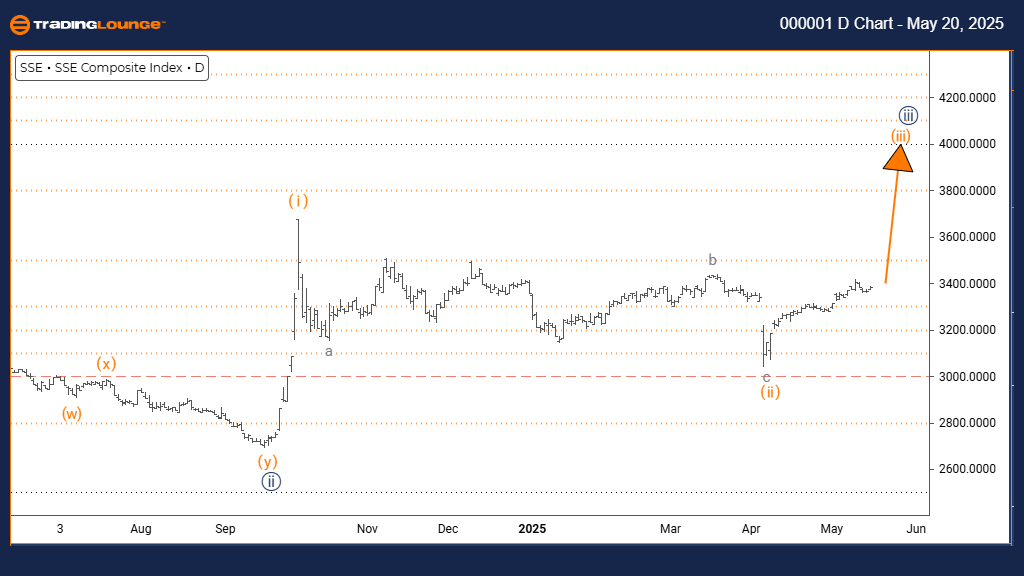

Shanghai Composite Elliott Wave Analysis – Trading Lounge Daily Chart

Shanghai Composite Technical Analysis – Daily Timeframe

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 3

NEXT HIGHER DEGREE DIRECTION: Orange Wave 3 (Ongoing)

DETAILS: Orange wave 2 looks complete; orange wave 3 of 3 has begun.

The Shanghai Composite Index daily chart shows a solid bullish trend, supported by a classic Elliott Wave impulse structure. The current pattern places orange wave 3 within a broader navy blue wave 3, indicating the end of the orange wave 2 correction and the beginning of a strong upward move.

As orange wave 3 takes hold, the chart reflects clear buying momentum. This phase often marks a period where many traders recognize the trend, adding strength to the rally. The ongoing wave could extend significantly before any noticeable correction appears.

This Elliott Wave analysis helps investors understand where the index is within the broader market cycle. The potential for more upward price action remains strong in this wave 3, but caution is advised as it progresses toward a natural correction phase. Monitoring wave completion signals is essential for effective position management.

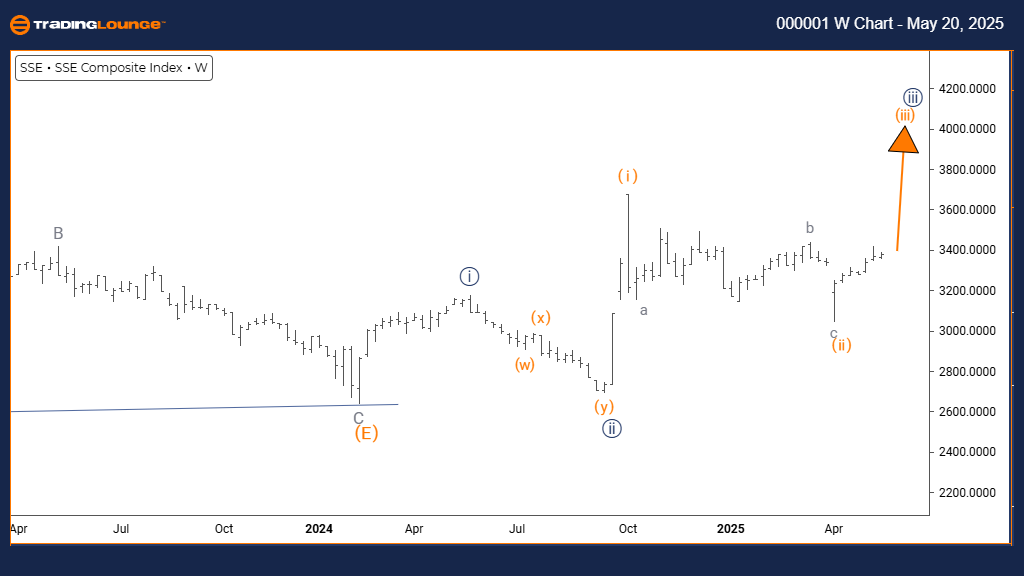

Shanghai Composite Elliott Wave Analysis – Trading Lounge Weekly Chart

Shanghai Composite Technical Analysis – Weekly Timeframe

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 3

NEXT LOWER DEGREE DIRECTION: Orange Wave 4

DETAILS: Orange wave 2 looks complete; orange wave 3 of 3 remains active.

On the Shanghai Composite weekly chart, the Elliott Wave structure indicates a continuing bullish trend. Orange wave 3 is unfolding within navy blue wave 3, following a completed orange wave 2. This supports a strong upward movement that fits the typical profile of an impulsive wave.

This current wave reflects heavy buying pressure, potentially driven by large-scale investors. Orange wave 3 is usually one of the most extended and powerful phases in Elliott Wave theory, suggesting a sustained rally with room to grow.

For traders, this wave count offers long-term insight into the market’s trajectory. While momentum is currently strong, preparation for orange wave 4 is necessary once wave 3 begins to lose steam. Effective risk management and regular structure assessments will help navigate this phase of the Elliott Wave cycle.\

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: S&P 500 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Exclusive TradingLounge Offer: $1 Two-Week Trial, then $29 Per Month - 58% Discount NOW

Access 8 analysts, 250+ markets, real-time chat rooms, AI-powered Elliott Wave charting, and portfolio tools.

Claim This Deal Now