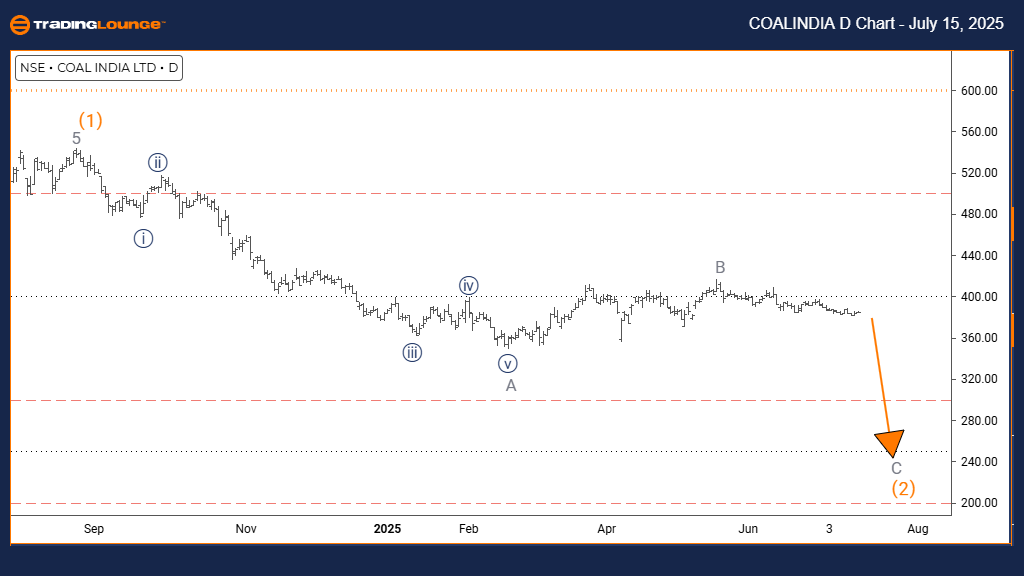

COAL INDIA Elliott Wave Analysis – Trading Lounge Day Chart

COAL INDIA Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Gray Wave C

Position: Orange Wave 2

Direction Next Lower Degrees: Gray Wave C (In Progress)

Details: Completion of Gray Wave B confirmed; Gray Wave C now developing.

Daily Elliott Wave analysis for COAL INDIA highlights a counter-trend scenario. Current price movement confirms an impulsive Gray Wave C, forming inside the corrective phase identified as Orange Wave 2.

The pattern suggests that Gray Wave B has ended. With Gray Wave C in motion, COAL INDIA enters the concluding leg of its corrective sequence. This wave generally marks the end of a correction before the dominant trend resumes.

The impulsive nature of Gray Wave C indicates intensified bearish momentum. As the wave unfolds, further price drops are likely. This implies COAL INDIA remains within a corrective structure, with Gray Wave C aimed at completing the ongoing adjustment.

Positioned within Orange Wave 2, this decline likely forms part of a broader correction. Gray Wave C is the pivotal movement traders should monitor. As this wave evolves, signs of exhaustion could indicate the potential start of a new upward trend. The intensity in this impulsive wave suggests the downtrend has not yet concluded.

Understanding COAL INDIA’s current wave position offers critical insights for traders. Although the counter-trend phase may continue, being aware of Elliott Wave patterns can help identify trend reversals. Caution remains essential as corrections can shift unexpectedly, making robust risk management strategies crucial.

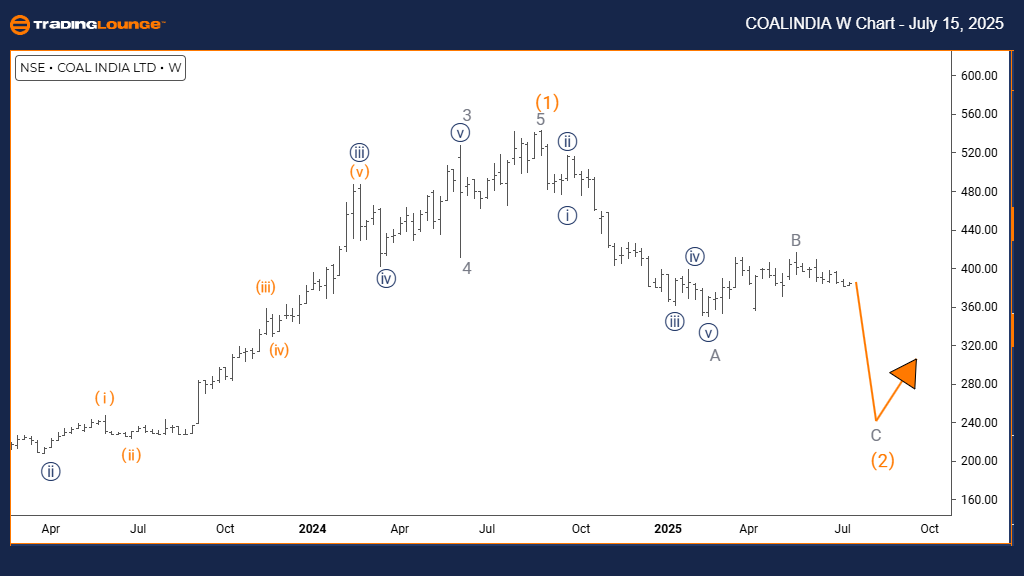

COAL INDIA Elliott Wave Analysis – Trading Lounge Weekly Chart

COAL INDIA Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Gray Wave C

Position: Orange Wave 2

Direction Next Higher Degrees: Orange Wave 3

Details: Gray Wave B appears finished; Gray Wave C is now unfolding.

The weekly Elliott Wave view of COAL INDIA confirms a corrective move within a larger trend. The development of impulsive Gray Wave C under Orange Wave 2 signals a pullback in progress.

Evidence from wave structure indicates Gray Wave B has concluded. Current price behavior supports the active formation of Gray Wave C, typically seen as the final movement in a standard corrective cycle. The impulse-driven price action points to a continuing decline.

This structure, as part of Orange Wave 2, reflects an intermediate retracement. Once Gray Wave C completes, Orange Wave 3—a wave of higher degree—could initiate a new bullish phase. COAL INDIA appears to be in the latter stage of correction, preparing for trend resumption.

Close observation of Gray Wave C is key. When this wave loses momentum, the transition to Orange Wave 3 may occur. For now, price pressure is expected to continue as the impulsive decline progresses.

This Elliott Wave analysis on the weekly chart helps traders position COAL INDIA within a macro-cycle. The current counter-trend phase may be reaching completion. Traders can use Elliott Wave insight to spot reversal zones, although high uncertainty means applying disciplined risk control remains vital.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AXIS BANK Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support