Bovespa Index Elliott Wave Analysis - Trading Lounge Day Chart

Bovespa Index Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 3

Direction Next Higher Degrees: Orange Wave 1 (Initiated)

Details: Navy Blue Wave 2 appears complete; Orange Wave 1 of Navy Blue Wave 3 is underway.

Analysis Overview

The daily chart of the Bovespa Index reveals a bullish Elliott Wave structure. The ongoing wave sequence, identified as Orange Wave 1, is a part of Navy Blue Wave 3, signaling an impulsive phase in the market. This setup highlights a continuation of the upward trend, suggesting robust market dynamics.

The conclusion of Navy Blue Wave 2 has initiated Orange Wave 1, which now drives the early stages of the impulsive sequence within Navy Blue Wave 3. This aligns with the principles of Elliott Wave Theory, forecasting a strong bullish trend supported by the structure's momentum.

Insights for Traders

This bullish Elliott Wave analysis provides actionable insights for traders. The progression of Orange Wave 1 within Navy Blue Wave 3 suggests sustained upward momentum, presenting opportunities for potential market gains. Traders can leverage this structure to align with the unfolding impulsive phase for informed decision-making.

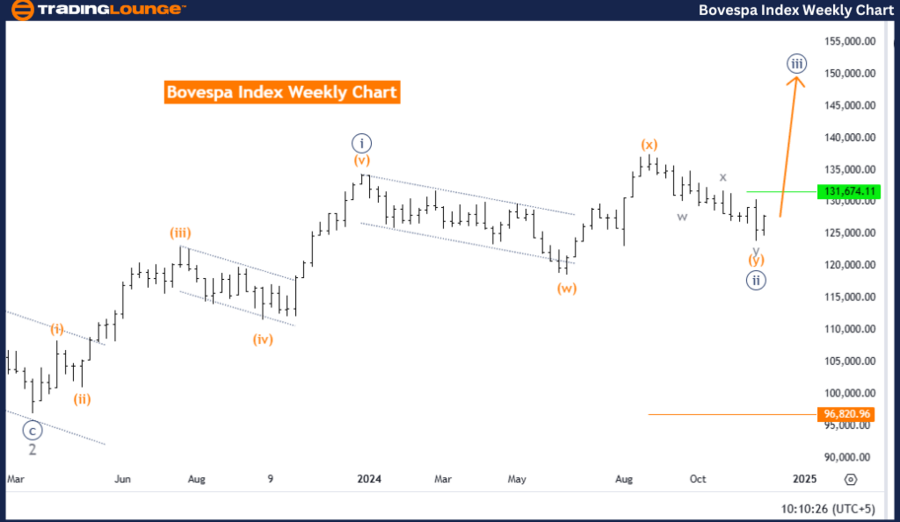

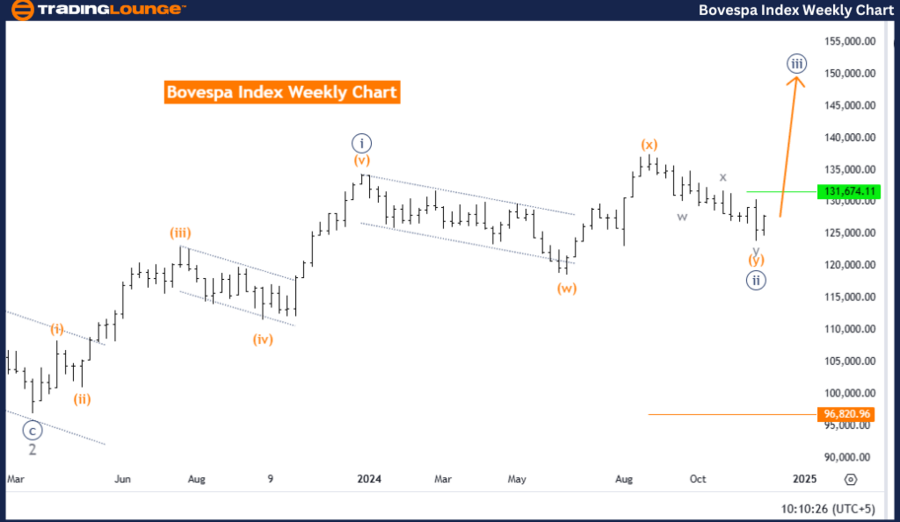

Bovespa Index Elliott Wave Analysis - Trading Lounge Weekly Chart

Bovespa Index Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 3

Position: Gray Wave 3

Direction Next Higher Degrees: Navy Blue Wave 3 (Initiated)

Details: Navy Blue Wave 2 appears complete; Navy Blue Wave 3 is now active.

Wave Cancel Invalid Level: 96,820.96

Analysis Overview

The weekly chart of the Bovespa Index provides further confirmation of the bullish trend through Elliott Wave analysis. The wave sequence is defined as Navy Blue Wave 3, which forms a key component of the broader impulsive movement. Gray Wave 3 is currently advancing within this structure, signaling continued upward momentum in the market.

The conclusion of Navy Blue Wave 2 has allowed the transition into Navy Blue Wave 3, a hallmark of Elliott Wave Theory's impulsive wave phases. The ongoing development of Navy Blue Wave 3 indicates a period of strong bullish momentum, offering the potential for further upward progression.

Key Levels and Considerations

The invalidation level for the current wave count is identified at 96,820.96. A break below this threshold would necessitate a reevaluation of the wave structure, possibly indicating a deviation from the expected bullish trajectory.

Insights for Traders

The analysis of Navy Blue Wave 3 provides a strategic framework for understanding the ongoing bullish trend. By monitoring critical levels and the impulsive sequence's progression, traders can position themselves to capitalize on potential market gains as this phase unfolds. The persistence of upward momentum offers a favorable outlook for trading opportunities.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: IBEX 35 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support