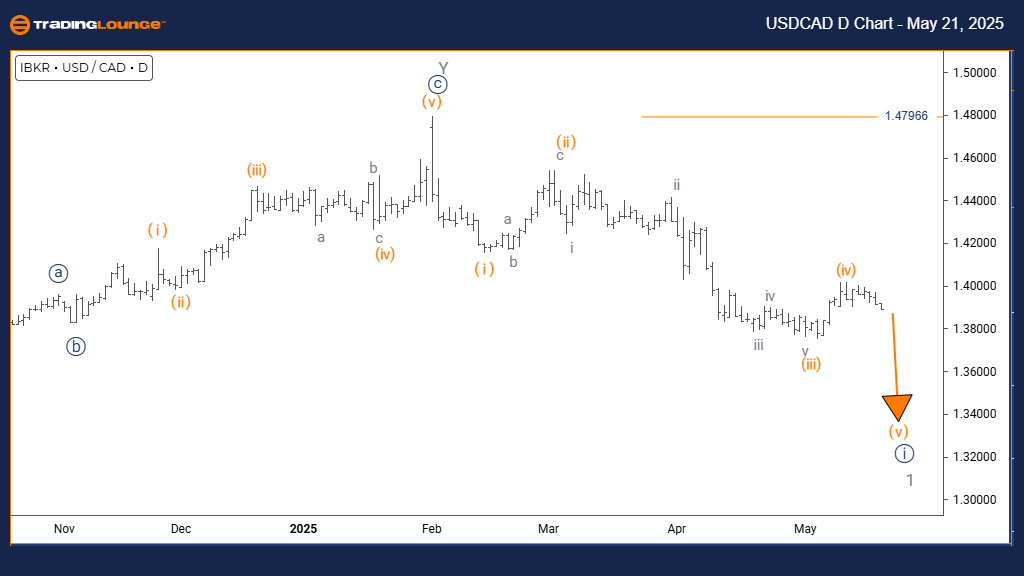

USDCAD Elliott Wave Analysis – Trading Lounge Daily Chart

U.S. Dollar / Canadian Dollar (USDCAD) Daily Chart Analysis

USDCAD Elliott Wave Technical Analysis

FUNCTION: Bearish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 1

DIRECTION NEXT HIGHER DEGREES: Navy Blue Wave 2

DETAILS: Navy Blue Wave 1 within Gray Wave 1 is currently developing. Invalidation level set at 1.47966.

The Elliott Wave outlook on the USDCAD daily chart highlights a prevailing bearish trend. Current analysis positions the market within Gray Wave 1, with Navy Blue Wave 1 unfolding as an impulsive leg. This configuration points to the early phase of a larger downward structure, reinforcing a negative market outlook.

Price action supports an evolving Navy Blue Wave 1, indicating strong bearish momentum. The market is likely in the beginning stages of a prolonged decline, with sustained selling pressure visible on the daily timeframe. If price breaches the invalidation level at 1.47966, the current wave structure would become void, necessitating a revised wave count.

This ongoing impulsive move is key for understanding USDCAD’s bearish potential. Completion of Navy Blue Wave 1 would transition into Navy Blue Wave 2, anticipated as a corrective phase. Until then, downside movement is expected to persist under the influence of wave dynamics.

Key Takeaways:

- Wave count favors a bearish continuation in USDCAD.

- Monitor for validation or invalidation at 1.47966.

- Completion of current impulse will lead into a corrective wave.

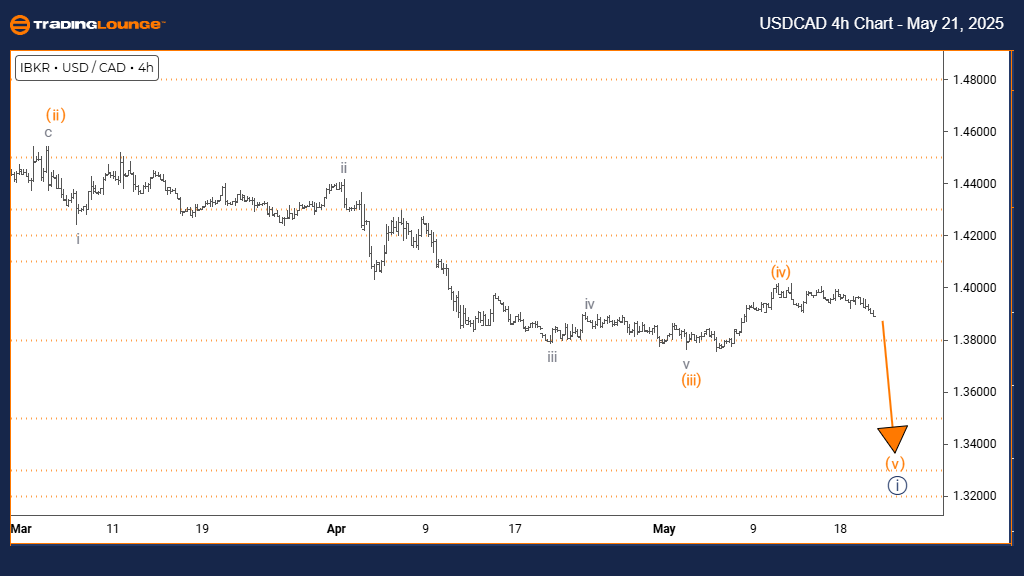

U.S. Dollar / Canadian Dollar (USDCAD) 4-Hour Chart Analysis

USDCAD Elliott Wave Technical Analysis

FUNCTION: Bearish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 5 (in progress)

DETAILS: Orange Wave 4 is confirmed complete; Orange Wave 5 is active.

The USDCAD 4-hour chart supports a sustained bearish bias, with the Elliott Wave structure confirming that Orange Wave 5 is currently active within Navy Blue Wave 1. This follows the completion of Orange Wave 4, marking the beginning of the final leg in this impulsive sequence.

Evidence of Orange Wave 4’s completion strengthens confidence in a continued downward move via Orange Wave 5. Momentum remains firmly negative, aligning with broader downtrend expectations. As part of the larger wave formation, this phase may continue to extend or begin transitioning to a corrective pattern.

This setup offers actionable insights for traders seeking short opportunities. Monitoring for typical fifth-wave signals—such as slowing momentum or divergence—can assist in fine-tuning entry and exit strategies.

Key Takeaways:

- Active Orange Wave 5 within Navy Blue Wave 1 indicates more downside.

- Validates a near-term bearish setup in line with broader wave count.

- Look for signs of trend exhaustion to manage positions effectively.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AUDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support