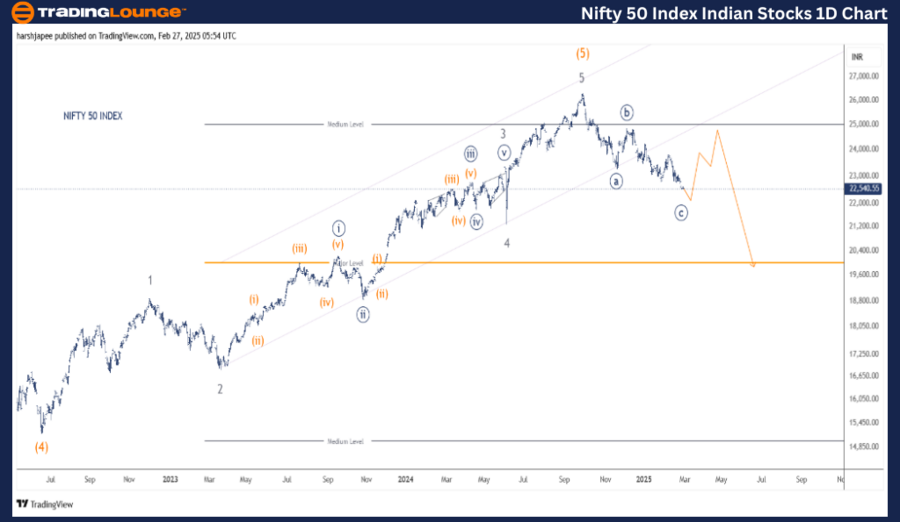

NIFTY 50 INDEX (1D Chart) – Elliott Wave Technical Analysis

NIFTY 50 Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Zigzag

Position: Minute Wave ((c))

Invalidation Point: 26,400

Market Overview & Wave Count Analysis

The alternate Elliott Wave count is currently the preferred outlook, indicating a potential ((a)) - ((b)) - ((c)) zigzag pattern nearing completion within the 22,500 - 22,550 zone. There is a strong probability of a counter-trend rally emerging from this level or possibly around 22,100.

NIFTY 50 INDEX Daily Chart – Elliott Wave Technical Analysis & Forecast

The NIFTY 50 Daily Chart suggests a major market top was formed around 26,300 in September 2024. The high-probability Elliott Wave count projects the following:

- Minute Wave ((a)) / ((i)) completed near 23,267

- Wave ((b)) / ((ii)) formed before Wave ((c)) / ((iii)), leading to a move toward 24,900 and the 22,500 - 22,550 range

- The Intermediate Wave (4) Orange previously ended near 15,200, followed by a Minor degree impulse (Waves 1-5), which propelled prices to 26,300, marking the termination of Wave (5)

Market Outlook: Bullish or Bearish?

- Bulls may attempt a rally toward the 24,700 range in the short term.

- If the correction finalizes at the 22,400 mark, the likelihood of a return to 26,300 remains low.

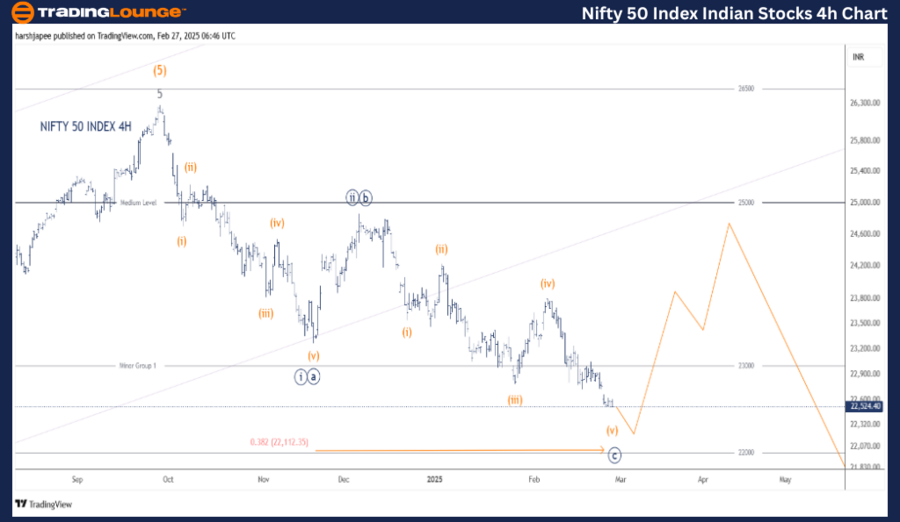

NIFTY 50 INDEX (4H Chart) – Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree, Grey)

Mode: Corrective

Structure: Zigzag

Position: Minute Wave ((c))

Invalidation Point: 26,400

Short-Term Market Insight & Key Levels

The alternate Elliott Wave count suggests that a ((a)) - ((b)) - ((c)) zigzag formation may be nearing completion around 22,500 - 22,550. A counter-trend rally remains likely from this level or closer to 22,100.

Alternatively, if NIFTY continues within Minute Wave ((iii)), the market may present a sell-on-rallies opportunity instead.

NIFTY 50 INDEX 4H Chart – Elliott Wave Counts & Price Forecast

The NIFTY 50 4H Chart tracks sub-wave movements from the 26,280 - 26,300 highs reached on September 27, 2024. Adjustments confirm a ((a)) - ((b)) - ((c)) zigzag completion from those peaks.

Alternate Wave Scenarios:

- Minute Wave ((i)) - ((ii)) may be complete, with ((iii)) currently unfolding

- The initial decline to 23,257 was labeled as Minute Wave ((a)) / ((i))

- Followed by Wave ((b)) / ((ii)), reaching 24,900

- Minute Wave ((c)) / ((iii)) is possibly nearing completion within 22,500 - 22,550

Potential Price Movements & Confirmation Signals

- If the wave structure remains valid, a counter-trend rally to 24,400 - 24,500 could emerge

- A breakout above 23,750 will confirm bulls have regained control, suggesting a potential move above 26,300

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: IBEX 35 (Spain) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion & Market Summary

The NIFTY 50 INDEX is currently trending downward toward the 22,000 - 22,100 zone, aligning with a larger corrective wave structure.

📢 Note: TradingLounge subscribers receive daily NIFTY 50 INDEX trade setup videos featuring Elliott Wave counts & technical analysis.