward movement before potentially experiencing a major corrective pullback. After recovering approximately half of its November sell-off, gold's rally has temporarily paused as it awaits the necessary momentum for another upward push.

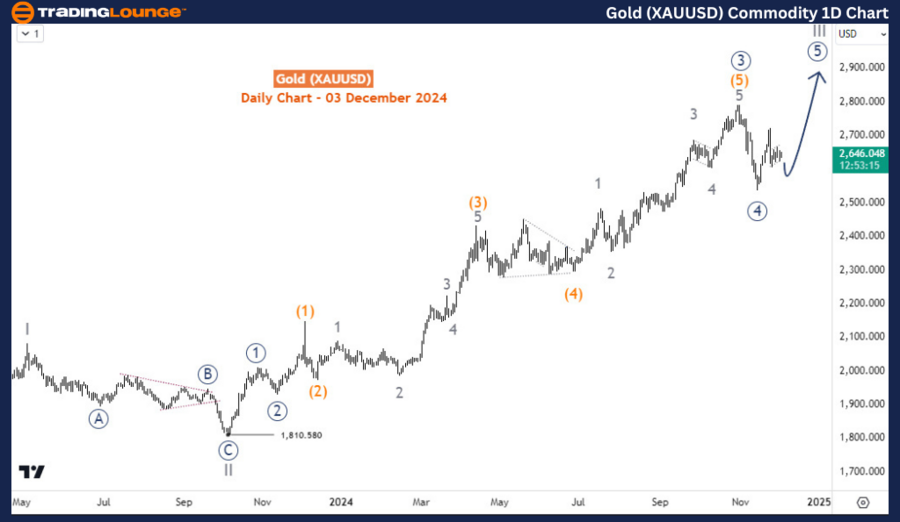

Gold (XAUUSD) Daily Chart Analysis

Gold entered a bullish phase in September 2022, marking the end of a more than two-year bearish correction at the 1616 level. This downward trend was identified as part of the supercycle degree wave (IV). Since then, the initiation of supercycle degree wave (V) has driven gold prices to reach multiple record highs, most notably breaking its previous records in May 2023.

- Wave II of (V): Concluded at 1810 in October 2023, as seen on the daily chart.

- Wave III of (V): Subsequent rallies have pointed towards the ongoing completion of wave III. The sharp sell-off observed in November 2024 signifies wave ((4)) of III.

While there's still a possibility for wave ((4)) to extend to prices below 2540, the focus is now on the development of wave ((5)) of III, which could potentially lead to another record high. Upon the conclusion of wave III, a more significant pullback is anticipated.

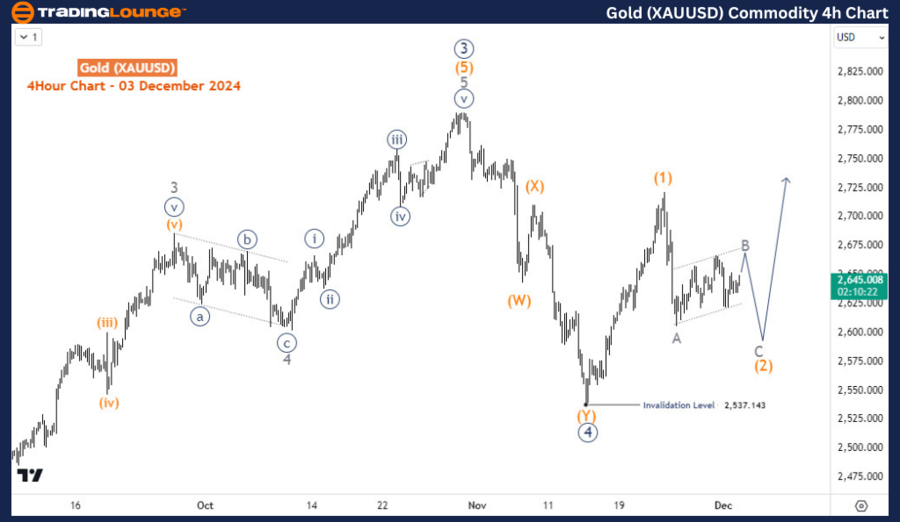

Gold (XAUUSD) H4 Chart Analysis

The H4 chart suggests that gold prices may still be in wave (2) of ((5)). The bounce from late November appears to represent wave B of (2), which indicates another potential decline for wave C of (2). Key observations include:

- Above 2537: If the anticipated dip ends above the 2537 level, the subsequent rally should confirm the progression into wave (3).

- Below 2537: A breach of this level could extend wave ((4)) lower, potentially reaching 2500 or below.

These technical setups highlight critical price levels to monitor as gold continues its bullish cycle.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Iron Ore Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support