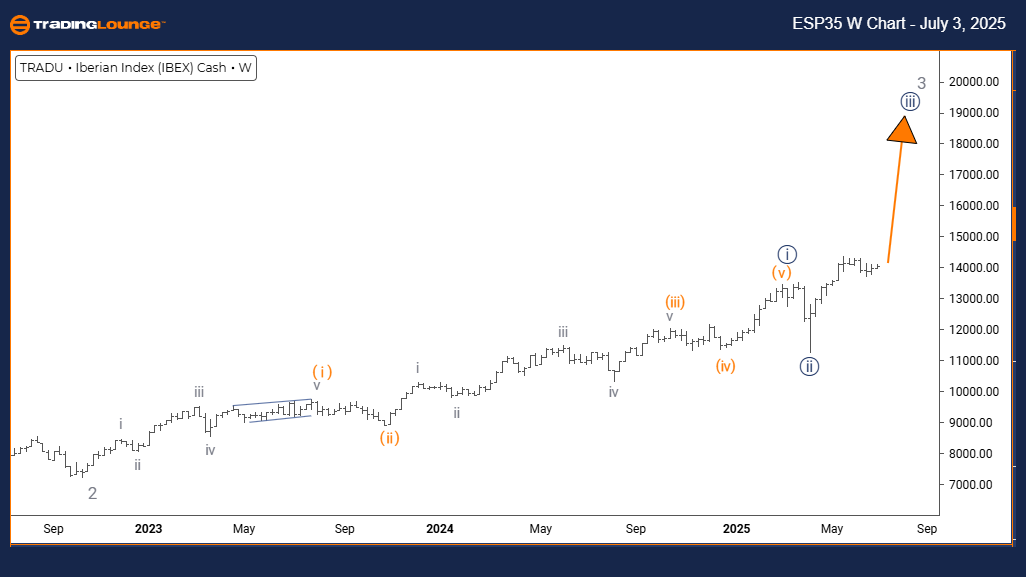

IBEX 35 (Spain) Elliott Wave Analysis – Trading Lounge Day Chart

IBEX 35 (Spain) Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 3

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange wave 1 seems completed; orange wave 2 is currently unfolding

The IBEX 35 daily Elliott Wave chart reveals a corrective structure inside a broader bullish framework. Currently, the index is undergoing orange wave 2, which follows the completion of orange wave 1. This correction signals a standard retracement pattern, marking a temporary consolidation phase within the larger navy blue wave 3 uptrend.

This orange wave 2 correction may display sideways movement or modest pullbacks before the bullish trend resumes. Upon the completion of this phase, the index is expected to initiate orange wave 3, aligning with the next upward momentum.

Traders analyzing IBEX 35 using Elliott Wave theory should observe orange wave 2's development. Its conclusion may act as a key trigger for entering long positions aligned with the upcoming move in orange wave 3. This setup continues to reflect a short-term correction inside a long-term bullish trend.

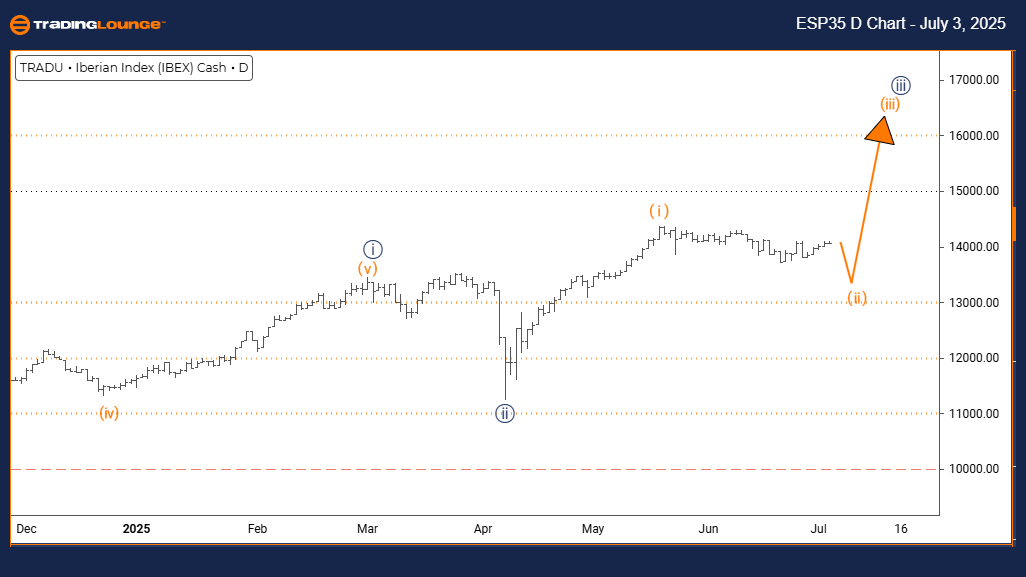

IBEX 35 (Spain) Elliott Wave Analysis – Trading Lounge Weekly Chart

IBEX 35 (Spain) Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 4

DETAILS: Navy blue wave 2 looks complete; navy blue wave 3 is advancing

The weekly Elliott Wave outlook for IBEX 35 supports a continued bullish trend, where the market remains in an impulsive structure. The current movement reflects navy blue wave 3, developing as part of a larger gray wave 3 sequence, generally associated with strong bullish momentum.

Since navy blue wave 2 has ended, the market is advancing through navy blue wave 3, which is typically the longest and most forceful wave in the Elliott sequence. This phase often provides extended price gains with minimal retracements.

Given this Elliott Wave pattern, IBEX 35 is likely to see further upward momentum as navy blue wave 3 continues to unfold. The next significant correction, navy blue wave 4, is expected only once this impulsive wave matures. Current market dynamics suggest strong institutional interest, favoring additional upside potential.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: TASI INDEX Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support