NZDUSD Elliott Wave Analysis - Trading Lounge Day Chart

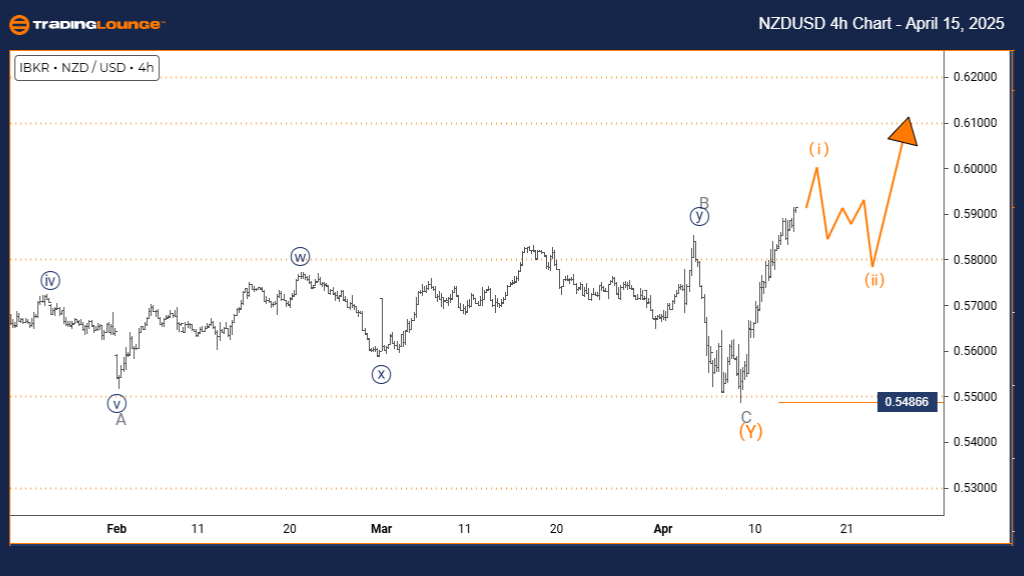

New Zealand Dollar/U.S. Dollar (NZDUSD) Day Chart

NZDUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange wave 1

POSITION: Navy blue wave 1

DIRECTION NEXT LOWER DEGREES: Orange wave 2

DETAILS: Orange wave 1 of navy blue wave 1 is forming, indicating a new bullish trend.

Wave Cancel Invalid Level: 0.54866

The NZDUSD daily chart highlights the development of a new bullish impulse wave, signaling a trend change based on Elliott Wave theory. The current formation shows orange wave 1 advancing within a larger navy blue wave 1, suggesting the initiation of a five-wave structure on the daily timeframe.

Orange wave 1 represents the first leg of this upward move and typically forms with growing buying pressure. Although wave 1 is generally less aggressive than waves 3 or 5, its identification is critical in confirming the trend's origin. This structure reinforces the forecast of a sustained upside sequence unfolding.

Traders should expect orange wave 2 to follow as a corrective pullback, potentially offering a retracement opportunity before orange wave 3 accelerates. This wave sequence is pivotal in defining trend continuation across multiple timeframes.

The wave count remains valid as long as NZDUSD holds above 0.54866. A break below this support would invalidate the current bullish outlook, requiring a reevaluation of the wave structure.

Traders are encouraged to monitor early trend signals such as steady upward price action and increasing momentum. Confirmation through technical indicators and price structure will assist in validating wave 1's development and preparing for wave 2’s correction and the upcoming rally in wave 3.

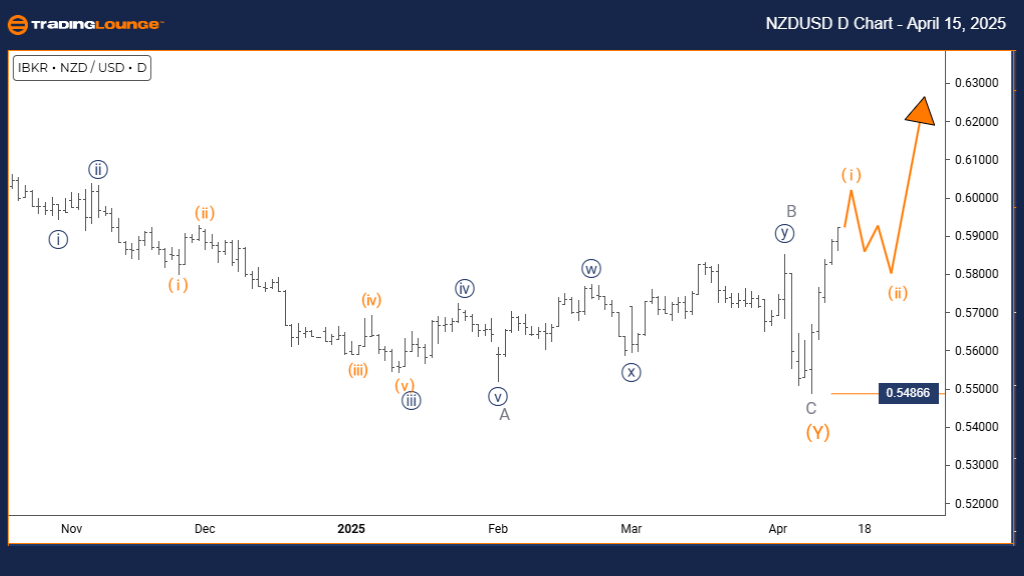

New Zealand Dollar/U.S. Dollar (NZDUSD) 4 Hour Chart

NZDUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange wave 1

POSITION: Navy blue wave 1

DIRECTION NEXT LOWER DEGREES: Orange wave 2

DETAILS: Orange wave 1 of navy blue wave 1 is forming, marking the beginning of an impulsive trend.

Wave Cancel Invalid Level: 0.54866

The NZDUSD 4-hour chart reinforces the start of a new upward trend under Elliott Wave principles. The pair is in the early stages of orange wave 1 within a broader navy blue wave 1, outlining the initial wave of a bullish five-wave pattern.

Orange wave 1 shows the market's first push upward, generally accompanied by increasing momentum as traders begin positioning for a potential trend shift. Although not as powerful as later waves, wave 1 lays the foundation for sustained bullish movement.

Upon completion of wave 1, a corrective phase—orange wave 2—is anticipated. This retracement may provide a strategic entry point before the emergence of a strong wave 3. The 4-hour timeframe offers a closer look at this formation, offering insight into early price dynamics of a larger trend.

The invalidation point stands at 0.54866. A move below this support would negate the current wave scenario and require a fresh analysis of the price structure.

Watch for typical wave 1 behavior: upward bias, rising volume, and building momentum. Combining Elliott Wave analysis with technical indicators will help confirm this setup and spot opportunities as the market transitions from wave 1 into wave 2 and beyond.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: USDCAD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support