FTSE 100 (UK) Elliott Wave Analysis Trading Lounge Day Chart

Function: Trend

Mode: Impulsive

Structure: Gray Wave 1

Position: Orange Wave 5

Direction for Next Lower Degrees: Gray Wave 2

Details

Current Status:

- Orange wave 4 is complete.

- Gray wave 1 of orange wave 5 is actively progressing.

- Invalidation Level: 7,990.76 (A drop below this level invalidates the current Elliott Wave structure).

Analysis Overview

The FTSE 100 daily chart showcases a bullish trend, analyzed using Elliott Wave principles. The impulsive mode indicates strong upward momentum within the current wave sequence.

Key Highlights:

Wave Progression:

- Completion of orange wave 4 transitions into gray wave 1 of orange wave 5.

- Gray wave 1 initiates a fresh impulsive sequence, continuing the bullish trend.

Upward Momentum:

- Gray wave 1 is propelling prices higher, backed by strong bullish sentiment.

Upcoming Correction:

- After gray wave 1, a corrective phase is expected in gray wave 2.

Key Considerations

Bullish Sentiment:

- The completion of orange wave 4 and the start of gray wave 1 signify robust upward momentum.

Potential Reassessment:

- A drop below 7,990.76 would invalidate the current Elliott Wave count, necessitating a revised analysis.

Strategic Implications for Traders

Capitalizing on the Trend:

- Align trading strategies with the bullish momentum of gray wave 1 within orange wave 5.

Preparing for Gray Wave 2:

- Anticipate a potential correction in gray wave 2 to manage positions effectively.

Monitoring Progression:

- Closely track price movements and wave developments for informed decisions.

This analysis reflects a strong bullish outlook for the FTSE 100 daily chart. The active phase of gray wave 1 provides opportunities for traders to benefit from the prevailing upward momentum.

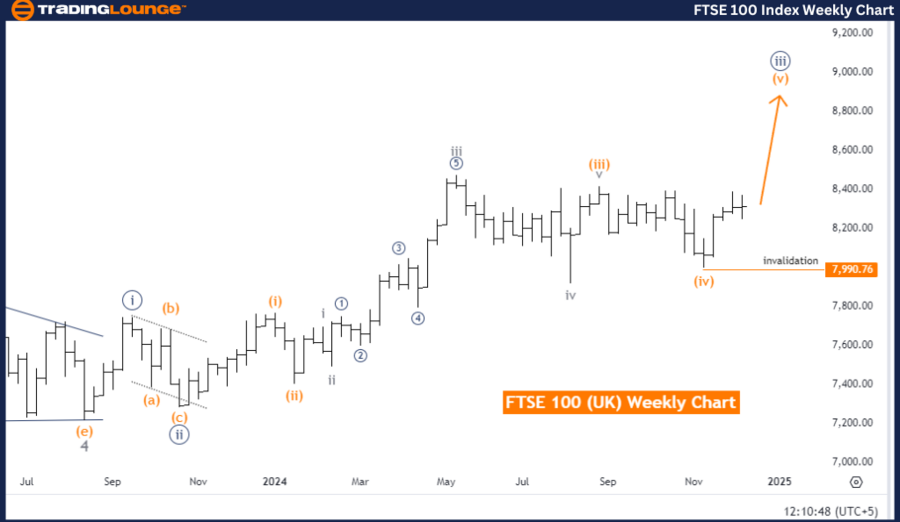

FTSE 100 (UK) Elliott Wave Analysis Trading Lounge Weekly Chart

FTSE 100 (UK) Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 5

Position: Navy Blue Wave 3

Direction for Next Lower Degrees: Navy Blue Wave 4

Details

Current Status:

- Orange wave 4 is complete.

- Orange wave 5 is progressing within navy blue wave 3.

- Invalidation Level: 7,990.76 (A drop below this level invalidates the current Elliott Wave structure).

Analysis Overview

The FTSE 100 weekly chart highlights a bullish trend, underpinned by Elliott Wave analysis. The impulsive mode indicates sustained upward momentum within the current wave structure.

Key Highlights:

Wave Progression:

- Completion of orange wave 4 transitions into orange wave 5, the final phase of the impulsive sequence.

- The market remains within navy blue wave 3, reinforcing bullish sentiment.

Final Impulsive Phase:

- Orange wave 5 represents the culmination of the upward trend, marking the peak of this phase.

Upcoming Correction:

- After orange wave 5 and navy blue wave 3, a corrective phase is anticipated in navy blue wave 4.

Key Considerations

Bullish Sentiment:

- Orange wave 5’s progression within navy blue wave 3 indicates sustained upward momentum.

Potential Reassessment:

- Prices below 7,990.76 invalidate the current wave count and require a revised analysis.

Strategic Implications for Traders

Trend-Following Opportunities:

- Orange wave 5 presents opportunities to capitalize on the bullish momentum during this market phase.

Preparing for Navy Blue Wave 4:

- Anticipate the corrective phase following navy blue wave 3 to manage risk effectively.

Monitoring Progression:

- Continuously observe price action and wave developments for accurate decision-making.

This analysis emphasizes a bullish outlook for the FTSE 100 weekly chart. Traders can align strategies with the ongoing orange wave 5 momentum while preparing for eventual corrective phases.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: DAX (Germany) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support