Greetings, Our Elliott Wave analysis today focuses on the Australian Stock Exchange (ASX), specifically on COMPUTERSHARE LIMITED - CPU. According to our analysis, CPU.ASX is not yet ready to rally, with a strong possibility of another move downward before a significant upward trend begins.

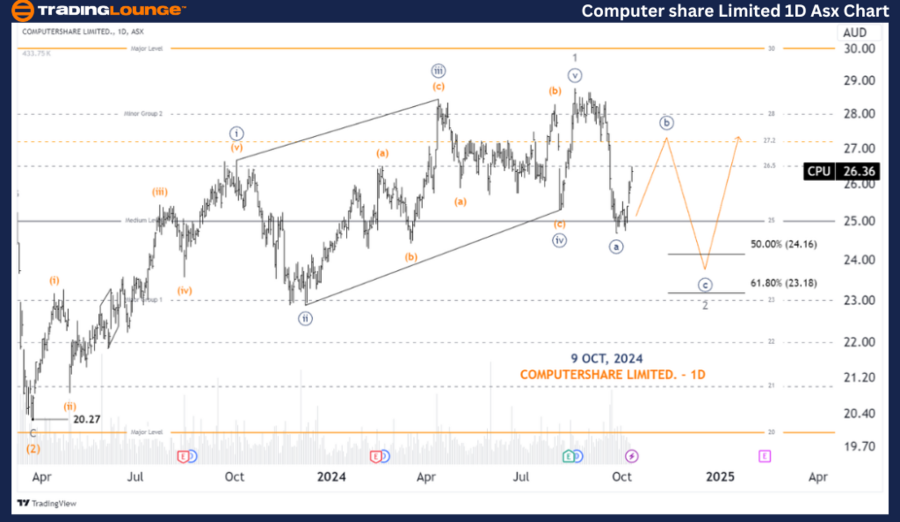

Computershare Limited ASX Stock Analysis - TradingLounge 1D Chart

ASX: Computershare Limited - CPU 1D Chart (Semilog Scale) Analysis

Computershare Limited Elliott Wave Technical Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((b))-navy of Wave 2-grey

Details: Wave 1-grey has completed as a Diagonal pattern, and wave 2-grey is expected to push lower, targeting retracement levels between 50% - 61.8%. Diagonal patterns are typically followed by deep and forceful moves. Hence, wave 2-grey will likely continue its development, forming a Zigzag structure. Currently, wave ((a))-navy has finished, and wave ((b))-navy is anticipated to push slightly higher.

Invalidation point: 20.27

Computershare Limited ASX Analysis - TradingLounge 4H Chart

ASX: COMPUTERSHARE LIMITED - CPU 4-Hour Chart Analysis

Function: Counter trend (Minute degree, navy)

Mode: Motive

Structure: Zigzag

Position: Wave ((b))-navy of Wave 2-grey

Details: A closer look reveals that wave 1-grey ended as a Diagonal, and wave 2-grey continues to develop, expected to push lower. Post-Diagonal price action tends to be sharp and strong, supporting the idea that wave 2-grey will move lower towards the targets of 24.16 - 23.18. The wave 2-grey is unfolding as a Zigzag, with wave ((b))-navy currently moving higher and targeting the 26.5 - 27.2 - 28 range before wave ((c))-navy resumes its downward push.

Invalidation point: 28.76

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: AMCOR PLC (AMC) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our Elliott Wave analysis for ASX: COMPUTERSHARE LIMITED - CPU provides a detailed look into current market trends and short-term price movements. By highlighting key price points for validation and invalidation, we aim to give investors clear guidance on market entry and exit points. This objective perspective helps readers confidently navigate the market, capitalizing on opportunities as they arise.