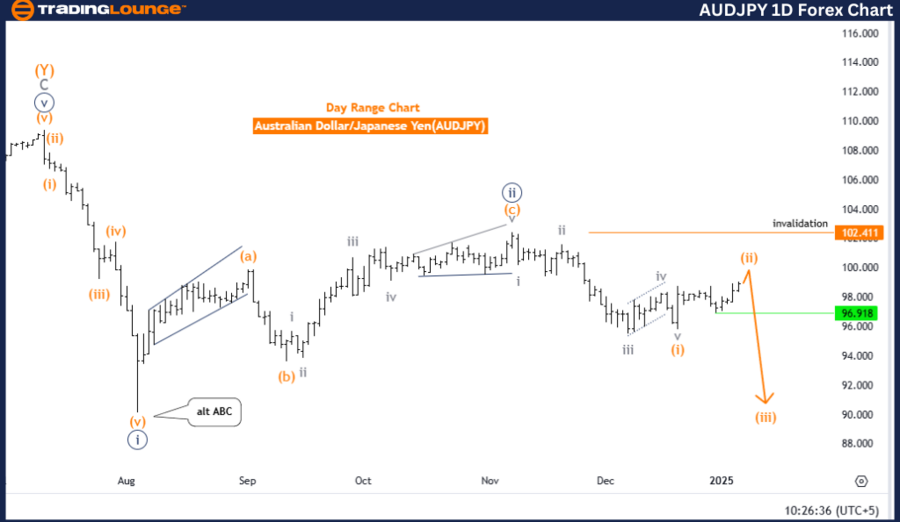

Australian Dollar / Japanese Yen (AUDJPY) Daily Chart

AUDJPY Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 3

Direction Next Lower Degrees: Orange Wave 3

Details: Orange wave 1 appears completed; orange wave 2 is currently in progress.

Wave Cancel Invalidation Level: 102.411

The Australian Dollar to Japanese Yen (AUDJPY) currency pair is currently in a counter-trend corrective phase, according to the Elliott Wave Analysis on the daily chart. This phase is marked by the progression of orange wave 2, forming part of the overarching navy blue wave 3 structure. The completion of orange wave 1 indicates that the market is now within the formation of orange wave 2.

This corrective phase represents a temporary pullback within the broader upward trend. Once orange wave 2 concludes, the market is anticipated to enter orange wave 3, resuming the upward momentum in the navy blue wave 3 sequence. These phases align with Elliott Wave Theory, which highlights the interplay between impulsive and corrective wave structures.

An invalidation level has been identified at 102.411. If the price surpasses this level, the current wave analysis will be invalid, necessitating a reexamination of the structure. This point acts as a key reference for confirming or adjusting the ongoing analysis.

Summary

- Current Phase: Corrective (Orange Wave 2 within Navy Blue Wave 3)

- Future Outlook: Transition to Orange Wave 3 is expected.

- Invalidation Level: 102.411

The invalidation level serves as a crucial marker for maintaining the accuracy of the analysis and predicting future price movements.

Australian Dollar / Japanese Yen (AUDJPY) 4-Hour Chart

AUDJPY Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 3

Direction Next Lower Degrees: Orange Wave 3

Details: Orange wave 1 appears completed; orange wave 2 is currently unfolding.

Wave Cancel Invalidation Level: 102.411

The AUDJPY currency pair is also exhibiting a counter-trend corrective phase on the 4-hour chart, characterized by the formation of orange wave 2. This wave is a segment of the larger navy blue wave 3 structure, and its progression follows the recent completion of orange wave 1.

This phase highlights a short-term pullback in the market. Upon finalizing orange wave 2, the pair is forecasted to transition into orange wave 3, advancing the broader navy blue wave 3 trend. These developments mirror the natural oscillation between impulsive and corrective phases described by Elliott Wave principles.

The analysis sets the invalidation level at 102.411. Exceeding this threshold invalidates the current wave count, requiring an updated structural interpretation. This point is integral for validating or revising the existing forecast.

Summary

- Current Phase: Corrective (Orange Wave 2 within Navy Blue Wave 3)

- Future Outlook: Anticipated progression into Orange Wave 3.

- Invalidation Level: 102.411

This corrective stage represents a preparatory phase before the market resumes its upward trajectory, with the invalidation level offering a critical benchmark for the accuracy of the analysis.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDCAD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support