Natural Gas Elliott Wave Forecast – Trading Lounge Insights

Natural Gas Recovery Momentum May Target $6.2

Natural Gas continues to show bullish strength after rebounding from the late April lows. This rally may be part of a larger bullish corrective cycle that began in February 2024, with potential upside aiming for the $6.2 level.

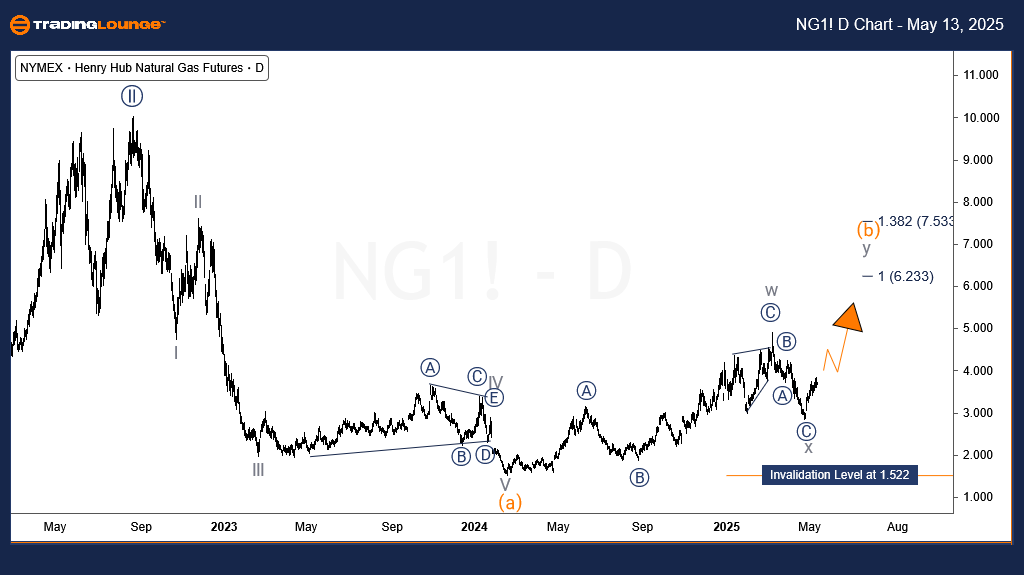

Natural Gas Elliott Wave Analysis – Daily Chart

The daily chart analysis suggests Natural Gas completed a major bearish impulse—labeled as wave (a) in Elliott Wave terminology—from the high in August 2022, bottoming in February 2024. The structure aligns with Elliott Wave principles, where a corrective 3-wave structure typically follows a completed 5-wave move.

Wave (b) appears to be forming as a double zigzag. The initial zigzag leg, wave W, ended in March 2025. It was followed by wave X, another zigzag pattern, which wrapped up by late April 2025. The current rise likely represents wave Y’s early stages. If this count proves accurate, the next targets could be $4.9 initially and potentially extend toward $6.2. The 1.522 support remains the key invalidation point for this structure.

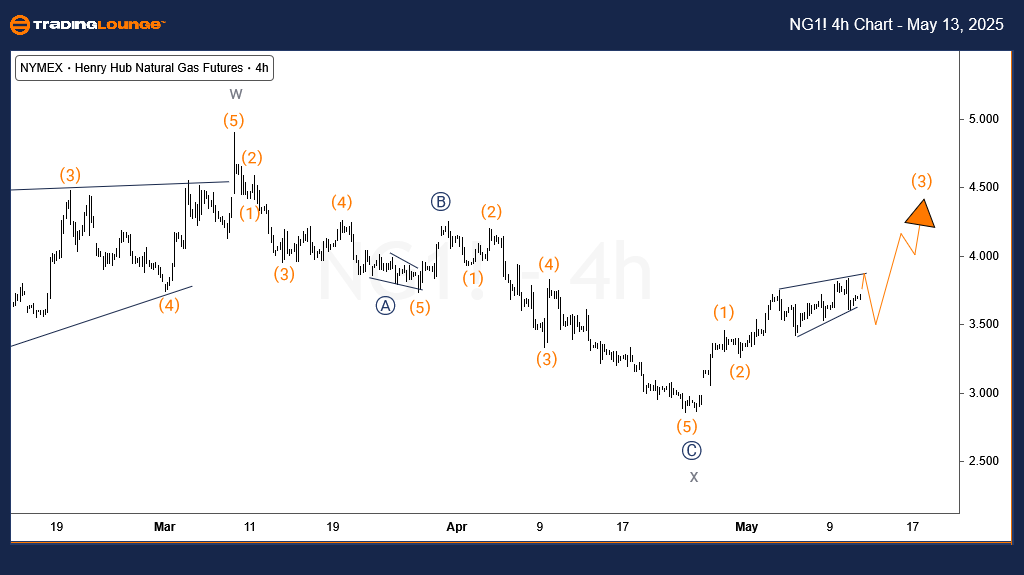

Natural Gas Elliott Wave Analysis – H4 Chart

In the H4 timeframe, the structure reveals the potential formation of wave (3) within ((1))/((A)) of wave X. This setup implies ongoing bullish momentum, with critical support found at the 2.85 level. Short-term traders should monitor the price for a full five-wave sequence from the April low. A corrective pullback following this impulse may offer a favorable entry for long positions.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Wheat Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support